Cohen (2024) argues that well being economists ought to begin utilizing a reduction fee of two% for well being financial fashions. Why is that? Under I summarize the article.

First, Cohen discusses two totally different strategies for estimating low cost charges.

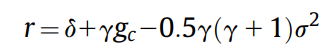

- Ramsey equation. This method takes into consideration 4 elements: pure time desire, catastrophic threat, wealth impact and macroeconomic threat. The primary three elements improve the low cost fee as a result of they point out that future results are much less vital; the latter issue lowers the low cost fee as a result of it suggests higher future want. A fifth issue – project-specific threat – will increase the low cost fee, however doesn’t seem within the formal Ramsey equation. Within the literature, the worth of pure time desire ranges from 0% to 1%; Claxton et al. 2019 recommends a catastrophic threat of 0.1%; a wealth impact of 1% to 4% and a macroeconomic threat of -0.07% to -0.20%. As a result of project-specific threat by definition varies from venture to venture, it isn’t utilized in normal Ramsey modeling. Within the comparability beneath

δ = the pure fee of time desire; γ is the elasticity of marginal utility of consumption, and gc = the expansion fee of per capita consumption, and σ is the uncertainty of financial progress.

- Monetary markets. The market rate of interest represents the return that society may 'earn' from different investments; Thus, a healthcare funding with a return beneath market charges carries an “alternative price” that outweighs its advantages. Nonetheless, there are numerous totally different low cost charges for various monetary devices, relying on elements such because the tax remedy of bonds, the timeframe for compensation and the chance of credit score default, amongst others.

What reasoning do HTA our bodies use to justify the low cost fee they use in observe? Most present no express justification.

What cause does Cohen give for decrease rates of interest? Turning to the Ramsey equation, he notes that actual progress charges in Western international locations have fallen over time.

From 1995 to 2022… annual per capita consumption progress was 1.6% in the USA and

1.2% within the 17-country Eurozone. The projected progress charges of per capita consumption for the interval 2030 to 2060 are 0.5% and 1.0% respectively in these two areas. A median throughout these two areas (that are roughly comparable in measurement and financial output) yields annual per capita consumption progress of 1.4% for 2010 and 0.75% for 2030 to 2060, suggesting that in international locations with excessive incomes the expansion in per capita consumption Within the coming years this will probably be 0.65% per 12 months decrease than when many of those international locations launched their advice of a 3% low cost fee. For the elasticity of marginal utility of consumption values of 1 ≤ Ɣ ≤ 2.8, a decline in per capita consumption progress (gc) by 0.65% signifies that the contribution of the wealth impact to the low cost fee by 0.65 % has decreased to 1.3%, indicating a reduction fee of 1.7% to 2.35% is now applicable.

He notes this for the monetary markets Actual Rates of interest have additionally fallen over time.

The gross home product-weighted common of actual rates of interest within the 9 high-income international locations for which knowledge can be found has fallen from about 4% earlier than 2000 to about 1.5% lately.

Dr. Cohen recommends utilizing a reduction fee of 1.5%-2% for valuation, if not as a fundamental evaluation, no less than as a part of a sensitivity evaluation. Do you agree with that?