What sources can be found for privately insured sufferers who obtain shock stability payments?

For privately insured sufferers, sudden medical payments can come up from having to pay a excessive deductible, or from “stability billing.” Sometimes, well being plans negotiate funds to in-network suppliers. Out-of-network suppliers could immediately invoice privately insured sufferers the distinction between the everyday in-network well being plan cost and the complete quantity, often known as “stability payments.” In these circumstances, sufferers could also be answerable for the stability invoice, along with any deductibles, coinsurance, or copay below the well being plan.

The No Surprises Act will ban many of those stability payments beginning in 2022. Privately insured sufferers (together with these with employer protection, non-group plans, and grandfathered plans) are shielded from sure shock stability payments. Shock stability invoice safety requires personal well being plans to cowl out-of-network claims and implement in-network price sharing (deductibles, co-pays) for sure lined advantages. The regulation prohibits sure suppliers, hospitals and air ambulances from billing sufferers for out-of-network care except the affected person consents upfront.

The brand new protections require plans and suppliers to maneuver sufferers out of lots of the commonest cost disputes. Whereas it’s attainable that sufferers should still obtain stability payments attributable to, amongst different issues, plan or supplier billing errors, the invoice shouldn’t be lined by the brand new regulation (e.g., floor ambulance rides, non-covered providers, affected person consent for out-of-network well being care prices), or the well being plan denies the declare totally as a result of it’s not lined by the plan.

For instance, the affected person could obtain balanced payments if the affected person's plan improperly processes a declare or applies an out-of-network cost-sharing quantity when the NSA prohibits it. A affected person could also be billed greater than they need to be, for instance if the plan doesn’t acknowledge {that a} declare is roofed by the No Surprises Act, or due to a billing oversight. Sufferers can attraction these errors by the plan's inner claims and appeals course of. Beneath federal regulation, a affected person has the precise to attraction a well being care plan denial (known as an opposed profit willpower or “ABD”). ABDs additionally embody plan selections to use the inaccurate cost-sharing quantity. As soon as the opposed profit is recognized, the well being plan should enable the affected person at the very least 180 days to file an inner attraction. For post-service claims, the plan should full the interior attraction no later than 60 days after it’s filed. If the plan upholds the denial, the affected person can have a brand new proper below the NSA to request an impartial exterior attraction for NSA compliance points. Federal laws present a number of examples of the place NSA-related selections could also be topic to overview by a third-party reviewer, together with a call on whether or not a selected declare entails an merchandise or service lined by the NSA as a shock invoice.

