Novartis will get section 3-ready uncommon kidney illness drugs through $ 800 million regulus acquisition

Novartis has made kidney problems into a spotlight space and it now provides a brand new drug perspective through a deal to accumulate Regulus Therapeutics, a biotech with a drugs that’s prepared for essential assessments in a uncommon kidney illness with restricted remedy choices.

The Swiss pharmaceutical big on Wednesday mentioned it agreed to pay $ 800 million prematurely to purchase Regulus. Shareholders of the San Diego -based biotech might get extra if the protagonist, a genetic drugs known as Farabursen, passes the regulating muster.

Farabursing is developed as a remedy for autosomal dominant polycystic kidney illness (ADPKD). This uncommon illness results in the event of cysts in organs, primarily the kidneys. Because the illness progresses, the fluid -filled cysts improve the kidneys, which impacts their perform. Signs embody again and aspect ache, hypertension, blood within the urine and urinary tract infections. In some sufferers, ADPKD continues to the kidney illness within the closing stage.

Normal ADPKD remedy is the administration of signs and making an attempt to decelerate illness development. The one therapeutic is Tolvaptan, model identify Jynarque, an Otsuka pharmaceutical drugs authorised by the FDA in 2018 for delaying cyst progress in ADPKD. However today's day introduces the chance of significant liver toxicity.

Regulus's analysis focuses on micrornas, non-coding RNAs that play a task in regulating gene expression. The biotech medication are oligonucleotides designed to inhibit microrna's related to sickness. Farabursen focuses on MIR-17 and ideally blocks this microrna within the kidneys. This method is meant to scale back the cyst progress and kidney dimension, in order that the development of the illness is delayed.

ADPKD is attributable to mutations within the PKD1 or PKD2 genes that cut back the perform of their respective protein merchandise. In a placebo-controlled, a number of dose of section 1B research, the outcomes confirmed elevated ranges of those protein merchandise in urine. Outcomes additionally confirmed enhancements in different kidney well being measures. Furthermore, Farabursing was nicely tolerated by contributors within the research. In January Regulus mentioned that it had reached settlement with the FDA on what it ought to show in a section 3 -examination to request an accelerated approval of farabursing in ADPKD. On the finish of March, Regulus mentioned that it was planning to begin the essential research within the third quarter of this yr.

“With restricted remedy choices which are at present obtainable for sufferers affected by ADPKD, Farabursen represents a doubtlessly first-in-class drugs with a profile that may supply improved effectiveness, tolerance and security versus care as commonplace,” mentioned Shreeram Aradhye, president, improvement and chief medical officer at Novartis, mentioned in a ready clarification.

In a memorandum despatched to traders, Leerink companions analyst Joseph Schwartz mentioned that Novartis is “a logical accomplice” to compete in opposition to Farabursing, particularly given the rising presence of the pharmaceutical big in uncommon kidney ailments. Originally of April, Novartis Vanrafia gained FDA approval accelerated as remedy for immunoglobulin a nephropathy (Igan). That small molecule got here from the $ 3.2 billion takeover from Chinook Therapeutics in 2023.

Novartis' internally found and developed Fabhalta, a complement -protein inhibitor, gained accelerated FDA approval final August as remedy for Igan. In March, this twice-day capsule expanded his label and have become the primary remedy authorised by the FDA for C3 Glomerulopathy, an ultra-silly kidney illness that may proceed to kidney failure. Novartis carries out further research that may assist an extra enlargement of Fabhalta to different kidney problems.

Regulus was shaped in 2008 as a Microrna -Three way partnership between Alnynamceuticals and ISIS Prescription drugs (now generally known as Ionis Prescription drugs). When Regulus grew to become public in 2012, it price its shares every for $ 4. The monetary circumstances of the Regulus Acquisition break all the way down to $ 7 in money for every share of biotech, which is $ 800 million. That value is a premium of 108% for the Biotech closing value on Tuesday. Regulus shareholders can obtain one other $ 7 per share of a conditional worth proper within the deal that’s linked to the approval of Farabursen laws.

SCHWARTZ famous {that a} Regulatory Regulatory Displaying states that Farabursen should shield the approval of the laws by the tip of 2034 to activate the conditional worth proper, however the doc doesn’t point out whether or not that’s accelerated approval or conventional approval. Leerink -Initiatives accelerated approval can happen in 2029, so that there’s a lot of time left if there are delays or the FDA requests extra information. Though the Regulus Acquisition nonetheless wants the approval of anti -icing regulators, Schwartz doesn’t see a lot federal buying and selling committee concern as a result of Farabursen doesn’t overlap with the kidney indications that Novartis tackles or investigates for Fabhalta.

The Novartis and Regulus Boards of Administrators have authorised the acquisition, which the businesses anticipate to shut within the second half of this yr.

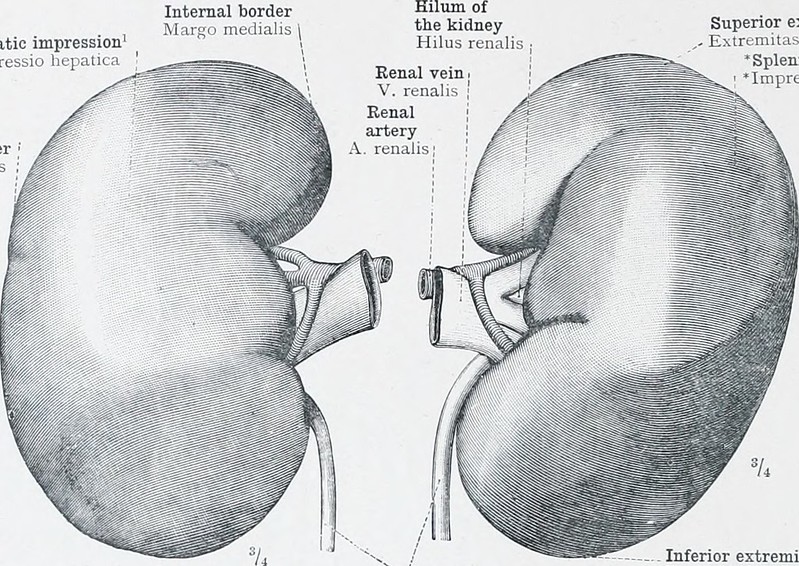

Public Area Picture by Flickr Consumer Web Archive Ebook Photos