M&A shifts, VC squeezes and market traits

What you need to know:

– After a decade of uncontrolled enlargement, the healthcare IT market confronted a actuality verify in 2023, based on a brand new report from Healthcare Development Companions.

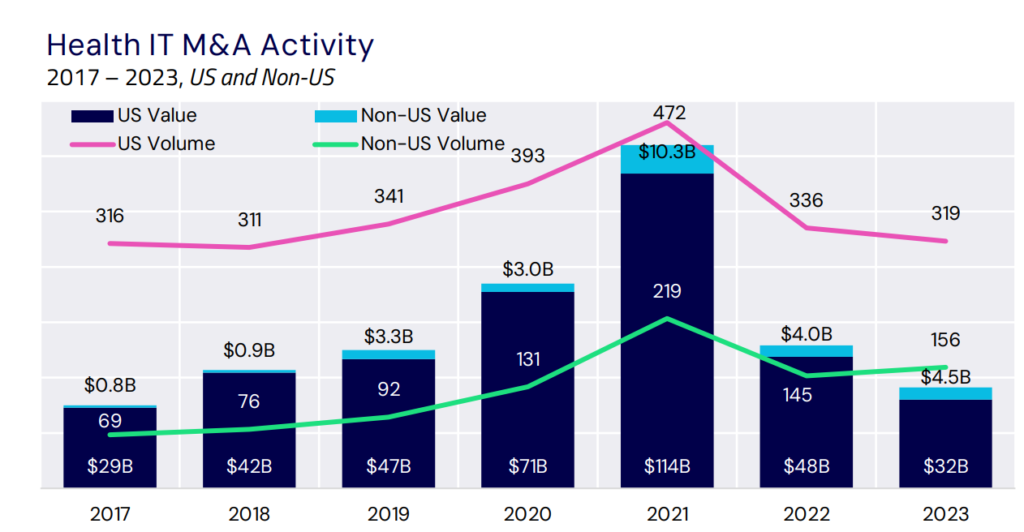

– The January 2024 report, Well being IT Market Evaluation, reveals that runaway inflation, rising rates of interest and a reset in expertise valuations dampened investor enthusiasm and led to a correction in valuations in each M&A and funding exercise. Nevertheless, regardless of the challenges, there have been indicators of a restoration by the tip of 2023, with M&A quantity returning to pre-pandemic ranges and the potential for renewed IPOs in 2024.

M&A and buyout actions

- Returned to pre-pandemic volumes in 2023 after declining in 2022.

- Valuations remained decrease than earlier than the pandemic, however there have been indicators of restoration within the latter a part of the 12 months.

- Buyout exercise noticed a slight improve in 2023 in comparison with 2022.

Funding exercise

- The financial system fell from $29 billion in 2021 to $9 billion in 2023, however remained barely above the pre-pandemic common.

- Falling rates of interest and enhancing investor sentiment might result in a rebound in 2024.

Public market efficiency

- The general public healthcare IT market skilled vital volatility in 2023.

- Many firms noticed their share costs fall and a few have been even delisted or filed for chapter.

- Nevertheless, there have been indicators of a possible rebound with improved broader market efficiency and stronger sentiment.

Financial prospects

- The US financial system is in a fancy state of affairs with slowing development and excessive unemployment.

- Falling rates of interest are anticipated to result in a reallocation of capital to dangerous property, probably benefiting the healthcare IT market.

Wanting forward

Regardless of the persistent uncertainties, a number of constructive indicators are rising. Falling rates of interest, enhancing investor sentiment and a potential revival of IPOs level to a extra balanced and resilient market in 2024. Firms with robust financials and differentiated choices are poised to profit from this shift.