BioNTech pact and inventory sale offers Autolus with $600 million for its cell therapies

Cell remedy developer Autolus has a lead program below FDA evaluation for a sort of blood most cancers and in scientific growth for different indications. As the corporate seems forward to a attainable product launch later this yr, it has stuffed its coffers with $600 million from a pair of offers, together with a partnership with BioNTech.

BioNTech will purchase $200 million value of Autolus shares and make a $50 million money cost to the London-based biotech, the businesses introduced Thursday. In return, BioNTech can be eligible to obtain a royalty on gross sales of the Autolus cell remedy, obe-cel. Whereas Autolus retains full rights to this remedy, BioNTech may have the chance to entry the biotech's scientific web site community and manufacturing and business supply infrastructure, which can be utilized to advance the event of therapies in its personal pipeline.

Shortly after the BioNTech deal was introduced, Autolus raised more cash with a $350 million fairness providing. The corporate mentioned proceeds from each transactions will assist actions reminiscent of obe-cel manufacturing and continued scientific growth of the cell remedy.

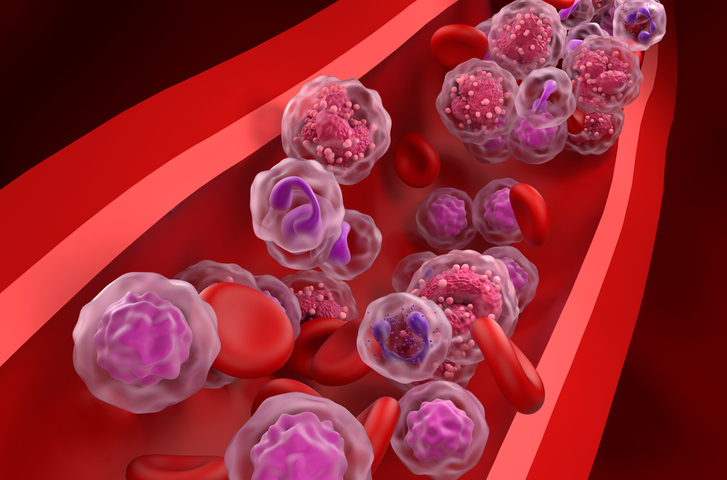

Obecabtagene autoleucel, or obe-cel, is a CAR T-cell remedy. Like the primary era of CAR T medication, Autolus' remedy targets the CD19 protein on most cancers cells. However Autolus is creating its remedy to offer decrease toxicity and an extended length of motion. Autolus initially developed this remedy as a remedy for adults whose acute lymphocytic leukemia (ALL), a most cancers of the blood and bone marrow, has relapsed or has not responded to earlier strains of remedy. The FDA's goal date for a regulatory choice is November 16. Autolus expects to submit an utility in Europe within the first half of this yr.

The Autolus cell remedy can also be in Section 1 growth for pediatric ALL sufferers and B-cell non-Hodgkin's lymphoma. Autoimmune ailments supply extra alternatives. Autolus has mentioned it expects a part 1 trial of obe-cel in lupus to offer preliminary knowledge in late 2024.

In the meantime, BioNTech's pipeline consists of BNT211, a CAR T-cell remedy for strong tumors. This program is presently in Section 1 growth, however the firm has mentioned it plans to have ten or extra probably registered scientific trials within the pipeline by the top of this yr. BioNTech co-founder and CEO Ugur Sahin mentioned in a ready assertion that the Autolus collaboration permits his firm to increase the event of BNT211 into a number of most cancers indications in a cost-efficient method. He added that the power to entry Autolus' precision cell-targeted instruments will assist BioNTech's growth of in vivo cell therapies and antibody drug conjugates. If BioNTech workouts that choice, Autolus can be eligible to obtain train charges and milestone funds, plus royalties from gross sales of commercialized merchandise developed utilizing the biotech's applied sciences.

In a notice despatched to traders Thursday, William Blair analyst Matt Phipps wrote that capital from the BioNTech pact and the Autolus inventory providing will assist advance obe-cel's growth past most cancers and into autoimmune ailments. Autolus administration informed Phipps that the lupus research has begun enrollment, and that the extra capital will permit the corporate to extra broadly deploy its sources towards autoimmune illness analysis. The plans embrace a “basket research,” a technique extra generally utilized in most cancers. Such research take a look at a single focused most cancers drug in opposition to many varieties of most cancers to establish which of them it may deal with. This basket method might be used to seek out extra autoimmune indications for obe-cel.

“We consider the deal highlights the worth of Autolus' wholly owned manufacturing facility, which we toured late final yr, and the corporate's in depth cell programming applied sciences,” mentioned Phipps. “Administration believes that the obtainable capital will allow the corporate to attain profitability on obe-cel in mature ALL and increase growth of the complete pipeline.”

Picture: Getty Pictures