That is evident from an evaluation by PwC, at the very least with regards to returns on the inventory markets.

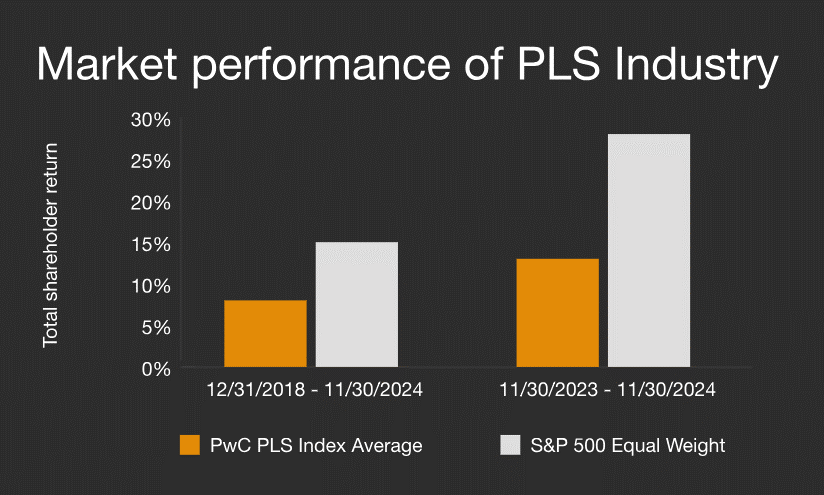

Our PwC Equal Weighted Index of fifty pharmaceutical firms analyzes the sector's complete shareholder returns in comparison with the S&P 500 Equal Weighted Index. From 2018 by way of November 2024, the PwC Pharma index returned 7.6% to shareholders, in comparison with greater than 15% for the S&P 500. Over the previous yr, this dynamic has grow to be even clearer: the PwC Pharma index returned 13.9% in comparison with 28.7%. for the S&P by way of November 2024.

It’s no shock that worth progress is extremely concentrated in just some firms:

…since 2018, a shrinking variety of firms have influenced optimistic returns within the pharmaceutical sector. Throughout the S&P 500, the so-called “Magnificent 7” was liable for 40% of the rise in worth since 2018. Within the pharmaceutical {industry}, this dynamic is even stronger with solely two [leading GLP-1 manufacturers]…liable for virtually 60% of the rise in worth progress among the many 50 pharmaceutical firms analyzed by PwC.

With the arrival of the IRA and growing stress on worth negotiations in lots of international locations, will buyers proceed to fund life sciences innovators? Let me know your ideas.