Premium funds as improved premium tax credit expire

Enhanced Premium Tax Credit (EPTCs), launched for the primary time as a part of the American Rescue Plan Act in 2021, made ACA market protection extra reasonably priced for the thousands and thousands of registered individuals. Improved tax credit are anticipated to have diminished the share of the ACA Market for the household earnings. For individuals who are already eligible for Premium subsidies, EPTCs have elevated the full quantity of tax credit that the Enrollee receives, whereas registered center earnings who earn greater than 400% of poverty ($ 62,600 for an individual who’s registered in cowl for planning 2026) are new to the tax figures. The EPTCs have been prolonged till the tip of 2025 by the inflation discount legislation.

This knowledge invoice compares how the outer a part of the premiums would differ if the EPTCs finish or prolong, for chosen eventualities. (To supply your personal estimate of how premium funds would differ in comparison with if the improved tax credit will not be accessible, KFF provides an interactive software the place customers are in a position to enter their desired geography, earnings and household dimension).

If improved Premium tax credit ends, backed ACA Market advantages can count on that their very own premium funds will enhance significantly. For instance, a 27-year-old who earns $ 35,000 (224% of poverty) would pay $ 1,033 yearly for a Benchmark Silver Plan in 2026 with the EPTCs. With out the improved tax credit, nevertheless, they pay $ 2,615 – a rise of $ 1,582 (153%).

With the improved tax credit, the registrations of {the marketplace} between 100% -150% of the federal poverty stage are eligible for a totally backed benchmark plan. Previous to the supply of the EPTCs, it was anticipated that registrations that made simply above the poverty would contribute to about 2% of their household earnings to a benchmark plan. If the improved tax credit expire, registered folks with low incomes at the moment pay $ 0 for a benchmark plan should begin paying for protection once more. A 35-year-old couple who earn $ 30,000 can count on, for instance, that he’ll begin paying $ 1,107 yearly for a benchmark plan for Marktplaats.

What occurs if premiums rise significantly in 2026?

There are two methods to consider premiums on the ACA marketplaces. First, there may be the online premium, that’s what the registered individual pays after taking their tax credit score. Secondly, there may be the gross premium, the quantity that the insurance coverage firm expenses (a part of which is paid by the federal authorities and of which an element is paid by the registered). The expiry of the improved premium tax credit will instantly affect the online premium (as a result of registrations obtain much less monetary assist) and it’ll additionally not directly cost the gross premium insurers.

A KFF evaluation of charges (gross premiums) proposed by insurers of the marketplace for the 2026 plan yr, it turned out that insurers ask for a median enhance of 18% of their charges. Insurers talked about numerous causes for these tariff will increase, together with that they count on some more healthy members to depart the ACA marketplaces as quickly as their internet (or, out-of-pocket) premium funds enhance if the EPTCs expire. This leads to a registered foundation that’s on common much less wholesome and costlier. Insurers say that the charges will rise by about 4 proportion factors greater than ordinary, as a result of expiry of the improved premium tax credit score.

If improved Premium tax credit ends, an earnings between the poverty -bound is registered and 4 occasions that the poverty threat will stay eligible for monetary assist – they may merely obtain a smaller tax credit score than they’re at the moment doing. As proven within the examples above, these registrations can pay significantly extra for his or her month-to-month premium, however they may nonetheless pay a sure proportion of their earnings for the Benchmark Silver Plan. In different phrases, the rise of their month-to-month premium will primarily be the results of a smaller tax credit score – the quantity backed registered registrations is essentially shielded from will increase the prices of the insurance coverage corporations.

