Eikon raises $ 350 million for the pipeline of the medicine for most cancers underneath the management of Melanomommed in essential checks

Eikon Therapeutics, an organization led by the previous Merck director who despatched the Keytruda most cancers drugs to FDA service inspection, has raised $ 350.7 million to assist a pipeline that now features a candidate for main medicines in just a few essential checks for the rising melanoma therapy.

The Lead Eikon Medicijn, Eik1001, is a small molecule that’s designed to the touch toll-like receptors 7 and eight (TLR7/8). The activation of those receptors is meant to generate an immune response that fights most cancers. In line with information of medical check, the part 3 check is analysis of EIK1001 alongside Merck's Checkpoint inhibitor Keytruda, the place that mixture is in contrast with Keytruda and a placebo as a first-line therapy for superior melanoma. The supposed registration of the examine is 740 sufferers. Individually, the Eikon pipeline mentions EIK1001 in part 2 checks in non-small lung most cancers.

EIK1001 was initially developed by seven and eight biofharmaceuticals. Eikon has a allow of world rights to that immunotherapy and one other TLR7/8 -agonist in 2023; Monetary circumstances haven’t been introduced.

Eikon can also be positioned within the clinic with Eik1003, an inhibitor from PARP1. This enzyme is the important thing to DNA restoration in cells, so blocking it results in cell demise. Though PARP inhibitors have already been authorized to deal with sure cancers, they provide you with toxicity dangers which might be regarded as related to blocking PARP2. Eikon's EIK1003 inhibits selective PARP1 with the goal of providing the identical efficacy as presently accessible PARP inhibitors whereas the toxicity of these medicines is averted.

Eik1003 is in part 1 testing in sufferers with chest, ovary, prostate or pancreatic most cancers. Eikon additionally follows a PARP1-Selective strategy with EIK1004, which is designed to penetrate the blood-brain barrier to deal with mind most cancers. The corporate's web site states {that a} part 1 check of this drugs began within the first quarter of this yr.

“With medical research that are actually energetic in 28 nations, on 5 continents, we speed up the event of much-needed therapies whereas we proceed to develop our analysis and improvement alternatives,” stated CEO Roger Perlmutter in a ready rationalization.

Eikon's PARP inhibitors got here from Impression Therapeutica. The corporate's pipeline additionally consists of belongings obtained from spare therapeutics in pre -clinical improvement for most cancers and neurodegenerative illness. Monetary circumstances for these offers weren’t introduced.

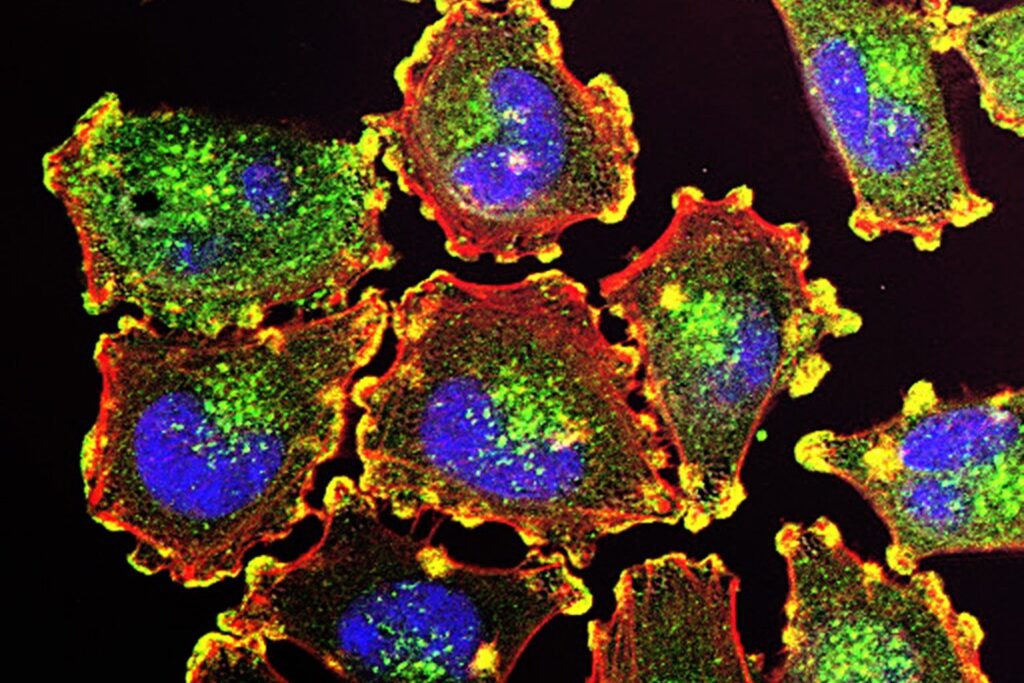

Hayward, Eikon, established in California, emerged in 2021, supported by $ 148 million in financing led by the column group. Perlmutter, previously the president of Merck Analysis Laboratories, was named CEO of the startup. Eikon discovers medicines with its personal expertise that visualizes proteins, in order that scientists can see how they transfer in a residing cell in actual time. This visualization expertise relies on the analysis by co-founder Eric Betzig, co-founder of the corporate, who has obtained the Nobel Prize for Chemie 2014.

Essentially the most superior internally found Eikon drug candidate is Eik1005. This drugs is a brake from WRN, an enzyme that performs a job in DNA restore. WRN has emerged as a therapeutic goal for tumors characterised by excessive microsatellite instability (MSI) and it’s a motor of sure gastrointestinal and endometrial cancers. In line with the Eikon web site, the corporate develops Eik1005 for MSI-high cancers and delicate cancers which have defects in DNA restore. The corporate expects to begin a part 1 check of EIK1005 within the first half of this yr.

Eikon's final financing was unveiled in 2023, unveiled as $ 106 million within the first tranche of a collection C spherical. With the brand new financing introduced on Wednesday, the corporate stated it has collected round $ 1.1 billion to date. The ultimate spherical was led by earlier buyers within the firm that had been accompanied by just a few new buyers. This funding syndicate consists of Lux Capital, Alexandria Enterprise Investments, Ame Cloud Ventures, The Column Group, E15 VC, Foresite Capital, Common Catalyst, Soros Capital, Stepstone Group, Funds and Accounts Suggested.

Public Area Picture by Julio C. Valencia through the Nationwide Most cancers Institute