Is There a Decline in Competitors within the US? – Healthcare Economist

It is a tough query to reply. Contemplate the next worldviews:

- Lower in competitors. Competitors has decreased as we see elevated market focus, rising markets, a decline in labor share, and decrease charges of latest enterprise formation on the macro degree.

- Competitors in motionIf just a few “celebrity” companies in an {industry} develop by offering prospects with extra worth based mostly on their superior capacity to undertake and use new applied sciences that entail increased mounted prices and decrease marginal prices, we might count on each focus and worth/price markups to extend in the identical path.

Briefly, the identical empirical proof might assist very completely different worldviews.

Market focus: Contemplate one other instance the place the market focus of the highest 4 companies (referred to as the C4 metric) elevated from 50% to 90% over time. If this focus have been purely attributable to acquisition, there is perhaps issues about market focus/market energy. If, alternatively, the expansion in C4 was attributable to inner development by a number of giant, environment friendly companies, main to higher merchandise and decrease costs, this improve in C4 can be much less of an issue.

Additionally contemplate how market definitions can result in each upward and downward distortions in market focus.

Underestimation of market focus attributable to the usage of overly broad classes: NAICS code 325412 is “Pharmaceutical Preparations Manufacture.” If that is used as a “market,” a drug that treats one illness can be in the identical “market” as all different medication that deal with different ailments. Within the excessive case, if there have been many ailments of comparable prevalence and severity, and every illness class had a single patented monopoly, measuring focus in NAICS code 325412 would misleadingly yield a low focus. In distinction, researchers who research the {industry} group of pharmaceutical markets are inclined to outline markets far more narrowly. For instance, Cunningham, Ederer, and Ma (2021) outline markets as a mixture of therapeutic class and mechanism of motion. This smart process ends in lots of of separate pharmaceutical markets. Equally, NAICS code 513210 is “Software program Publishers.” This code teams collectively all software program, whether or not desktop working programs, enterprise databases, cellular apps, pc video games, or specialised technical software program. Market Overestimation Focus by utilizing areas which can be too broad: NAICS code 444130 is “{Hardware} Shops.” Contemplate the competitors amongst {hardware} shops earlier than and after the growth of Residence Depot and Lowe's. Suppose that every city begins with its personal monopoly ironmongery store with a distinct native proprietor. New expertise then makes economies of scale potential throughout geographic areas, permitting probably the most environment friendly {hardware} shops to develop nationwide. Suppose that the result’s that every city is served by two giant {hardware} shops, Residence Depot and Lowe's. The focus measured on the nationwide degree could have elevated dramatically, from a extremely fragmented {industry} to a duopoly. However shoppers would profit from better native competitors, with two decisions as a substitute of only one.

Worth markups can inform us whether or not a agency workouts market energy. Markups are costs which can be far above marginal price. Nonetheless, even estimating marginal price is problematic for a variety of causes.

First, on a big scale, this can be very tough to differentiate prices that adjust with output (over the related vary and timeframe) from prices that don’t. Second, marginal prices usually embody difficult-to-observe alternative prices, particularly when companies face capability constraints. Third, multi-product companies usually have variable prices which can be shared throughout a number of merchandise and are tough to allocate. Fourth, how one aggregates estimated worth/price markups from the product degree to the agency degree, and from the agency degree to industry-wide or economy-wide abstract measures, issues quantitatively and for interpretation. For instance, a shift to industries wherein mental property is extra necessary will by itself trigger common markups to rise throughout the economic system, even with none adjustments throughout the {industry}.

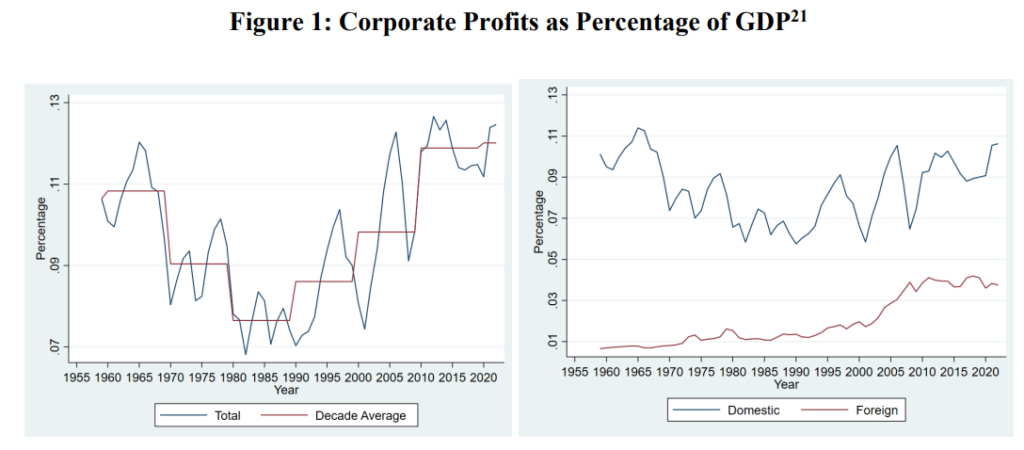

For instance, have a look at the chart beneath. Company income have grown over time (see chart on the left), however that is largely as a result of home corporations have change into extra profitable in overseas markets (see chart on the appropriate).

There are two major approaches to estimating markups, the latter of which is probably the most extensively used. The De Loecker, Eeckhout, and Unger (2020) (“DLEU”) methodology for making use of the manufacturing strategy has been influential on this literature.

- Demand strategyOne estimates a client demand system and makes assumptions concerning the conduct of companies to deduce what the marginal prices should have been to generate the noticed costs, provided that demand system and the assumed conduct of companies.

- Manufacturing strategy. Information on inputs and outputs are used to deduce what the value/price mark-up should have been such {that a} cost-minimizing agency would select to supply the noticed quantity of output utilizing the noticed quantity of inputs.

Most of those arguments have been put ahead in a paper by Carl Shapiro and Ali Yurukoglu (2024), which goals to research what’s going on by specializing in detailed industry-level knowledge moderately than simply aggregated economy-wide knowledge. The paper does an awesome job of summarizing current literature on tendencies in market focus, worth/mark-ups, and retrospective evaluation of current mergers. The above content material summarizes among the challenges, however the full paper does a really good job of reviewing the present literature on each side of the argument.

Further particulars:

- The articles by Sutton (1991) and Sutton (1997) clarify the argument from competitors in motion in his two books on competitors.

- The Clayton Act prohibits mergers and acquisitions when “the impact of such acquisition can be materially to minimize competitors or create a monopoly.”

- Presently, transactions valued at greater than $119.5 million should be reported below the Hart-Scott-Rodino (“HSR”) Act.