AstraZeneca companions with Gracell to achieve a lead in next-generation cell therapies

Turning a affected person's cells into focused most cancers fighters poses manufacturing challenges that massive pharmaceutical firms and early-stage biotech firms try to handle. The sector of cell remedy can also be increasing into autoimmune illnesses. AstraZeneca thinks it may well tick each bins with the acquisition of Gracell Biotechnologies.

AstraZeneca has agreed to a $1 billion deal for Gracell. Underneath monetary phrases introduced Tuesday, the Cambridge, U.Ok.-based pharmaceutical big pays $2 for every Gracell share, which is a 62% premium to Gracell's closing value final Friday and a 154% premium to the inventory's common value within the earlier 60 days. till the deal was introduced. AstraZeneca may pay out extra if China-based Gracell reaches a significant regulatory milestone.

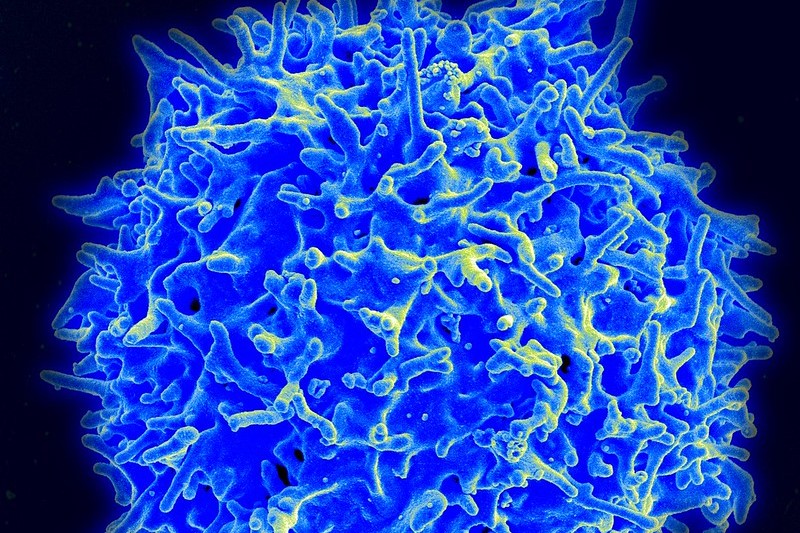

The commercially accessible cell therapies are most cancers remedies carried out by harvesting a affected person's immune cells and engineering them in a laboratory to acknowledge and goal tumors. After these cells have multiplied within the laboratory, they have to be transported again to the medical web site for infusion into the affected person. This costly, multi-step manufacturing course of can take weeks.

Gracell has two manufacturing applied sciences designed to dramatically scale back cell remedy manufacturing time and enhance the suitability of cells to carry out their therapeutic capabilities. The FasTCAR expertise is designed to allow next-day manufacturing of autologous cell therapies. Gracell additionally develops allogeneic or off-the-shelf cell therapies, constituted of cells from wholesome donors. Gracell manufactures these therapies utilizing a proprietary expertise known as TruUCAR.

Gracell's lead program is a possible remedy for a number of myeloma codenamed GC012F. This autologous cell remedy produced by FasTCAR concurrently targets BCMA, a protein plentiful on a number of myeloma cells, and CD19, a most cancers protein focused by a number of blood most cancers cell therapies. GC012F has reached early medical growth within the US as a remedy for relapsed or refractory a number of myeloma.

On the American Society of Hematology annual assembly in San Diego earlier this month, Gracell introduced up to date Section 1 information from an investigator-initiated research testing GC012F in sufferers with newly identified a number of myeloma. Of the 22 evaluable sufferers, all achieved an total response to remedy; 95%, or 21 of twenty-two sufferers, achieved a stringent full response. The median follow-up time was 18.8 months.

The Gracell acquisition comes with a contingent valuation, an extra fee tied to a milestone that may set off the payout of an extra 30 cents for every Gracell share, bringing the whole worth of the deal to $1.2 billion. Underneath the merger settlement, the important thing milestone is accelerated regulatory approval or full approval. The indication for this milestone was not specified, however Gracell has a number of photographs at this aim. Along with a number of myeloma, Gracell's lead program in China can also be in growth for B-cell non-Hodgkin's lymphoma. The corporate has further plans for GC012F in autoimmune illnesses. The cell remedy has been permitted to start a US part 1/2 trial in systemic lupus erythematosus, the most typical kind of lupus.

In asserting the Gracell acquisition, Susan Galbraith, AstraZeneca's govt vice chairman of oncology R&D, stated the deal enhances the pharma big's current capabilities and former investments in cell remedy.

“GC012F will speed up our cell remedy technique in hematology, with the chance to offer a possible best-in-class remedy for blood most cancers sufferers utilizing a differentiated manufacturing course of, and to discover the potential of cell remedy to reset the immune response in autoimmune illnesses,” she stated.

AstraZeneca struck a deal final 12 months to purchase Neogene Therapeutics, a startup creating T-cell receptor therapies meant to sort out strong tumors, which have up to now eluded cell therapies. Efforts to carry cell remedy to immunology embody a partnership with Quell Therapeutics within the areas of kind 1 diabetes and inflammatory bowel illness. Final month, AstraZeneca dedicated to paying $105 million upfront to work with Cellectis in a cell remedy partnership spanning oncology, immunology and uncommon illnesses. AstraZeneca expects the Gracell acquisition to be accomplished within the first quarter of 2024.

Picture by Flickr person NIAID through a Artistic Commons license