Residence well being care dealmaking slows and stabilizes in residence well being care resulting from Medicare fee rule

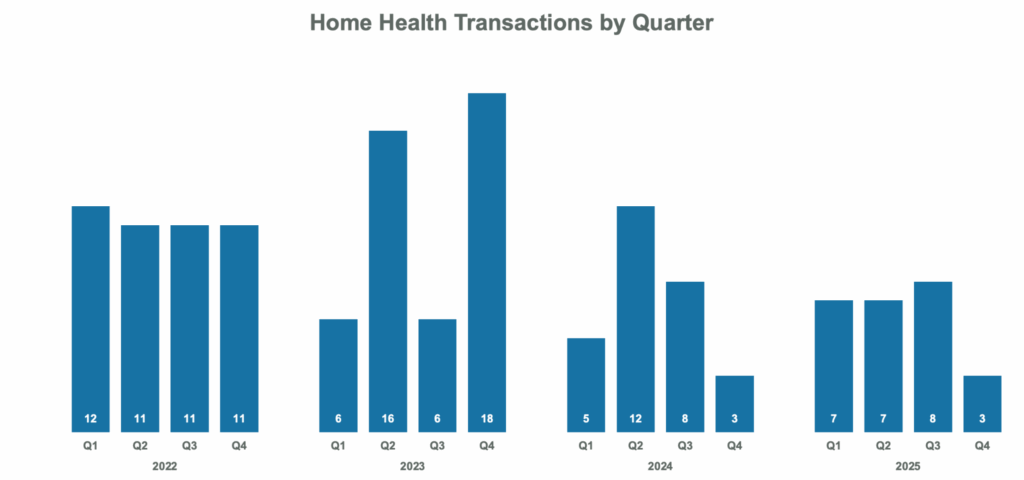

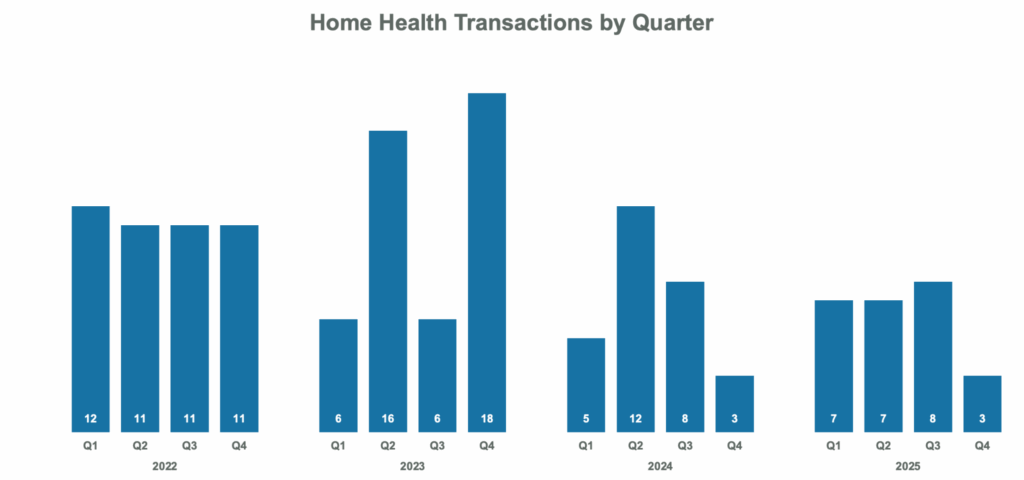

After a number of months of uncertainty over the house well being care deal, fueled by the largest-ever proposed minimize to Medicare funds for residence well being care, a softer-than-expected remaining rule has paved the best way for higher investor confidence within the sector in 2026.

