Monetary misery drives market reorganization and partnerships

What you need to know:

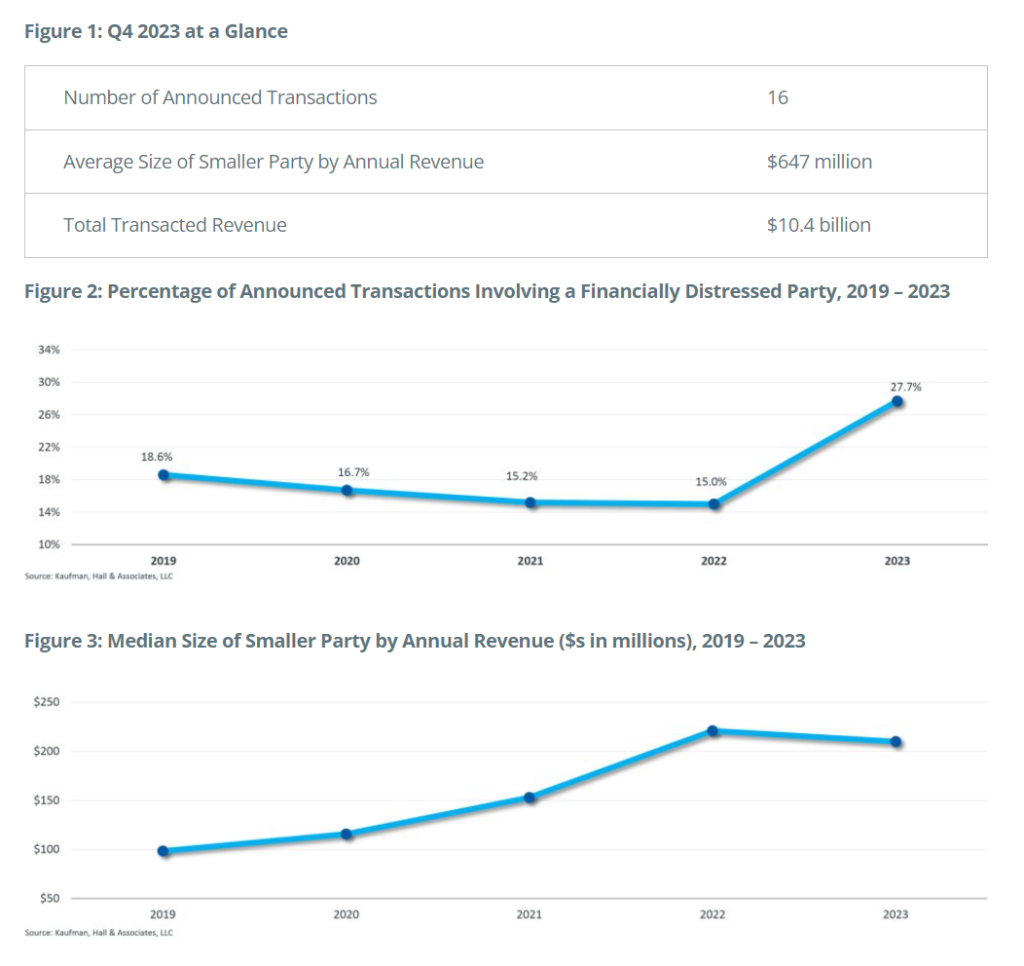

In response to Kaufman Corridor's newest evaluation of healthcare transactions, hospital and healthcare system mergers and acquisitions in 2023 shall be pushed by elevated strain on operations and funds. The report reveals that momentum round mergers and acquisitions continued into 2023 65 introduced transactionsin comparison with 53 in 2022. Monetary points had been cited as an element or in any other case evident in 28% of transactions introduced final 12 months, in comparison with 15% in 2022.

– This whirlwind of transaction exercise resulted in $38.4 billion in whole transaction income, with “mega mergers” – these transactions the place the vendor, or a smaller celebration, has annual revenues of greater than $1 billion – representing greater than 10% of the whole variety of transactions introduced in 2023.

Monetary misery and market reorganization dominate the healthcare M&A panorama

The healthcare M&A panorama noticed vital shifts in 2023, with two key traits dominating the scene:

1. Rising monetary strain drives partnerships: Financially distressed organizations in search of companions emerged as a driving issue, driving the best share of such transactions in latest historical past (28%). These pressures, which have an effect on each smaller and bigger methods, emphasize the necessity for proactive methods and discovering companions earlier than issues restrict flexibility.

2. Reorganization of the regional market redefines the enjoying subject: Healthcare methods prioritized reshaping regional markets via a number of methods:

– Portfolio realignment: For-profit methods and even giant nonprofit methods comparable to Ascension, CommonSpirit Well being and AdventHealth have optimized useful resource allocation by divesting non-core markets and specializing in areas with sturdy development potential.

– Regional consolidation: Methods comparable to Froedtert Well being-ThedaCare (Wisconsin), BJC Healthcare-St. Luke's Well being System (Missouri/Kansas) and Vandalia Well being (West Virginia) aimed to create built-in networks inside geographic areas.

– Growth of the tutorial healthcare system: These establishments continued to construct regional networks with group hospitals, utilizing their capability for lower-acuity sufferers and relieving strain on their key amenities.

Waiting for 2024

The traits we noticed in 2023 are prone to proceed in 2024, together with:

– Regional focus intensifies: Balancing nationwide scale with regional flexibility shall be vital as methods prioritize the event of key markets or areas inside their portfolios.

– Monetary strain stays related: Whereas efficiency is stabilizing, considerations about long-term sustainability stay, prompting continued exploration of partnerships, even for beforehand steady group methods.

– Inventive partnerships emerge: Regulatory challenges, cost-effectiveness and a want for autonomy are driving curiosity in revolutionary partnership fashions that transcend conventional merger and acquisition buildings.

– Political uncertainty threatens: The upcoming basic election might have a major impression on healthcare and future mergers and acquisitions.