Within the U.S., medical health insurance premiums are tax deductible if they’re paid via out-of-pocket bills, however out-of-pocket bills should not. There are exceptions to this rule, nevertheless. These embody two frequent tax-favored accounts:

- Versatile Financial savings Accounts (FSA)These accounts enable staff to put aside a portion of their pre-tax earnings to cowl certified medical bills. Nonetheless, if the worker has not used these funds by the tip of the yr, they expire.

- Well being Financial savings Accounts (HSA)HSAs additionally enable staff to save lots of pre-tax earnings to cowl certified medical bills, however in contrast to FSAs, HSA balances roll over from yr to yr. Whereas anybody with a certified plan can enroll in an FSA, solely staff who enroll in a high-deductible well being plan (HDHP) could contribute to an HSA.

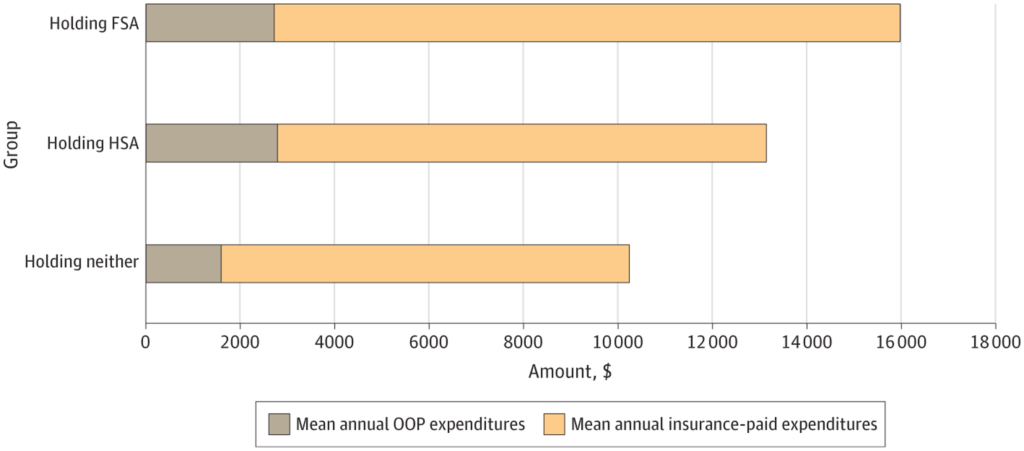

How does an FSA or HSA have an effect on well being care spending? A paper by Ding and Glied (2024) makes use of well being care spending information for working-age adults from the 2011-2019 Medical Expenditure Panel Survey (MEPS) to seek out the reply. Their examine discovered that:

…households with FSAs spent a median of 20% or $2,033 (95% CI, $789-$3,276) extra on well being care per yr than households with out an account, largely because of greater insurer-paid expenditures. Households with HSAs spent a median of 44% or $697 (95% CI, $521-$873) extra on out-of-pocket expenditures and had insignificantly greater insurance-paid expenditures than households with out an account, leading to whole expenditures much like these of households with out an account. The extra tax expenditures related to FSAs averaged $1,306 (95% CI, $536-$2,076) per yr per household.

You’ll be able to learn the complete article right here.