Empirical Estimates of Loss Aversion – Well being Care Economist

Kahneman and Tversky's Prospect Idea states that people have an aversion to loss. What’s loss aversion?

It implies that people expertise losses extra intensely than positive aspects of the identical magnitude; For instance, the psychological impression of shedding a certain quantity is larger than the pleasure you expertise in case you win that very same quantity. A key query is: what number of How extra intensely can people expertise positive aspects than losses?

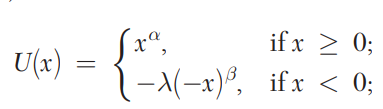

To formalize issues, prospect concept assumes the next utility perform:

Essentially the most generally cited estimates for these parameters are from Tversky and Kahneman (1992). In that article they discover that loss aversion is λ=2.25, and α=β=0.88. We will plot the utility perform with this parameterization within the graph beneath as follows.

A significant drawback, nevertheless, is that Tversky and Kahneman's (1992) estimates of loss aversion come from a single survey of 25 graduate college students at an elite American college. How generalizable are these outcomes? Is there a greater estimate of loss aversion?

An article Brown et al. (2024) goals to reply this query by conducting a meta-analysis of estimates of loss aversion from all research revealed between 1992 and 2017. They discovered 607 empirical estimates of loss aversion in 150 articles. The research got here from quite a lot of disciplines (e.g. economics, psychology, neuroscience) and quite a lot of information sorts. Most research (53%) have been primarily based on a laboratory experiment design, however 26.5% of the recognized articles have been from a discipline experiment with different discipline information; 42% of the research got here from Europe and 30% got here from North America.

The unadjusted outcomes (proven beneath) estimate a median loss aversion of 1.69 and a imply loss aversion of 1.97. After making use of a meta-analytic distribution with random results, the typical loss aversion coefficient was discovered 1,955 with a 95% chance that the true worth falls between 1.820 and a pair of.102.

These outcomes are barely decrease, however not completely different from Tversky and Kahneman's (1992) estimate of two.25. We will additionally examine the outcomes with two earlier meta-analysis research on loss aversion. Neumann and Böckenholt 2014 – which examined loss aversion throughout 33 client model selection research – reported a base mannequin estimate of λ = 1.49 and an “enhanced mannequin” estimate of λ = 1.73; Walasek, Mullett, and Stewart (2018) – who examined seventeen research of win-lose monetary lotteries – estimate that λ = 1.31. In brief, Brown et al.'s outcomes are larger than earlier estimates, however decrease than these of Tversky and Kahneman.

You may learn the total article right here.

Key references

- Brown, Alexander L., Taisuke Imai, Ferdinand M. Vieider, and Colin F. Camerer. “Meta-analysis of empirical estimates of loss aversion.” Journal for Financial Literature 62, no. 2 (2024): 485-516.

- Neumann, Nico and Ulf Böckenholt. 2014. “A Meta-Evaluation of Loss Aversion in Product Selection.” Journal of Retail 90(2):182–97.

- Tversky, Amos and Daniel Kahneman. 1992. “Advances in Prospect Idea: Cumulative Illustration of Uncertainty.” Journal of Threat and Uncertainty 5 (4): 297–323.

- Walasek, Lukasz, Timothy L. Mullett, and Neil Stewart. 2018. “A Meta-Evaluation of Loss Aversion in Dangerous Contexts.” http://dx.doi.org/10.2139/ssrn.3189088.