So what’s the take care of Ichra?

Particular person protection for well being charges, popularly generally known as Ichras, have entered the spirit of the instances. Ichras allows employers to offer staff with a set quantity earlier than taxes to purchase and pay for particular person well being care protection for well being prices. Current articles have known as the VC curiosity in house, with some well being care gamers even evaluating Ichras with Bitcoin given the extent of Buzz. The thrill is effectively earned as a result of the variety of American staff that Ichras supply continues to develop. However, headwind – together with competitors, particular person protection market uncertainty and complexity – can hinder the possibility of Ichra.

Ichra overview

Earlier than Ichras, employers with fewer than 50 full -time staff with fewer than 50 full -time staff have been capable of present staff for healthcare for workers earlier than the tax cash. The primary Trump administration created the Ichra the place Ichras grew to become out there to the general public in 2020. The Ichra is an outlined contribution or everlasting fee to staff, which limits the publicity to employers to the growing medical prices. Employers have confronted with growing prices, because the Kaiser Household Basis states that the common premium for a single and household protection for the employer's medical health insurance coverage has grown by 22% since 2018.

Estimates counsel that round 500K staff take part in an Ichra on the finish of 2024. Normally, the variety of American employers that Ichra / Qsehra affords has virtually tripled since 2020. Oscar -Well being initiatives that the overall dimension of the Small and Medium Enterprise (SMB) phase is 75 million lives, which signifies that solely 0.66% of the SMB inhabitants is now supplied an Ichra. As such, there’s potential for Ichra to increase to a big inhabitants.

Apparently, Ichra's progress deviates from the expansion of one other outlined employer's contribution: the 401 (Okay). In the direction of the tip of 1982, virtually half of the main American employers supplied a 401 (Okay). The 401 (Okay) expanded from massive employers to small employers. The Ichra, however, is a progress story of a small firm attempting to get to the market. The vast majority of employers who take part in an Ichra are small employers with fewer than 50 staff. It’s an open query whether or not Ichra's adoption will proceed to increase to employers with greater than 50 staff, however the adoption of Ichra amongst these employers grew by 84% between 2023 and 2024.

