Half 1 – Healthcare Economist

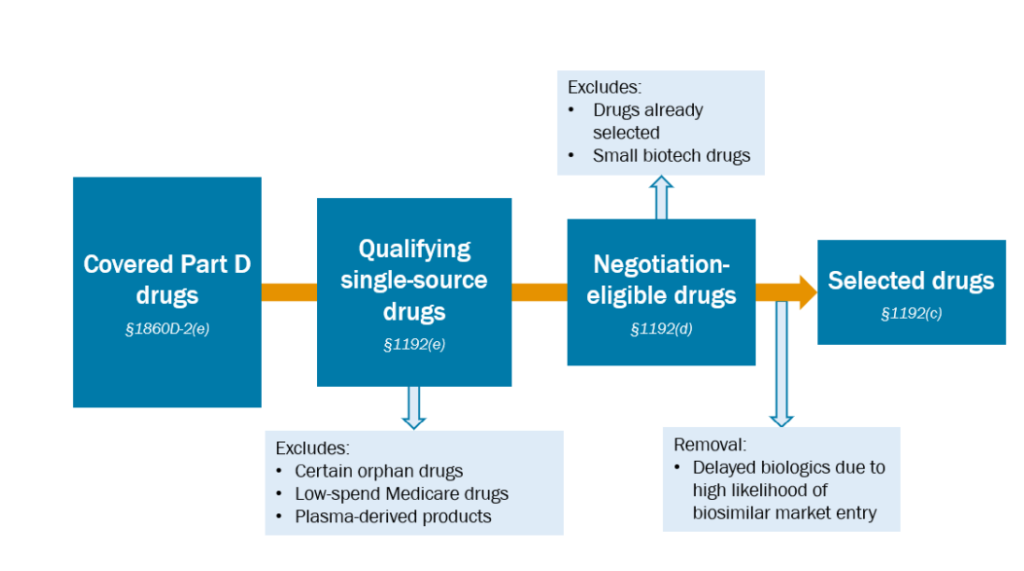

CMS launched steering on IRA value negotiations final week. Under are some highlights concerning how medication are chosen.

Which drugs are eligible for negotiation?

- For small molecules, medication have to be (i) accepted by the FDA, (ii) accepted by the FDA at the very least seven years in the past, and (iii) not have a generic equal in the marketplace.

- For biologic molecules, medication should (i) be accepted by the FDA, (ii) be accepted by the FDA at the very least 11 years in the past, and (iii) don’t have any biosimilar equal in the marketplace.

Mixture medicines which might be at all times prescribed collectively are thought-about one therapy.

Medication which might be within the prime 15 Half D expenditures between November 1, 2023 and October 31, 2024 are eligible for negotiation.

How do medication qualify for the orphan drug exclusion?

Medicines could solely be indicated for one uncommon situation. CMS states that “a drug with orphan designation for multiple uncommon illness or situation doesn’t qualify for the orphan drug exclusion, even when the drug isn’t accepted for any indication for the extra uncommon illness(s) or situation(s) ). ).”

How do drugs qualify for the low-spending exception?

Medication with a mixed annual Medicare expenditure of lower than $200 million are usually not eligible for value negotiations. The $200 consists of each Half B and Half D bills in the course of the interval November 1, 2023 via October 31, 2024. The $200 million threshold can be adjusted for inflation (CPI-U) in future years. Complete allowable prices (i.e., funds to Medicare, the beneficiary, and different third events) can be used to calculate whether or not medication meet this threshold. When a Half B drug is bundled with different medication in a single HCPCS code, CMS makes use of common retail value (ASP) knowledge.

Are plasma-derived merchandise excluded from value negotiations?

Sure.

How do corporations adjust to the small biotech exception?

CMS applies two primary guidelines:

- Non-material portion of Half D prices. CMS requires {that a} drug's Half D expenditures be <1% of whole CMS Half D expenditures. The rationale is that if a small biotech has a drug that accounts for greater than 1% of Half D spending, it's probably not a small biotech.

- Drug gross sales by small biotech corporations account for almost all of income. CMS requires that at the very least 80% of the corporate's Half D expenditures profit the drug in query. CMS's logic might be that if an organization sells a number of medication, it's most likely not a small biotech. Nonetheless, if a small biotech firm has one lead drug and one which has simply come to market, they don’t need to punish the small biotech firm for bringing one other drug to market. Nonetheless, it’s clear that this provision will discourage the corporate from bringing a second (or third) drug to market and you would see small biotech corporations establishing spin-off corporations for when the second and third medication come to market.

How does the CMS decide whether or not a biosimilar is prone to enter the market?

CMS requires a biosimilar producer to request this deferment. The producer of the biosimilar should both (i) be the holder of the BLA for the biosimilar, or (ii) if the biosimilar isn’t but licensed, the corporate have to be the sponsor of the BLA submitted to the FDA for evaluation. Nonetheless, CMS is not going to contemplate a biosimilar deferral if the biosimilar firm was issued a BLA greater than a yr in the past however has not but begun advertising the product. Additionally, the producer of the biosimilar might not be the identical producer because the organic reference. To make sure that a biosimilar has an excellent likelihood of reaching the market, CMS requires that (i) there are not any excellent patents, (ii) the biosimilar firm 'offers details about capital investments, income expectations and actions which might be in step with the enterprise as regular. for commercialization of a biosimilar organic product,” (iii) has entered into an settlement with the FTC to commercialize the product, and (iv) {that a} manufacturing schedule has been submitted to the FDA.