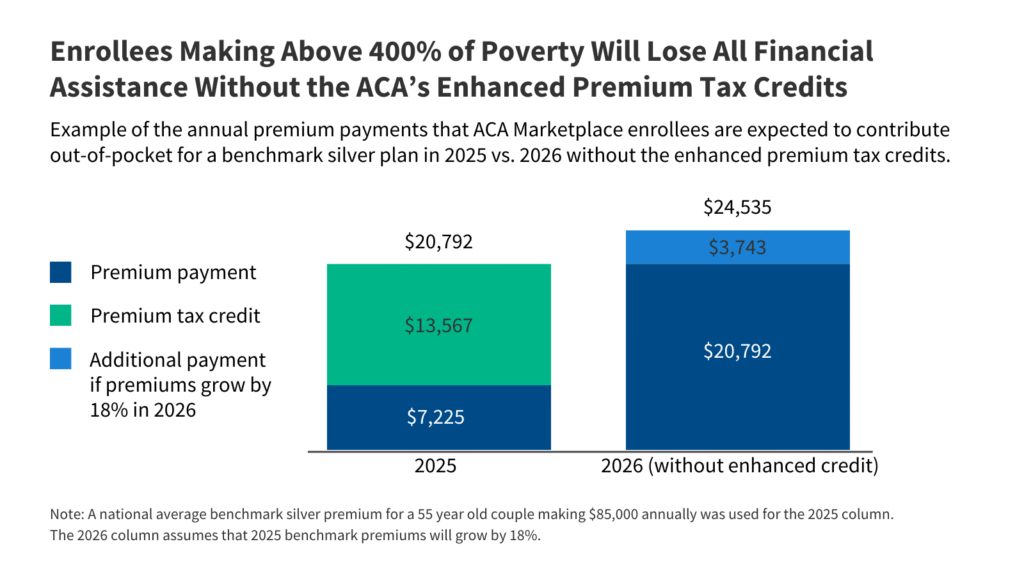

Nonetheless, if improved premium tax credit ends, folks with an earnings are now not eligible for monetary help greater than 4 occasions. As a result of their month-to-month funds are now not sure by a sure proportion of their earnings, these registrations is not going to solely lose monetary help, however may also be uncovered to a rise in underlying gross premiums. With the improved tax credit, center earnings registrations that earn greater than 400% of poverty at the moment have their premium funds for a benchmark plan coated with 8.5% of their earnings. Nonetheless, if the EPTCs will not be prolonged, these registrations will expertise a “double Whammy” – dropping their eligible premium tax credit for Marktplaats and are confronted with the annual will increase of a market plan.

On common, a 55-year couple who earns $ 85,000 at the moment earns $ 13,567 from Premium tax credit yearly, with 65% of the full prices of a benchmark plan. If the EPTCs expire, this pair would lose monetary help and pay the complete annual prices of $ 20,792, assuming that premiums stay the identical. Nonetheless, if the gross premium grows at a velocity of 18% till 2026, the 55-year-old couple can count on that their internet (out-of-pocket) premium funds are greater than triple if EPTCs finish, with $ 17,310 (240%), from $ 7,225 to $ 24,535 yearly for a similar plan.

How do the rules of the Trump administration have an effect on premium funds?

The utmost required contribution of households for a Benchmark ACA marketplan plan is listed yearly to adapt to progress in premiums in relation to earnings. Because the introduction of improved premium tax credit, new (and beneficiant) required contributions for premiums have been applied with out annual adjustment.

Because the EPTCs will finish, the IRS has launched the required contributions for 2026. Earlier this yr, the Trump administration launched adjustments to the calculation of the required contribution by way of the Market Integrity and Affordability rule. As compared with the sooner indexation technique, the utmost out-of-pocket contribution for benchmark premiums for many who obtain premium tax credit has elevated as a share in earnings.

Earlier estimates indicated that in 2024, out-of-pocket premium funds between backed registered folks would have been greater than 75% greater with out the improved tax credit. In 2026, registrations might pay much more on common as a result of annual will increase within the common prices of premium and IRS adjustments within the contribution necessities.

Strategies

Premium knowledge for 2025 is utilized in Desk 1, for the reason that charges for 2026 haven’t but been accomplished. Premium knowledge for 2025 have been obtained from Facilities for Medicare and Medicaid Providers (CMS), the tariff functions from the insurer and knowledge that has been acquired instantly or collected by KFF researchers from commerce festivals or insurance coverage departments. To insulate the impact on premiums with out improved tax credit in Desk 1, the utmost required contribution was calculated utilizing the federal poverty threshold for 2025, whereby the relevant proportion below the IRA is predicted with what is predicted for 2026. In Determine 1, the 2025 Scenariaberines) the required tax credit score is the required tax credit score the required for the required core for the required Circle Crediet for the required Circle Crediet for the Required Circle Crediet for the required Circle Crediet for the required Circle Crediet for the required Circle Crediet for the required KREDIET Circle Circle Modeling.