What are the implications of care money owed among the many aged?

Healthcare debt is a pervasive downside in america, attracting the eye of some policymakers and rising as a possible marketing campaign challenge. A 2022 KFF survey discovered that 2 in 5 U.S. adults (41%) of all ages report some type of debt resulting from medical or dental payments for their very own or another person’s care. Practically three-quarters of adults say they fear about paying surprising medical payments or the price of healthcare providers, increased than the shares who say they fear about paying different family bills. The Medicare program, which supplies medical health insurance to 66 million individuals, most of whom are 65 or older, helps cowl the price of medical care for individuals who qualify, however healthcare value issues amongst Medicare-age adults should not unusual and depart many uncovered to debt, with doubtlessly critical and long-term well being and monetary penalties.

Medicare supplies protection for a spread of well being care providers, together with hospital stays, physician visits, pharmaceuticals, and post-acute care, however Medicare beneficiaries typically pay out of pocket for his or her month-to-month premiums and deductibles, cost-sharing for Medicare-covered providers, and the price of providers not coated by Medicare, corresponding to dental, imaginative and prescient, and listening to care, and long-term providers and helps. Medicare households additionally spend extra on well being care than different households, allocating a bigger share of their family budgets to medical prices and premiums. Well being care prices pose a specific problem for the hundreds of thousands of Medicare beneficiaries whose incomes and financial savings are restricted sufficient to soak up surprising well being or different bills. Lastly, older adults are extra doubtless than youthful populations to have cognitive issues, corresponding to Alzheimer's illness, which have been proven to contribute to declining credit score scores and monetary instability years earlier than the situation is recognized.

This information word presents the findings of the KFF Survey on Healthcare Debt to evaluate the prevalence, sources, and penalties of well being care debt amongst Medicare-age adults.

Key studying factors

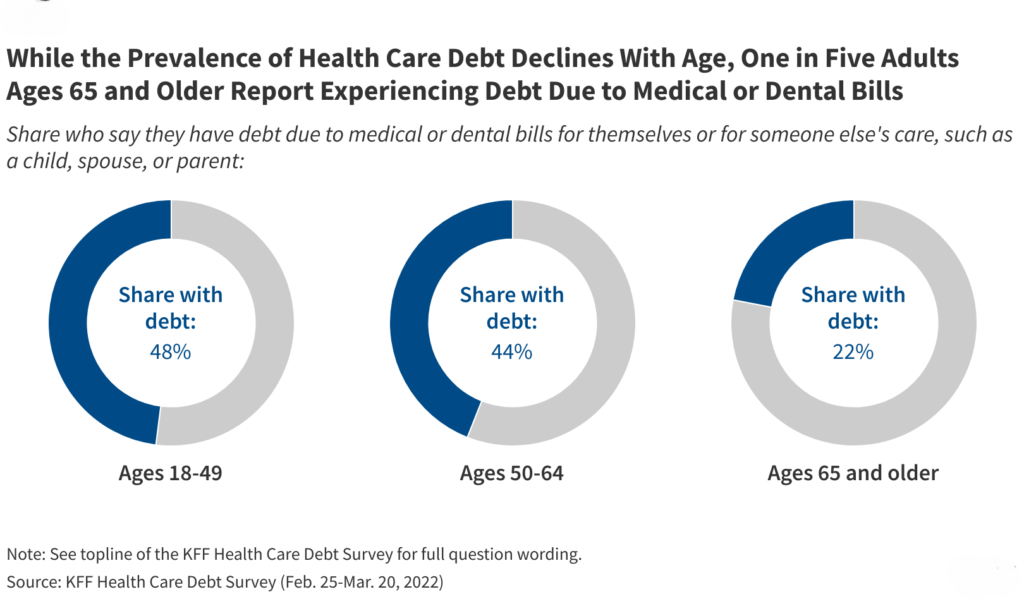

- A couple of in 5 U.S. adults ages 65 and older (22%) stated they’ll have some type of debt on account of medical or dental payments for their very own care or another person’s in 2022. That’s half the proportion for adults ages 50 to 64 (44%).

- Amongst adults with Medicare well being care debt, a big proportion report that a few of the payments that triggered the debt had been for routine well being care providers, corresponding to lab charges and diagnostic exams (49%), dental care (48%), and physician visits (41%).

- Practically three in 10 adults with Medicare eligibility and healthcare debt (29%) say their family has been contacted by a group company over medical or dental payments up to now 5 years, whereas one in 4 (23%) say healthcare debt has negatively affected their credit score rating.

- Three in 5 adults with Medicare eligibility and healthcare debt (62%) say they or one other member of the family delayed, skipped, or sought alternate options for obligatory well being care or prescription drugs up to now yr due to value.

In 2022, multiple in 5 U.S. adults aged 65 and older (22%) had some type of debt resulting from medical or dental payments (Determine 1). That is about half the share amongst adults ages 50 to 64 (44%), who should not but eligible for Medicare based mostly on age. Decrease charges of healthcare debt amongst older adults are doubtless due partly to the practically common Medicare protection amongst individuals 65 and older. As well as, most Medicare beneficiaries have some type of protection that limits their cost-sharing, corresponding to Medicare Benefit, or supplemental protection, corresponding to Medicaid, retiree well being care, or Medigap.

