What influence would the inclusion of specialty medicine have on CPI-Rx? – Healthcare Economist

The Bureau of Labor Statistics (BLS) Prescription Drug Shopper Value Index (CPI-Rx) appears to be like at value modifications for medicines distributed at outpatient pharmacies. Nevertheless, many pharmaceutical merchandise, notably infusions and injections, are administered at doctor places of work or hospitals. How would together with physician-administered medicines have an effect on the CPI-Rx?

That’s the query a paper by Hicks, Berndt, and Frank (2024) makes an attempt to reply. The authors argue that together with the largely physician-administered specialty medicine is vital as a result of specialty medicine accounted for 55% of U.S. drug spending in 2021, almost double the 28% share from a decade earlier. Greater than half (52%) of specialty drug spending was in oncology; the subsequent largest class was inflammatory ailments (e.g., rheumatoid arthritis) at 9%.

An vital observe when calculating the CPI is that medical prices embrace all allowable prices (i.e., affected person co-payments and reimbursements from private and non-private insurers).

To look at the potential influence of together with physician-administered and specialty medicine within the CPI-Rx, the creator makes use of 2010-2019 knowledge from the Merative MarketScan Industrial Database. The authors examine variations of CPI that seize 100% of specialty medicine in MarketScan with different CPIs

measures that seize solely 5%, 25%, 33% and 50% of specialist medicines. CPI is calculated utilizing a linked Laspeyres index.

Utilizing this strategy, the authors conclude that:

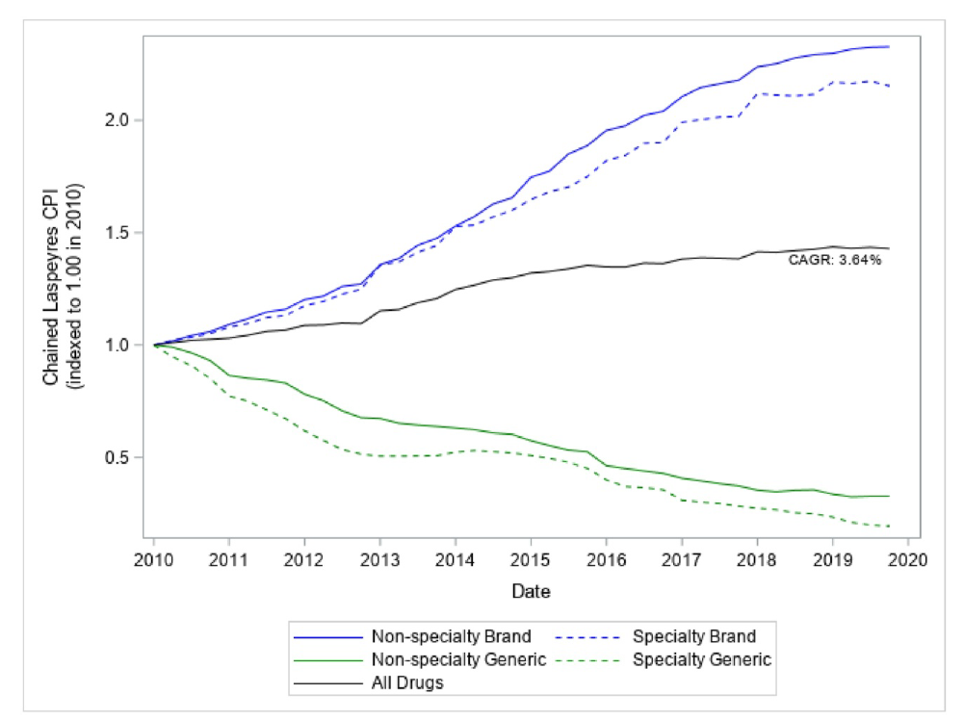

The non-seasonally adjusted printed BLS CPI-Rx has a cumulative annual common development fee (CAGR) of two.99% for the interval January 2010 – December 2019.30 Our absolutely consultant CPI-Rx, which incorporates all specialty and nonspecialty retail and mail order pharmaceutical claims from MarketScan knowledge, has a CAGR of three.64%. The extra consultant pattern subsequently has a CAGR that’s 22% increased than the BLS CPI-Rx (0.65% factors increased).

Paradoxically, the CPI-Rx will increase because of the inclusion of specialty medicine within the CPI, whereas costs for non-specialty medicine really elevated quicker than for specialty medicine.

The authors clarify this phenomenon as follows.

Surprisingly, costs of non-specialty manufacturers and non-specialty generics are rising quicker than the corresponding specialty costs. This can be as a consequence of excessive launch costs of specialty medicine (which aren’t captured in a linked Laspeyres index). As a result of new merchandise make up a considerably bigger share of specialty merchandise in comparison with all branded medicine, the share of generics within the specialty class might be a lot smaller than within the non-specialty drug grouping. When calculating the entire value index, the load given to generics is lowered by rising the specialty pattern. That is what causes the entire index to extend because the specialty pattern grows, though branded drug costs develop extra slowly than non-branded medicine.

Word that the value index appears to be like at gross costs and doesn’t account for drug rebates. Nevertheless, a 2019 CBO report notes that deductions for specialty medicine in Medicare Half D are smaller than these for brand-name prescribed drugs general.

You may learn the complete article right here.