The healthcare M&A market is gearing up for a cautiously optimistic 2024

What it’s best to know:

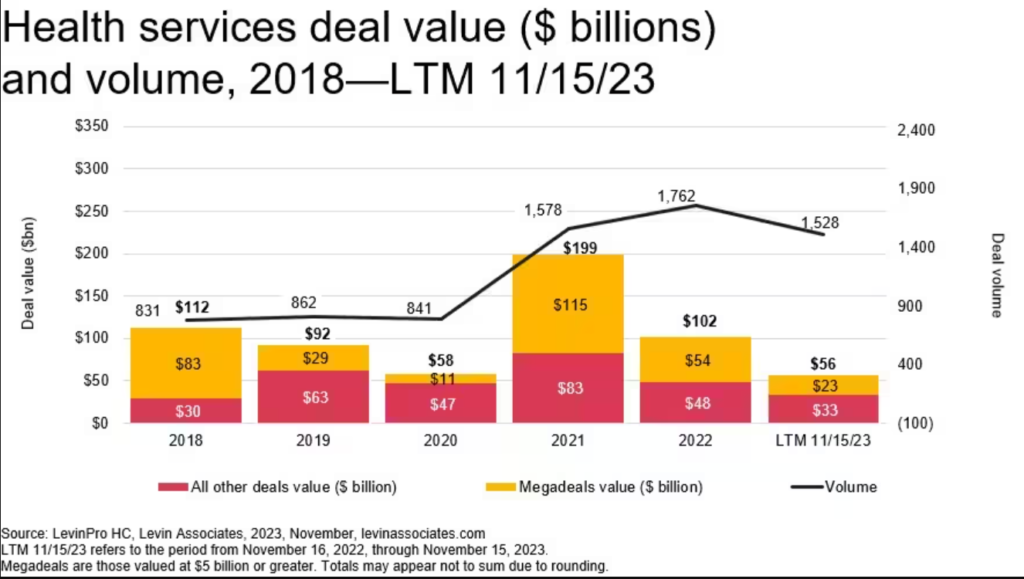

– Regardless of a 13% decline in deal quantity in comparison with 2022, PwC's newest Well being Companies Offers Outlook paints a cautiously optimistic image for 2024.

– Whereas there’s cautious optimism, a number of components recommend that 2024 might be a dynamic yr for healthcare mergers and acquisitions. Adaptability, ingenuity and a deal with worth creation shall be essential for dealmakers navigating the altering panorama.

Fanning the hearth

Whereas headwinds corresponding to excessive rates of interest and regulatory issues stay, a number of components level to a doubtlessly vibrant M&A panorama:

– Considerable capital: Report ranges of obtainable money, coupled with investments approaching the exit window, create the potential for important deal exercise.

– Strategic necessities: Each companies and personal fairness corporations are pursuing enterprise reinvention and portfolio transformation, usually pushed by mergers and acquisitions.

– Artistic approaches: The rise of non-traditional deal constructions corresponding to continuation funds and co-investor partnerships is a testomony to the adaptability of traders

Past quantity

– Decrease valuation multiples: Whereas deal quantity declined, the decline in disclosed deal values primarily displays bigger transactions impacted by financing points. This presents value-seeking alternatives for traders.

– Resilient sector: Macroeconomic indicators, together with strong healthcare enterprise capital fundraising, recommend the sector stays engaging for funding.

Key drivers

– Carve-outs on the rise: Established firms dealing with non-traditional competitors and conglomerates streamlining their operations are driving this development.

– Cross-sectoral cooperation: Not-for-profit healthcare techniques are looking for outdoors experience in areas corresponding to VBC and partnering with for-profit organizations for mutual profit.

– Generative AI: The potential for disruption and productiveness positive factors inside healthcare is being intently watched, however regulatory uncertainties stay.

Challenges to navigate

– Regulatory oversight: Continued scrutiny of particular transactions and trade focus stay issues, particularly for personal fairness.

– Refund points: Rising labor and provide prices that exceed government-approved price will increase might result in liquidity issues for some suppliers.