ICHRA Markt -participants

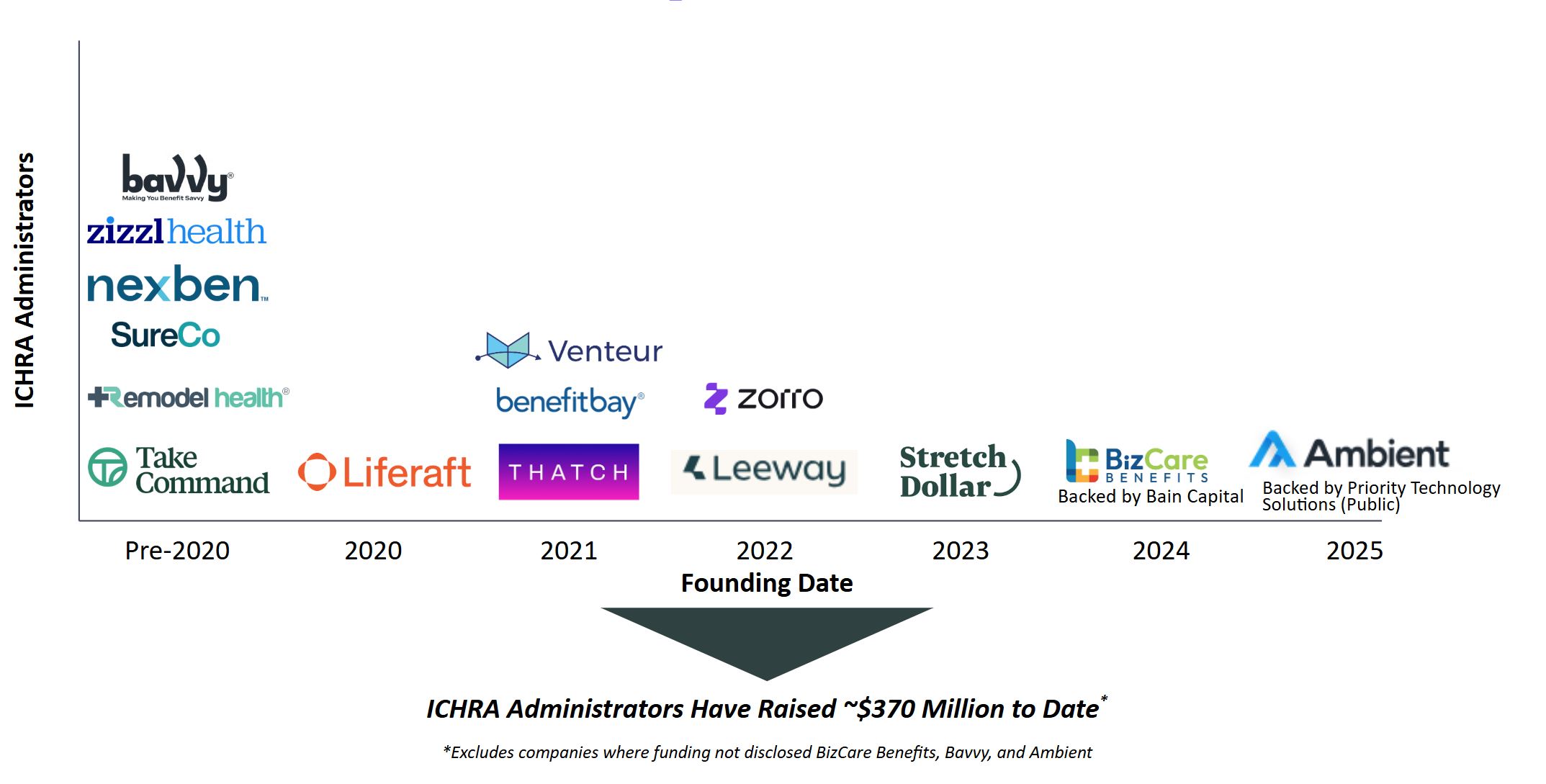

Persevering with and capitalizing the expansion of the Ichra market are Ichra managers. These firms equivalent to Take Command, Thatch, and so on. help employers in designing the ICHRA program, registering staff and the fixed administration of the Ichra. ICHRA managers earn earnings by way of platform prices and committees of insurance coverage firms. Platform prices for supervisor are charged for employers per 30 days (PEPM) and are normally within the vary of $ 20 to $ 40 PEPM. As well as, some managers have inner insurance coverage businesses that may generate insurance coverage firms committees when an ICHRA worker selects insurance coverage through his platform.

ICHRA managers per founding 12 months

Picture made by the creator, data supply, pitchbook

Along with Ichra managers, well being care firms and payers go into the Ichra room. Fintech firms, equivalent to Echo and Lynx, construct monetary infrastructure for ICHRA managers to ship premium and healthcare prices funds on behalf of staff. Payers equivalent to Artwork Cet Well being (a cash firm) and Oscar have each not too long ago seen to Ichra as a bike for progress. Artisten Well being has employed a president to oversee their Ichra actions, and conventional Well being has affected canal partnerships with Ichra managers (right here, right here). Oscar has known as on my concentrate on Ichra in a latest investor presentation and Oscar participated straight in Ichra supervisor fundraising (see Stretchdollar's Seed Fundraise).

Challenges for Ichra sooner or later

Ichras is dependent upon the soundness of the person market insurance coverage market. The person protection market is at present steady, however subsidies for ACA premiums are anticipated to run out on the finish of 2025. If the passage of subsidies ensures that the individuals who obtain them depart the ACA market, there could also be premium will increase that make ACA plans and due to this fact Ichra (a gateway to ACA plans) much less engaging.

Along with the ACA market dynamics, the Ichra supervisor market has been competing with plenty of newcomers lately. Managers make a distinction on their go-to-market technique, delivering service degree and fintech choices. But Ichra managers all fulfill related capabilities for related firms. Each supervisor tries to beat as many employers' clients as doable in a land grip that produces heavy competitors between gamers.

As well as, Ichra managers are confronted with competitors from Peos and brokers. PEOs, equivalent to Justworks, appearing advantages administration for small firms, and the PEO can typically join small firms on to a gaggle plan. Brokers compete in opposition to Ichra managers who promote the protection of the well being of small firms. Brokers will be confronted with decrease committees that contain a shopper in an Ichra in distinction to a gaggle plan that hinders the expansion of Ichra by the Makelaarskanaal. Brokers can solely attain anecdotal to an Ichra if an account would “roll” or depart it as a buyer. Regardless of these challenges, some Ichra managers work intently with Peos and brokers to behave as gross sales channels for employers who’re maybe concerned about pursuing an Ichra.

The place Ichra goes

Rising group plan premiums, steady particular person markets and a want for particular person alternative, counsel that Ichras will stay a sexy choice for employers. But the gamers on the Ichra market can look completely different sooner or later. We might present the massive variety of Ichra managers in a handful of enormous dominant gamers, given the restricted quantity of differentiation between managers. This is able to comply with an analogous pattern if what was seen within the PEO market, the place 5 PEOs from a complete of ~ 500 PEOs are good for ~ 40% of staff collaborating in Peos. We offer smaller ICHRA managers who distinguish from their channel associate boards (eg dealer, peo relationships), prospects (eg Care Navigation), paying relationships and employers' specialization (for instance aimed toward one / single employer sorts).

Along with the consolidation of the Ichra supervisor, we assume that there could also be consolidation between Ichra managers and PEOs. In keeping with this state of affairs, an Ichra administrator will get entry to a pool of present clients to promote, reducing acquisition prices and presumably increasing their attain. Though payers are lively within the Ichra house, we don’t suppose that an Ichra supervisor would welcome an acquisition of the payer as a result of it will restrict the variety of insurance coverage firms that an ICRA supervisor might supply employers. However, an organization equivalent to Artwork Cetter Well being of Oscar can contemplate an acquisition of an Ichra supervisor extra favorably as a method to increase their threat software and enrich their threat software with youthful staff, since 35% of the Ichra staff are youthful than 34.

Normally, we anticipate that the continual progress within the variety of staff has supplied an Ichra. Nonetheless, provided that sturdy aggressive dynamics amongst Ichra managers and probably particular person market threat with ACA subsidy -decay date, we’re gently when firms. New individuals should have a robust aggressive differentiation in comparison with present opponents to be thought of as potential funding candidates.

Picture: Rudall30, Getty photos

The creator thanks the OCA Ventures Healthcare group members Michelle CAO, Bob Saunders and Sarah Manasevit for his or her steerage and help about this text.

OHN SYMEJ is at present MBA -Stagia at OCA Ventures within the Healthcare group. OCA Ventures is a Chicago-based VC funding in seed and Sequence A expertise and well being care firms. The OCA Healthcare group invests in firms within the spectrum of diagnostics, digital well being and well being care. Previous to OCA, John was a co-founder and led a VC-supported Oncology Digital Well being Firm known as Primum. He’s at present following his MBA on the Northwestern Kellogg Faculty of Administration and is situated in Evanston, IL.

This message seems through the MedCity -influencers program. Everybody can publish their perspective on firms and innovation in well being care about medality information by way of medality influencers. Click on right here to learn how.