After reaching the bottom stage since Pandemie, dwelling -based M&A is prepared for rebound

Residence-based care agreements delayed significantly in 2024, however the circumstances enhance, in keeping with a brand new report by Mertz Taggart.

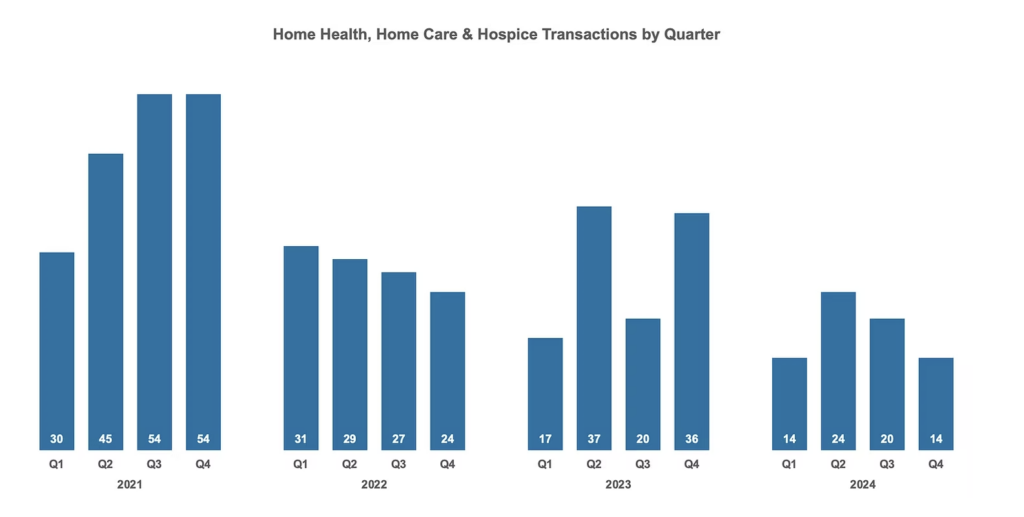

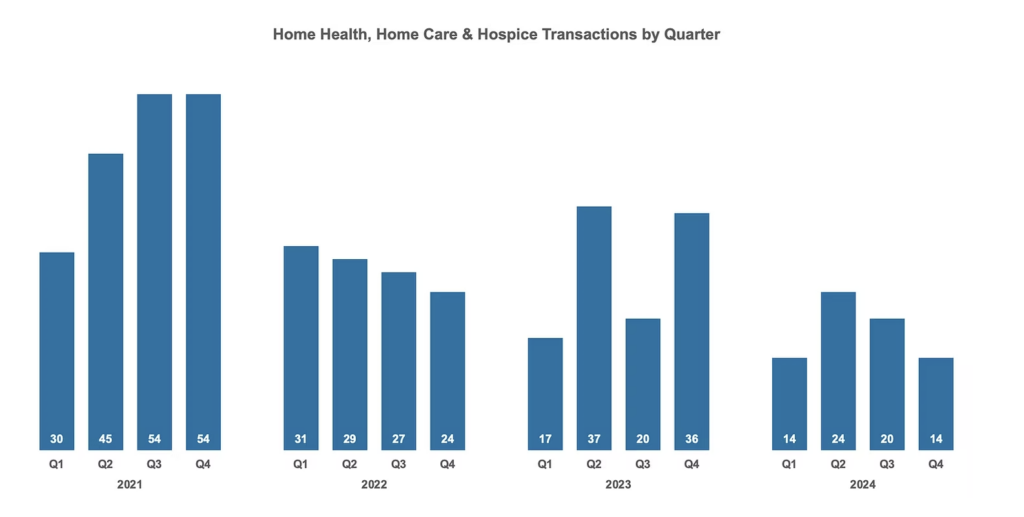

M&A exercise fell from 183 offers in 2021 to 110 in 2023 after which dropped to 72 in 2024, in keeping with the report. Ultimately, solely 14 transactions happened within the final quarter, which marked the bottom stage of home-based care-M & A exercise for the reason that pandemic. These offers included dwelling care, dwelling well being and hospice, with some transactions with multiple sort of care.

“Transactions are beginning to make progress,” mentioned Cory Mertz, managing accomplice at Mertz Taggart. “Though we don’t need to lead ourselves, we observe a powerful begin of Q1 2025 by way of closed offers.”

Mertz Taggart

Mertz TaggartMertz Taggart, primarily based in Fort Myers, Florida, has efficiently accomplished greater than 140 transactions in well being care since 2006.

When discussing the tendencies in mergers and acquisitions inside the dwelling -based healthcare sector, Mertz emphasised that the elections was an important occasion within the fourth quarter. The Trump administration is predicted to have a constructive affect on the M&A panorama in well being care by selling the expansion of the personal sector and minimizing the obstacles of laws.

“By giving precedence to deregulation, the administration promotes an atmosphere the place buyers of personal fairness (PE) really feel extra assured in environment friendly safety of offers, which unlocking alternatives within the healthcare sector,” mentioned Mertz.

Residence Well being Care M&A

Over the last 16 quarters, the 2 lowest for Residence Well being M&A in 2024, with solely two offers accomplished within the fourth quarter of final 12 months, in keeping with the report. Nonetheless, these offers have been essential.

The primary announcement got here on October 13 when Residence Well being Care Company Prime Residence Well being Providers, primarily based in Brooklyn, New York, acquired the asseting of the Nurs Affiliation of States Island, which stopped the actions on 27 September.

The second deal happened lower than a month later, when Alternative Well being at Residence Accentra Residence Well being and Hospice, positioned in Oklahoma Metropolis. This acquisition gives a selection with protection of 90% of the city and rural areas of Oklahoma.

Residence Care M&A

The fourth quarter was a busier time for dwelling care, accomplished with eight offers. Assist at dwelling closed 4 transactions within the quarter, together with acquisitions of assist nurses from Helpmatses in Pennsylvania and caregiver established in Florida.

Different exceptional transactions embrace the growth of Nova Leap Well being in Canada to Florida with the acquisition of $ 4.6 million from a non-public dwelling care company. The title of the gross sales firm has been withheld; Nonetheless, the ultimate settlement was introduced on October 11.

Avenues Residence Care, primarily based in Dallas, acquired Clear Path Residence Care, whereas Havencrest Capital Administration, a PE firm in Dallas, Sandhills Residence Care in Rockingham, North Carolina, has taken over through his Chicago-in Chicago-based dwelling care platform, Avid Well being at dwelling.

“We anticipate the exercise to choose up in 2025 in comparison with 2024,” mentioned Mertz. “There may be an excessive amount of demand from personal fairness, powered by outdated dry powder. These are devoted funds of their buyers that they haven’t but been capable of make investments. Leaving devoted funds behind can improve their subsequent fund extra a problem, so there’s an impulse to take a position now. We additionally anticipate extra exercise by sponsors -supported portfolio firms which might be searching for an exit. “