There isn’t any method out – The healthcare weblog

By MATTHEW HOLT

And out of the blue we’re again in 2021.

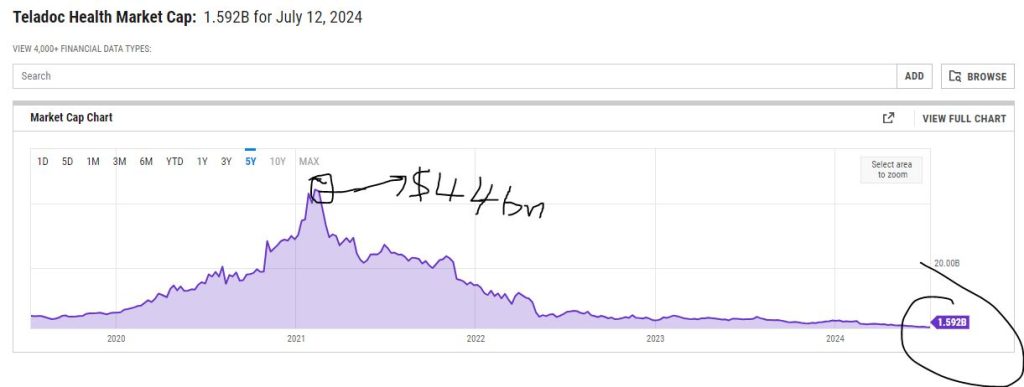

You digital well being followers do not forget that golden age. In 2019, a bunch of digital well being corporations went public, after which by some means acquired combined up within the pandemic meme inventory growth, culminating in Livongo’s sale to Teladoc in August 2020, valuing it at $19 billion, and rather more by early 2021, as Teladoc itself hit a market cap of $44 billion in February 2021

Enterprise capital was poured into digital well being because the fin de siècle for the ZIRP, which had been operating for a decade, mixed with the concept Covid meant we’d by no means depart our houses once more. The vaccine turning into broadly out there firstly of the Biden administration in 2021 put an finish to the concept telehealth was nearly all of the way forward for care supply.

But, between mid-2021 and early 2022, Jess DaMassa and I lined VC funding on a present referred to as Well being in 2 Level 00 (later Well being Tech Offers) and each week there have been a number of $100 million and up offers for brand new well being tech corporations.

Issues aren’t trying so rosy now. Whilst enterprise capital poured into digital well being, these publicly traded corporations, like Teladoc, started to see their inventory costs fall. Whereas it was truly a very good 12 months for the inventory market as an entire, the digital well being sector fell by about 60% in 2021. And it stored falling. 2022 was even worse, and whereas one or two particular person corporations have recovered (hello Oscar!), the market cap of the whole sector continues to be within the doldrums practically two years later.

Of the record I've been following for years, there are solely 11 broadly outlined digital well being corporations with a market cap of greater than $1 billion – that's simply 11 publicly traded unicorns

What’s worse is that just one firm on that record is definitely worthwhile, and that’s Doximity. It revamped $170 million in revenue final 12 months on lower than $500 million in income, and trades at 10x income. However Doximity has all the time been worthwhile, has been since 2014 (lengthy earlier than its IPO), and whereas it’s doing cool stuff with AI and telehealth, it’s primarily an promoting platform for pharma.

There isn’t any such factor as a worthwhile public digital well being firm within the mainstream of healthcare and even insurance coverage, except you rely Optum. Which implies there virtually definitely isn’t any worthwhile VC-backed non-public firm both.

Which brings me to this month. Bear in mind these large rounds that Jess & I used to report on and make enjoyable of? They’re again.

I get it. The inventory market is sizzling and all these pension funds are attempting to reinvest their Nvidia earnings someplace. VC looks as if an inexpensive guess and there have been just a few tech IPOs. In case you look actually laborious, as STAT's Mario Aguilar did, you might faux that Waystar & Tempus are well being tech IPOs, though a cost/RCM firm and a diagnostics firm each dropping a ton of cash wouldn't encourage confidence in me as an investor.

However the numbers being thrown round ought to make anybody assume. Let’s take just a few examples from the previous month. This isn’t a criticism of those corporations, who I’m positive are doing an ideal job, however let’s take a look at the maths.

Digital front-door chatbot Okay-Well being raised a valuation of $900 million. This spherical was a $50 million top-up, however it has raised practically $400 million. It says it will likely be worthwhile by 2025 and has Elevance as its largest buyer. Harmonycares is a home-calling medical group that’s presumably following the technique that Signify and others have adopted. It raised $200 million, so it presumably has a $500 million+ valuation – Centene purchased an earlier model of the corporate for $200 million a decade in the past and bought it to some buyers two years in the past. Headway is a community of psychological well being suppliers that makes use of instruments to get suppliers onto its system and promote them to insurers. It raised $200 million at a reported valuation of $2.3 billion.

You’ll be able to take a look at that record of publicly traded corporations, together with corporations which have gone non-public like Sharecare, and you’ll see that there are a whole lot of telehealth chatbots, medical teams, psychological well being corporations on the record. They in all probability all have comparable know-how in them. I’m positive should you shook Sharecare laborious sufficient, all of these applied sciences would fall out, given the variety of corporations they’ve acquired of their decade-plus of growth.

However let's speak about psychological well being.

Amwell acquired a psychological well being firm referred to as Silvercloud and a chatbot referred to as Conversa. Its market cap is someplace between $250 million and $350 million and it has greater than that in money, that means the corporate itself is price nothing! The VCs who put cash into Okay-Well being and Headway may actually have purchased Amwell for about what they invested in a fraction of these corporations. Is Headway doing greater than the $250 million in annual income that Amwell does? Headway is price virtually 6x the worth of Talkspace, which does about $150 million in annual income. And should you take into account BetterHelp to be 50% of Teladoc – which it roughly is – Headway is price 3x the worth of BetterHelp, which does $1 billion in annual income. Is there an opportunity that Headway will come near these numbers? Perhaps somebody who has seen the newest pitch deck can let me know, however I extremely doubt it.

In fact, these new investments may create new know-how or new enterprise fashions that the earlier era of digital well being corporations couldn’t think about. They could even have discovered methods to develop profitably, though so far as I can inform, Doximity stands alone as a worthwhile firm that took VC funding it by no means wanted and by no means used.

However isn't it extra seemingly that they are going to compete available in the market with the listed corporations and personal corporations that acquired funding in 2020-2022, have comparable pitches and know-how, however are equally loss-making?

I’ve been a longtime advocate for digital well being and I actually hope that know-how can change the sclerotic healthcare trade. I would like all these corporations to do properly and alter the world. Perhaps these VCs investing in these mega rounds are wiser than they have been in 2022. However given the state of the digital well being sector within the present inventory market – which is at document highs, by the best way – I simply don’t know what the exit will be, and it pains me to say that.

Classes: Well being Know-how, Matthew Holt