Startup Treline Bio comes from the shade by $ 1B+ raised and three most cancers medicines within the clinic

How can a startup of a biotech decide up greater than $ 1 billion over 4 plus years and say virtually nothing on the highway? Silence was strategic for Teline Biosciences. From an eye fixed on curious eyes, Treline has quietly constructed a pipeline, essentially the most superior packages of most cancers medicines that sort out nicely -known targets, however in new or probably higher methods. With a brand new infusion of $ 200 million added to his financing implementation and packages in early medical improvement, Treline is now withdrawing the curtain to a part of his work.

The brand new financing is an growth of Treline's Sequence A-financing spherical, mentioned it in Watertown, firm based mostly on Massachusetts on Wednesday. It features a vast syndicate of nicely -known traders who’ve bought the imaginative and prescient of Treline to re -establish and construct a unique type of drug discovering firm.

Rising biotechs are often financed milestone for milestone, mentioned Treline co-founder and CEO Josh Bilenker in a weblog put up on Wednesday. Following that method would result in making treline selections to succeed in the following milestone and focus on a lead program. As a substitute, Treline requested traders to finance 'repeated invention' that helps a number of however further packages. This method gave Treline flexibility to completely management packages earlier than he went to the clinic and likewise to drop strangling.

“We have now left packages as a result of we couldn’t discover good chemistry, as a result of we had unfavorable or blended knowledge in effectiveness fashions, as a result of there have been no good fashions for efficacy, as a result of we didn’t attain sufficient [absorption, distribution, metabolism, and excretion]As a result of we had persistent issues about security, and since different firms first got here up with nice knowledge, “wrote Bilenker.” The luxurious to proceed with packages might be the largest present that our financing mandate has given us. “

Treline introduced three most cancers packages on Wednesday, found two internally and one which was below license. TLN-121 discovers internally is a breakdown of BCL6, a pure protein that makes use of sure lymphoma cells to silence genes that might block their progress and survival. A section 1 examine is registering sufferers with B-cell and T-cell lymphomas.

The second revealed inside tree border program is TLN-372, a brake from Kras, a troublesome to drug mutation that stimulates most cancers progress. Amgen's Lumakras and Bristol Myers Squibb's Krazati are each authorized small molecular inhibitors of a selected scratch mutation referred to as Kras G12C. TLN-372 is a Pan-Kras small molecular bucket that blocks a number of scratch variants. Teline is conducting a section 1 examine through which sufferers are registered with scratch-changed fastened tumors. The startup has competitors on this area. Different firms that develop PAN-Kras inhibitors are revolutionary medicine, Astellas Pharma, Amgen and Bridebio Oncology Therapeutics.

The Third revealed Treline program is TLN-254, which had a allow from Jiansu Hengrui Prescription drugs. Hengrui had superior this medication for testing section 2 in refractory lymphoma. The small molecule inhibits EZH2, a protein that is dropped at overexpression or mutated in most cancers. Teline take a look at TLN-254 in a section 1 examination that registers sufferers with peripheral and cutaneous T-cellymfomen. A fourth program for an unknown goal is on schedule for an investigation into a brand new utility for brand spanking new medicines within the early 2026.

Treline's method to drug discovery brings collectively laboratory and computational approaches below the identical roof. Whereas different startups declare the identical factor, Bilenker mentioned that Treline isn’t targeted on a sure therapeutic space or a platform know-how. As a substitute, Treline strives rigorously chosen targets with one of the best obtainable know-how, he mentioned.

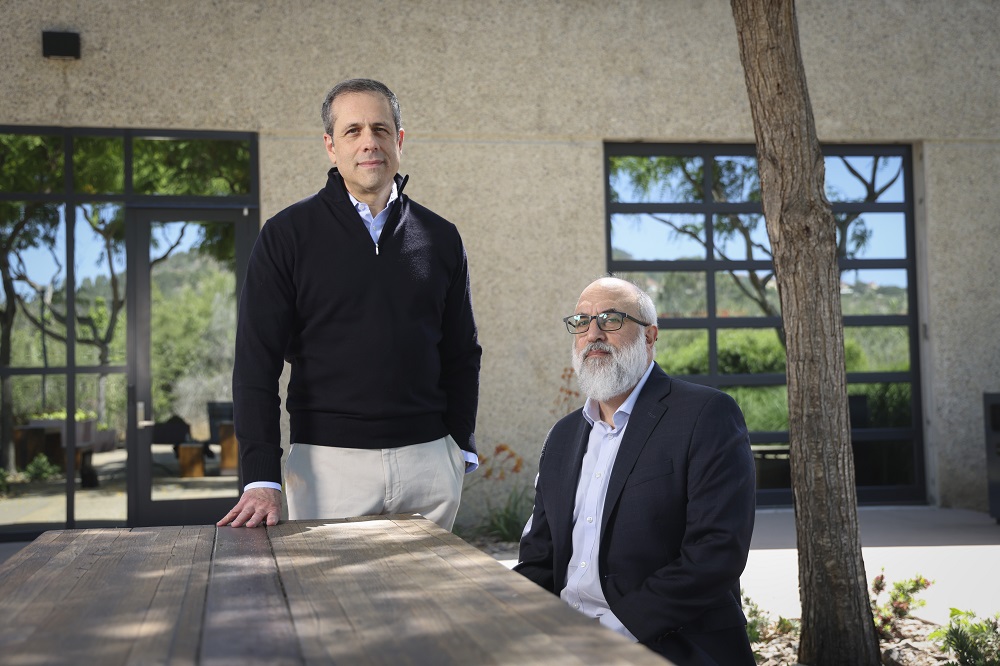

Bilenker's expertise consists of the institution of Loxo Oncology, who took over Eli Lilly for $ 8 billion in 2019. The opposite co-founder of Treline is Chief Science Officer Jeff Engelman, the previous international head of oncology on the Novartis Institutes for Biomedical Analysis. Though the oncology expertise of each is mirrored within the Teline Pipeline, the startup on its web site says that most cancers analysis informs his work in different therapeutic areas. The corporate strives for these areas, equivalent to Auto -Immuun and Neurological Ailments, “If we consider we’ve got a novel benefit.”

Teline fashioned in early 2021, based mostly in Watertown, in keeping with Massachusetts Company Information. The StartUp unveiled a bit about itself in 2022 when it revealed the addition of KKR to his investor syndicate with 'a substantial capital obligation'. On the time, a securities request confirmed that the corporate had collected greater than $ 261 million.

So far, Treline mentioned that it collected round $ 1.1 billion in complete. The traders of the startup embody AI Life Sciences, a department of Entry Industries; Arch Enterprise Companions; Orbimed; Gv; Kkr; Accounts suggested by T. Rowe Value Associates; Ajax Well being/Zeus; Casdin Capital; Constancy Administration & Analysis Firm; Aisling Capital; Rock Springs Capital; And exor.

Photograph by Treline Biosciences