KFF Well being Monitoring Ballot: Healthcare Prices in As we speak’s Second of Financial Concern

A number of latest polls have proven rising financial turmoil within the U.S., and a long time of KFF polling present how rising well being care prices are a key element of individuals’s financial considerations. New information from the KFF Well being Monitoring Ballot supplies further insights into who’s struggling most in right now’s economic system and the way healthcare prices play a job in these issues. General, it seems that youthful adults, LGBT adults, Latinx adults and folks with extra modest incomes are among the teams almost certainly to report problem creating wealth and paying for well being care and different requirements. Massive parts of those that are uninsured or self-insured additionally report problem incomes a dwelling and paying for care. These with greater incomes will not be proof against the issue of healthcare affordability; About one in 5 of these with incomes of $90,000 or extra say their family has had bother paying for well being care (19%) or pharmaceuticals (18%) previously yr.

Many adults wrestle to earn a dwelling, particularly those that are LGBT, youthful, or Hispanic and reside in low- to moderate-income households. Simply over half (53%) of American adults say it has turn into tougher for them and their households to make a dwelling since January, whereas simply 4% say it has been simpler and four-in-ten (43%) say their potential to make a dwelling has not modified. The share reporting problem creating wealth is greater amongst sure teams: practically three-quarters of LGBT adults (73%), seven-in-ten of these with a family earnings of lower than $40,000 (70%) and people ages 18 to 29 (69%), and two-thirds of Latinx adults (66%) say it has been more durable to make a dwelling this yr. Girls are additionally barely extra prone to report problem making a dwelling than males (57% vs. 49%).

Few inside the teams say it has been simpler for them and their households to make a dwelling this yr, though the share is barely greater amongst these with incomes of $90,000 or extra (6%) in comparison with these with incomes beneath $40,000 (2%).

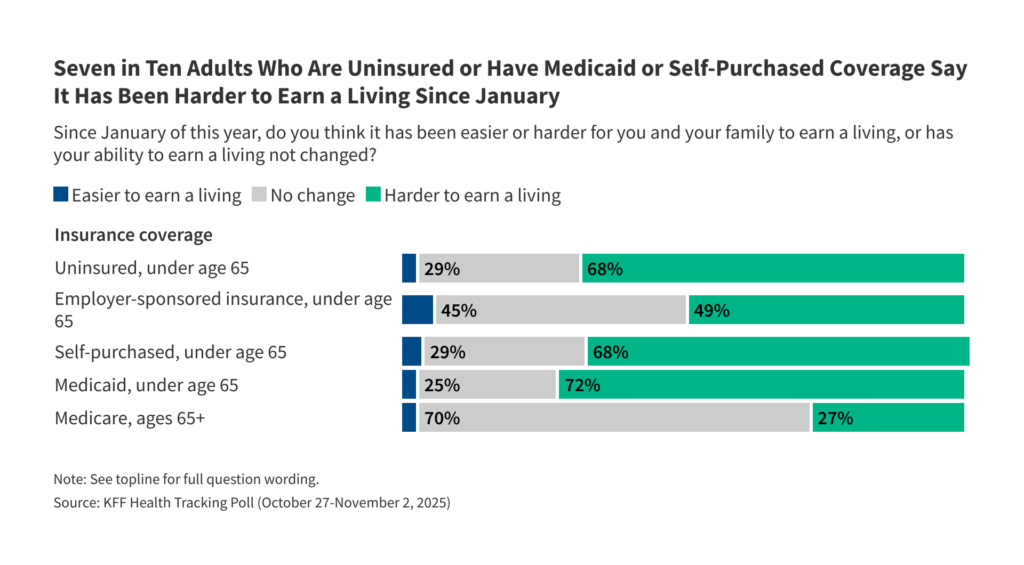

Uninsured adults and folks with Medicaid or self-purchased insurance coverage are extra seemingly than individuals with employer protection or Medicare to report problem supporting themselves. About seven-in-ten adults beneath age 65 who’re uninsured (68%) or lined by Medicaid (72%) say it has turn into tougher for them and their households to make a dwelling since January. This share is comparable (68%) amongst those that buy their very own insurance coverage, a lot of whom are self-employed or work in small companies. By comparability, about half (49%) of these lined by an employer and solely 1 / 4 (27%) of adults 65 and older with Medicare protection say it has been more durable for them and their households to make a dwelling this yr.

The price of healthcare and pharmaceuticals is a significant a part of the monetary challenges people and households face in right now’s economic system. General, virtually 4 in ten adults (37%) say their family has had bother paying for meals previously yr, whereas three in ten (30%) say they’ve had bother paying their hire or mortgage. Issues paying for healthcare are additionally frequent, with about three-in-ten (28%) reporting issues paying for healthcare, up barely from 23% in Might 2025, and a couple of quarter (26%) reporting issues paying for pharmaceuticals.

Issues affording all these requirements are extra frequent among the many identical teams almost certainly to say it has turn into tougher for his or her households to supply for themselves since January. For instance, about six-in-ten households incomes lower than $40,000 per yr (61%) and no less than half of LGBT adults (57%), Black adults (54%), Hispanic adults (53%) and adults beneath 30 (53%) say their family has had bother paying for meals previously 12 months.

4-in-ten LGBT adults (43%), Hispanic adults (41%), and youthful adults (40%) report problem paying for well being care, greater than their non-LGBT, white and older counterparts. Whereas well being care affordability issues are considerably better amongst individuals with decrease and average incomes, individuals with greater incomes will not be immune. About one in 5 adults in households incomes no less than $90,000 a yr say that they had bother paying for well being care (19%) or pharmaceuticals (18%) previously yr.

Six-in-ten (59%) uninsured adults report problem paying for well being care previously yr, as do greater than four-in-ten (44%) of those that buy their very own protection. Massive parts of the uninsured and people who buy their very own protection additionally report problem paying for meals (59% and 45%, respectively), housing (46% and 38%), and pharmaceuticals (39% and 34%, respectively). If Congress doesn’t act earlier than the top of this yr to increase the improved premium tax advantages for people who buy protection by the ACA Market, those that buy their very own protection will seemingly face growing monetary hardship within the coming yr.

Seemingly as a result of their decrease incomes, about six-in-ten adults ages 18 to 64 with Medicaid protection report problem paying for meals (63%) and housing (57%) previously yr. Medicaid gives this inhabitants some safety in opposition to well being care prices, however nonetheless about three in 10 say they’ve had bother paying for well being care (29%) or pharmaceuticals (29%) previously 12 months.