California 2025 Well being Advantages Survey

This survey asks employers about the price of single protection and protection for a household of 4 for as much as two of their largest plans.

Medical health insurance premiums

In 2025, common premiums for lined employees in California will probably be $10,033 for single protection and $28,397 for household protection. Premiums for lined employees in California are larger than for lined employees nationally for each single protection ($10,033 vs. $9,325) and household protection ($28,397 vs. $26,993).

Plan kind: Premiums differ by subscription kind. The common annual household premium for lined employees in well being care amenities is decrease than the general common ($26,562 versus $28,397). Common premiums for lined workers in HDHP/SOs, together with HSA-qualified plans, are similar to the general common for each single and household protection.

Strong dimension: The common annual premium for household protection is decrease for lined workers at corporations with 10 to 199 workers than for lined workers at bigger corporations ($24,990 versus $29,595).

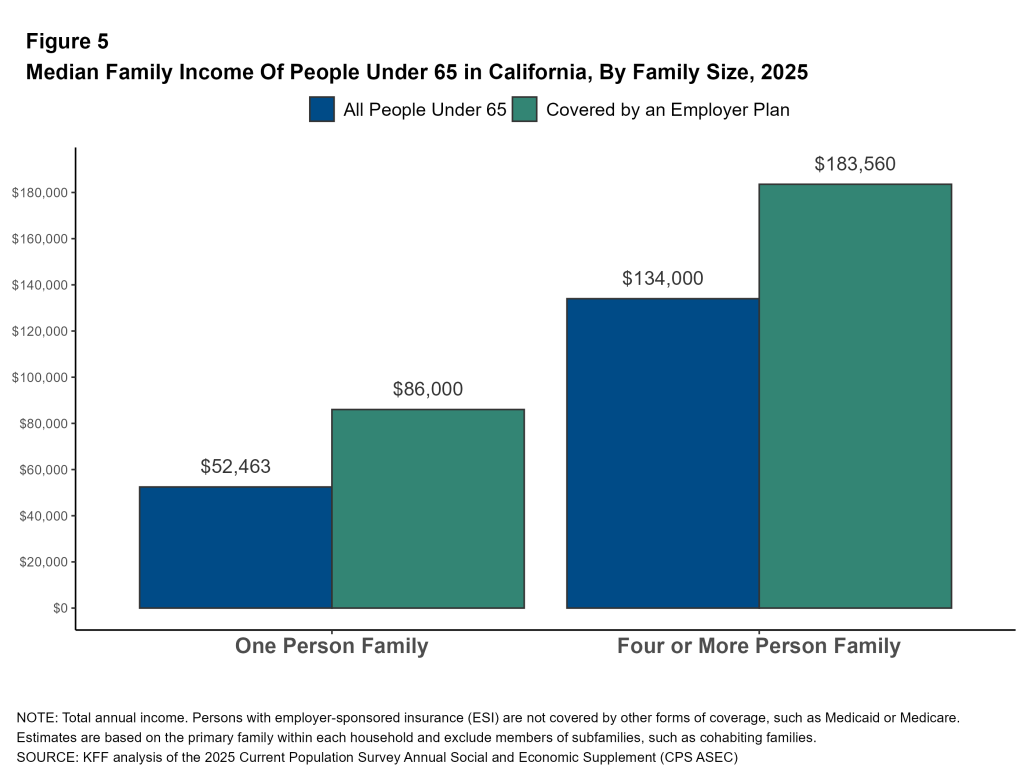

These premium quantities will be in contrast with the revenue of individuals with job-related protection. In California, non-elderly folks with employer-sponsored insurance coverage who reside alone have a median revenue of $86,000. Amongst households of 4 with employer-sponsored insurance coverage, the typical revenue is $183,560. Amongst all households of 4, together with these not enrolled in an employer plan, the median family revenue is $134,000.

Fastened options: Premiums differ relying on the age of the corporate’s workforce.

- In California, common premiums for lined workers at corporations with a excessive share of youthful workers (corporations the place at the very least 35% of workers are age 26 or youthful) are decrease than common premiums for lined workers at corporations with a smaller share of youthful workers for household protection ($24,906 versus $28,614).

- In California, common premiums for lined workers at corporations with a excessive share of older employees (companies the place at the very least 35% of workers are age 50 or older) are larger than common premiums for lined workers at corporations with a smaller share of older employees for each particular person protection ($10,543 vs. $9,413) and household protection ($30,099 vs. $26,289).

Premium progress: Since 2022, California household premiums have elevated 7% yearly, just like the nationwide general enhance of 6%. Premiums for single protection rose 8% yearly in California and 6% nationally. By comparability, annual inflation over the interval averaged 4% and worker wages rose 5%. Final 12 months there was a 4% enhance in worker wages and inflation was 2.7%.

Since 2022, the typical premium for household protection has elevated from $22,891 to $28,397, a rise of 24%, in comparison with inflation (12.2%) and wage progress (14.4%). Within the years earlier than the 2022 CHBS got here into impact, the economic system was experiencing excessive headline inflation. Since 2020, inflation has risen 24%, a lot quicker than the ten% enhance between 2015 and 2020, or the 8% enhance between 2010 and 2015.

Distribution of premiums: Premiums for household protection in California differ significantly. Premiums are decided primarily based on a wide range of elements, together with the prices of in-network suppliers, the scope of advantages lined, the cost-sharing construction, and the variety of well being care companies utilized by enrollees. Of California employees with single protection, 15% work at an organization with a mean annual premium of at the very least $12,500. Fifteen % of lined employees have plans with a household premium of lower than $21,000, whereas 27% have plans with a household premium of $33,000 or extra.