The speed of well being care debt amongst individuals 65 and older is increased than others report, largely due to methodological variations in how well being care debt is outlined. Surveys of well being care debt within the U.S. have usually targeted on unpaid medical payments or payments despatched to assortment businesses, doubtlessly overlooking the share of adults who pay their well being care payments by operating up bank card debt, taking out loans, or borrowing cash from household and buddies. Because of this, the KFF Survey on Healthcare Debt supplies a broad measure of well being care debt, which incorporates different forms of debt ensuing from medical or dental payments, in addition to debt owed for caring for another person, corresponding to a baby, partner, or mum or dad.

Many seniors pay their well being care payments by accumulating debt via bank cards or different sources (Determine 2)About one in 10 Medicare-age adults report having medical or dental payments that they pay on to a well being care supplier over time (12%), placed on a bank card and repay over time (11%), are late or unable to pay (8%), or are in debt to a financial institution, assortment company, or different lender on account of loans used to pay medical or dental payments (7%). A smaller share report being in debt to household and buddies for cash borrowed to pay medical or dental payments (3%).

About two in 5 Medicare-age adults with medical debt (39%) owe lower than $1,000, together with one in 5 (19%) who owe lower than $500, however one in 10 Medicare-age adults with medical debt (11%) owe $10,000 or extra (information not proven). Even comparatively small quantities of debt can contribute to a decline in creditworthiness.

The sources of well being care debt amongst older adults are various and embrace many routine well being care wants (Determine 3)Practically half of Medicare-age adults with well being care debt say a few of the payments that triggered their debt had been resulting from lab charges and diagnostic exams (49%), dental care (48%), and physician visits (41%). One in three (31%) attribute a few of their debt to emergency room prices, and one in 4 (24%) to pharmaceuticals. Dental care is a number one reason for well being care debt amongst Medicare-age adults, doubtless resulting from the truth that conventional Medicare doesn’t cowl dental providers. (Most Medicare Benefit plans embrace some dental protection, however the scope of protection varies broadly, and plan members should still pay important out-of-pocket prices for these providers.)

Solely 6% of Medicare-age adults attribute a portion of their debt to payments for long-term care providers and helps, corresponding to the price of nursing house care, assisted residing, or full- or near-full-time house well being aides. These providers are used extensively by a comparatively small phase of the Medicare inhabitants, however they are often fairly costly. For instance, in 2023, the median annual value of a personal room in a nursing house was $116,800 and $288,288 for 24-hour house well being aides. These prices far exceed the median earnings ($36,000 per particular person) and financial savings ($103,800 per particular person) of the typical Medicare beneficiary in 2023. Medicare typically doesn’t cowl these providers, making them unaffordable for a lot of older adults and leaving some with important debt. (The outcomes of the examine might not precisely mirror the prices and money owed incurred by individuals residing in nursing houses, assisted residing services and different establishments. Nonetheless, the examine does embrace money owed associated to long-term care and assist, if these money owed are additionally incurred by different relations.)

The monetary impression of healthcare debt will be lasting. Practically three-in-ten Medicare-age adults with healthcare debt (29%) say their family has been contacted by a group company on account of medical or dental payments, whereas one-in-four (23%) say healthcare debt has negatively affected their credit score rating (Determine 4). For retirees with healthcare debt, these impacts will be troublesome to reverse and will make it more durable to get reasonably priced credit score sooner or later. The Shopper Monetary Safety Bureau not too long ago proposed a rule that will take away healthcare payments from most credit score reviews and prohibit lenders from making lending choices based mostly on medical data, with the objective of lowering the burden of healthcare debt on American adults and defending towards coercive credit score reporting practices.

Two in 5 Medicare-age adults with well being care debt report that they or one other member of the family have reduce on spending on family provides (42%) or used up a big portion of their financial savings (39%) up to now 5 years on account of their well being care debt (Determine 5).. One in three has pulled cash from long-term financial savings accounts, corresponding to a retirement account (34%) or elevated their bank card debt for non-medical purchases (31%), and one in 5 has taken out a mortgage (21%) or skipped or deferred funds on different payments (18%). Such sacrifices can have critical penalties for monetary stability and general well-being and may perpetuate the cycle of well being care debt by leaving seniors with fewer assets for different obligatory well being care bills.

Three in 5 adults with Medicare age and healthcare debt (62%) say they or one other member of the family has delayed, skipped, or sought alternate options for wanted care or prescribed drugs due to value (Determine 6)Practically half (48%) of adults with Medicare eligibility and well being care debt delayed getting wanted well being care up to now yr, whereas two in 5 (43%) relied on house treatments or over-the-counter drugs as a substitute of going to the physician, and one in three didn’t get a medical take a look at or remedy really helpful by a physician (31%) or took lower than the prescribed dose of a drugs by skipping doses, halving capsules, or not filling the prescription (28%).