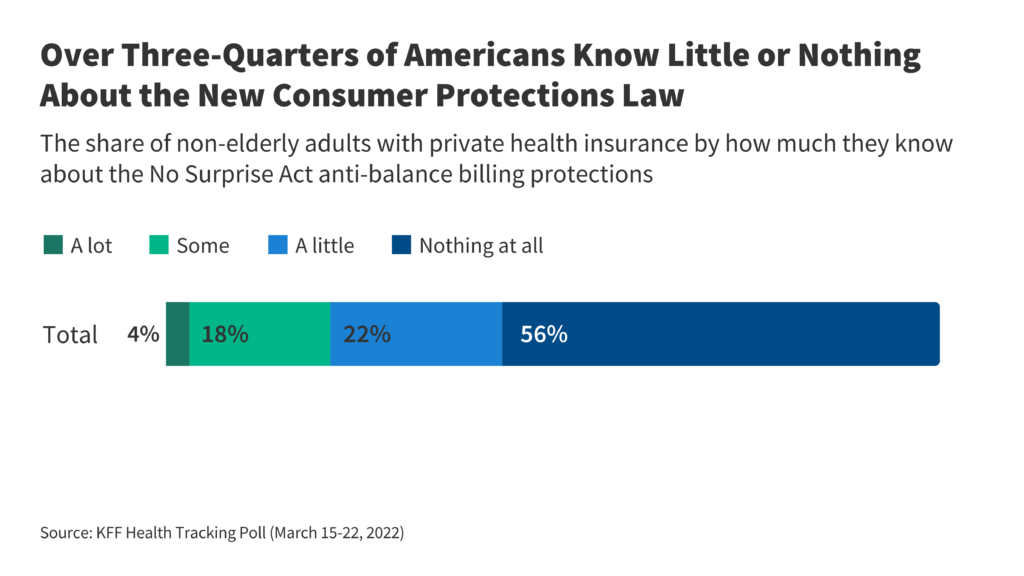

For sufferers who obtain a shock invoice once they shouldn't, the next will be extra sophisticated. To right the state of affairs, sufferers would first must acknowledge that the plan resolution was incorrect and that the supplier's invoice is roofed by the No Surprises Act. KFF polling reveals that the overwhelming majority of Individuals (78%) know little or nothing in regards to the new shopper safety regulation, so the effectiveness of shopper self-advocacy might be restricted if issues come up. Beneath present regulation, all ABDs for well being plans should embody contact data for state shopper help packages (CAPs) and state that such packages (in states the place they exist) may also help folks file appeals. Customers can contact CAPs to evaluate whether or not the bill obtained is legitimate. Moreover, as a part of the No Surprises Act, the Facilities for Medicare and Medicaid Companies (CMS) has established sources for sufferers to have their medical payments reviewed (by way of this web site: https://www.cms.gov/medical-bill – rights/aid/submitting a grievance or by calling the No Surprises Assist Desk at 1-800-985-3059, accessible 24/7 and through holidays). This “no unsuitable door” grievance system is out there to customers who’re involved that their plan has wrongly denied or lined an sudden medical invoice.

Nonetheless, if a plan incorrectly denies or covers a shock invoice and the affected person doesn’t acknowledge the error to attraction or search state or federal overview, the affected person could also be left with the invoice.

Though sufferers attraction, there isn’t a federal rule stopping suppliers from accumulating the excellent invoice. If the affected person appeals incorrect billings, the out-of-network supplier might be able to invoice the affected person for the complete quantity whereas the attraction is pending. Sufferers who can not pay the excellent invoice could also be referred to assortment companies. Though the Client Finance Safety Bureau (CFPB) has issued further pointers that restrict coercive practices by debt collectors. KFF polls have discovered that 41% of adults have healthcare debt by a broader definition, which additionally consists of healthcare debt on bank cards or debt to members of the family. KFF evaluation of a census survey means that Individuals could owe at the very least $220 billion in medical debt. Folks with medical debt report that they’ve skimped on meals, clothes, and different home items, spent their financial savings to pay medical payments, borrowed cash from pals or family, or taken on further debt. Medical debt could make it tough for sufferers to get loans for on a regular basis dwelling wants, corresponding to housing or a automobile.

If the affected person later prevails on attraction, the well being plan should reprocess the declare, this time below the principles of the No Surprises Act, and the out-of-network supplier should then be required to reimburse the affected person for any quantity was collected within the attraction. above the relevant in-network price sharing quantity.

Beneath the Reasonably priced Care Act and the No Surprises Act, federal companies can impose fines on well being plans and well being care suppliers for improperly billing sufferers. Plans that improperly course of claims might be charged as much as $100 per day per affected beneficiary below federal regulation. Authorities regulators could have further powers and enforcement instruments that they will use to handle billing points. On the supplier facet, the penalty for improper billing is as much as $10,000 per violation. That’s, if a supplier sends 200 incorrect invoices, the supplier might be fined $2 million. However for these penalties to happen, the affected person must efficiently file a grievance with federal regulators and the regulators must conduct investigations and take enforcement motion.

Via October 2023, roughly 11,000 affected person complaints have been filed by the federal suggestions portal. The federal authorities has mentioned 248 complaints alleged violations and resulted in $3 million in financial aid to customers or suppliers. Right now, it’s unclear whether or not the federal authorities has imposed fines on healthcare suppliers or well being plans for improper billing practices.

Dialogue

Most sufferers are unaware of the brand new shock invoice protections and are possible unaware of the sources accessible to hunt restoration for incorrect medical payments. It’s advisable to ask in regards to the prices upfront, if attainable. Moreover, if sufferers obtain a big, sudden invoice, calling the well being plan is an effective first step. New federal sources enable sufferers to file complaints and get a response from the federal authorities. The federal course of doesn’t present willpower or assist customers combat a invoice with the payer. Nonetheless, sufferers could have little recourse if their plan doesn’t cowl sure objects or providers, or if their shock stability shouldn’t be protected below federal regulation.

Plans and suppliers can now mediate disagreements over funds for out-of-network care by the No Surprises Act's impartial dispute decision. Most cost determinations by the arbitration course of favored the suppliers' asking worth. But most lawsuits towards the No Surprises Act are additionally filed by suppliers. The federal authorities not too long ago proposed a number of modifications geared toward making the IDR course of extra environment friendly and rising early communication between the events. Amid the authorized battles over the cost fee dispute decision course of, sufferers needs to be shielded from shock out-of-network payments.

Sufferers should not speculated to obtain shock stability payments except an error has been made or the shock invoice shouldn’t be protected. In these conditions, sufferers have some choices, though these are solely helpful if folks learn about them.