Worker contributions to the premium

For a lot of workers, medical insurance is a crucial a part of their complete compensation. On the similar time, most workers should contribute on to the price of their medical insurance premiums, often by payroll deductions. The common worker contribution for lined employees in California in 2025 is $1,303 for single protection and $7,312 for household protection. On common, lined employees in California contribute the same quantity to the nationwide common to enroll in single or household protection.

Employers contribute extra to the price of single protection for lined employees in California than employers nationally ($8,730 versus $7,884).

Change over time: In comparison with 2022, California-covered workers contribute the same quantity to enroll in single protection ($1,192 vs. $1,303) and household protection ($6,735 vs. $7,312). Since 2022, the typical contribution for household protection in California has elevated by about 9%, or about 3% per 12 months, however this doesn’t characterize a statistically important change.

Strong dimension: In California, the typical household protection premium for lined workers in smaller corporations (10 to 199 workers) is far larger than the typical for lined workers in bigger corporations ($9,980 versus $6,374).

Fastened options: In California, though common premiums and worker contributions are related between corporations with a big share of lower-wage workers and firms with fewer lower-wage workers, the typical employer contribution differs. Corporations with many lower-wage workers contribute much less to the price of household protection ($21,409 versus $18,001).

Share of premium paid by workers: On common, insured employees in California contribute 14% of the premium for particular person protection and 27% of the premium for household protection, just like nationwide averages.

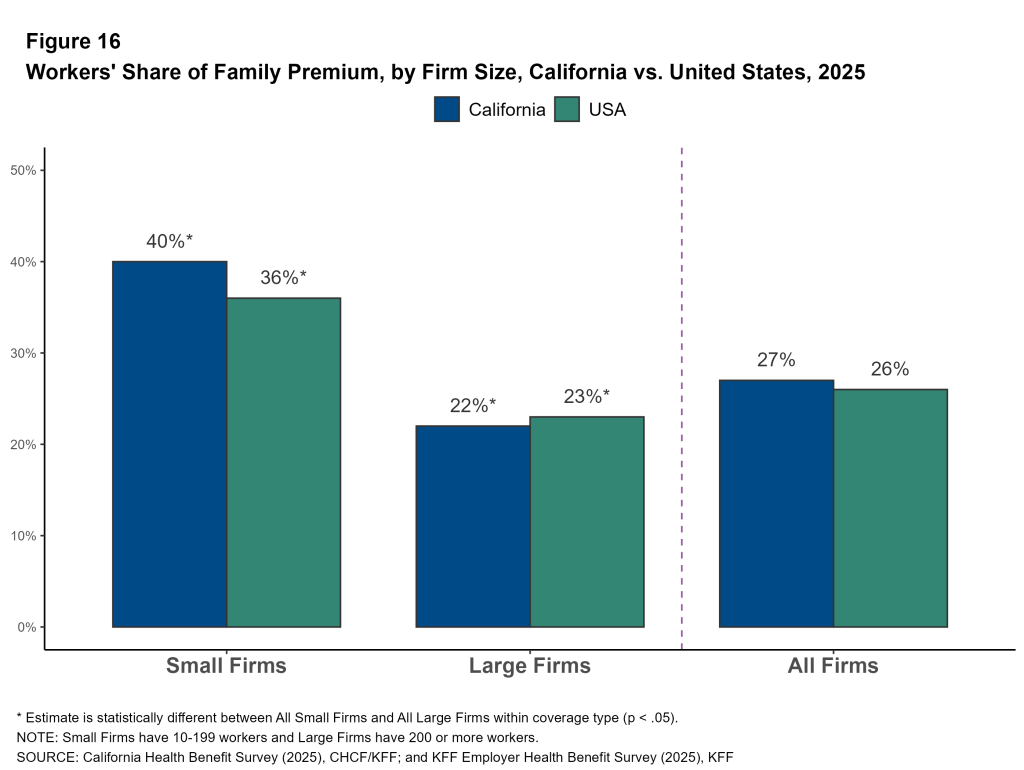

Strong dimension: Lined California employees in small companies contribute the next proportion of the household premium than these in bigger companies, 40% versus 22%.

Share of premium paid by workers, relying on firm traits: The common portion of the premium paid instantly by lined workers varies by kind of enterprise in California.

- Lined workers in non-public, for-profit corporations have comparatively excessive common premium charges for particular person protection (18%) and for household protection (31%). Lined workers in public corporations have comparatively low common premium charges for household protection (20%). Lined workers in non-public nonprofit corporations have comparatively low common premium charges for single protection (5%).

- Lined employees in corporations with many higher-wage employees (the place at the very least 35% earn $80,000 or extra yearly) have a decrease common premium for household protection than employees in corporations with a smaller share of higher-wage employees (23% versus 31%).

- Lined employees in corporations which have at the very least some union workers have a decrease common premium for household protection than employees in corporations with out union workers (20% versus 32%).

Distribution of worker contributions: In California, for single protection, 47% of lined workers at small companies are enrolled in plans with out premium contributions, in comparison with solely 13% of lined workers at giant corporations. By way of household protection, 35% of lined workers at small corporations are enrolled in plans with an worker contribution of greater than half the premium, in comparison with solely 5% of lined workers at giant corporations.

A larger share of lined employees in California are enrolled in a single protection plan with no premium contribution than lined employees nationally (23% vs. 12%). This sample additionally applies to workers lined by small companies (13% versus 7%).

One other option to illustrate the excessive value of household protection for some employees is to look at what share of employees face excessive annual premium contributions. Many small enterprise workers face important prices in the event that they select to enroll dependents. Amongst corporations that supply household protection, 38% of lined workers in small companies are enrolled in a plan with a premium contribution of greater than $10,000, in comparison with 12% of lined workers in giant corporations.