Which states have probably the most and least progressive tax techniques? – Healthcare Economist

These are the questions {that a} Nber -working doc of Fleck, Heathcote, Storeslettes and Violante desires to reply. With the assistance of assorted survey and administrative information, the authors come the next 8 conclusions:

(i) The federal tax and switch system is progressive.

(ii) State and native tax and switch techniques are nearly proportional on common.

(iii) There’s a substantial heterogeneity in tax stage and tax progressiveness between states.

(iv) States which can be often financed by gross sales and actual property tax often have regressive tax techniques and low common tax charges. States which can be often financed by earnings tax often have progressive tax techniques and excessive common tax charges.

(v) Regressive conditions are concentrated within the south and entice extra interstate web migration, particularly from migrants with a excessive earnings.

(VI) The progressiveness of the state remained broadly steady between 2005 and 2016.

(VII) The inclusion of company earnings and enterprise tax reduces the typical progress of the state however will increase federal progressiveness.

(VIII) Together with bills for public items and providers as a switch has a significant optimistic impact on the measured progressiveness.

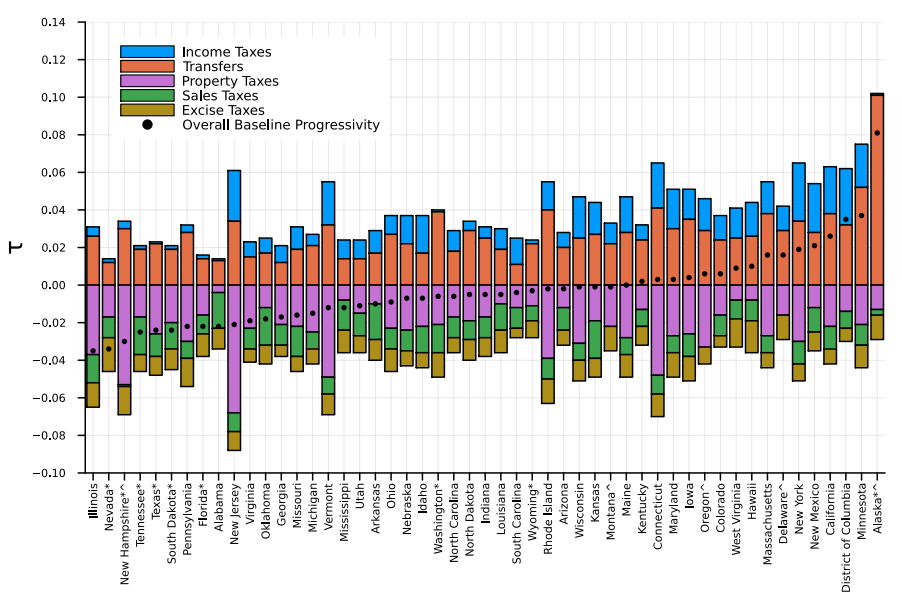

Which states have probably the most progressive tax system? Alaska, Minnesota, DC, California and New Mexico are on the high of the record.

Which states have probably the most regressive tax system? Illinois, Nevada, New Hampshire, Tennessee and Texas Lead.

Progressiveness is clearly illustrated by evaluating California and Texas. Each states have a progressive earnings tax. Nevertheless, the earnings tax is a a lot bigger share in California than Texas and the California Tax Code is rather more progressive. State transfers are additionally progressive in each states, however California has a lot bigger transfers as part of its funds than Texas. Conversely, gross sales, excise duties and actual property tax are regressive in each states, however Texas depends rather more on these financing mechanisms. Attributable to a mix of those financing mechanisms, the general Texas has a really regressive tax system, whereas that of California may be very progressive.

Rather more attention-grabbing particulars might be discovered right here in the complete article.