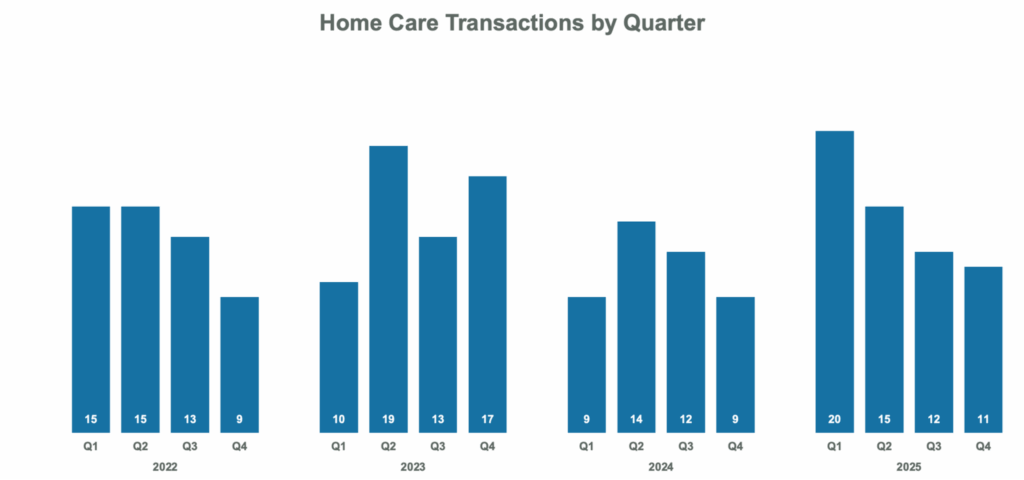

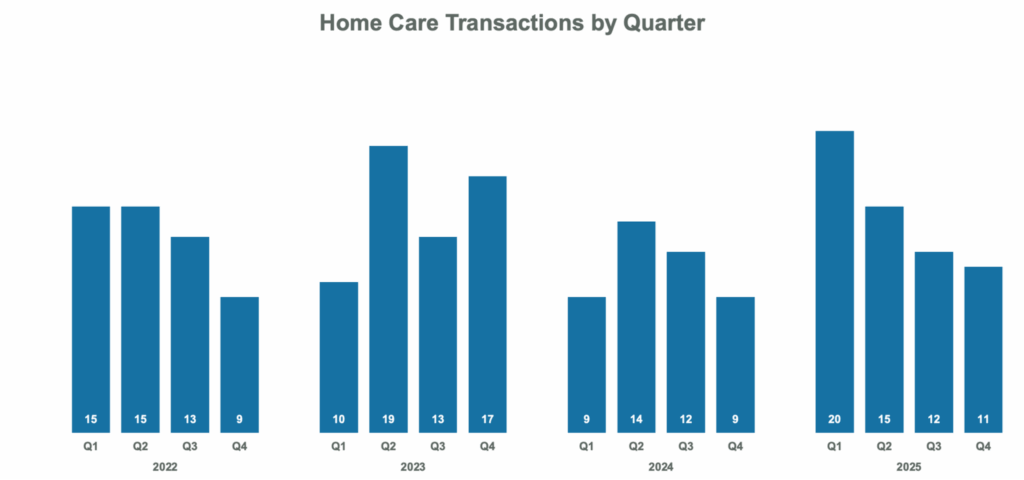

In the meantime, the non-medical residence care sector, which reported a number of sturdy quarters of dealmaking, had its slowest quarter of dealmaking in 2025, in accordance with a report from M&A consultancy Mertz Taggart.

“There are a variety of extremely acquisitive, sponsor-backed portfolio corporations within the house which might be getting ready for a 2026 exit, which implies they are going to look to get a couple of extra corporations on their platform to generate extra money circulate earlier than going to market,” Cory Mertz, managing associate at Mertz Taggart, stated in a press release. “We’re additionally seeing elevated curiosity in personal residence well being care from strategic consumers trying to diversify their payer combine.”

In pediatrics, there’s a big demand for personal companies, specialists beforehand instructed Residence Well being Care Information – though treating the inhabitants poses particular challenges.

Within the non-medical residence care trade as a complete, deal quantity continued its downward pattern all through every quarter of the 12 months, dropping to eleven accomplished offers. Notable offers embrace Amivie’s acquisition of Atrio Residence Well being Care, NexPhase Capital’s acquisition of At all times Greatest Care and Addus Homecare’s $7.4 million acquisition of Texas-based Del Cielo Residence Care Companies.

“This transaction is a continuation of our acquisition and improvement technique to extend our geographic footprint and density in Texas,” Addus CEO Dirk Allison beforehand stated of the deal. “Transferring ahead, our improvement group will proceed to concentrate on each scientific and non-clinical acquisition alternatives to extend each the density and geographic protection of our present states.”

Whereas higher certainty in residence care will seemingly result in a rise in dealmaking, the sector noticed solely three deal closures within the fourth quarter of 2025, much like the fourth quarter of 2024.

“We’re seeing some consumers who had been beforehand hesitant to take dangers due to all of the uncertainty, beginning to really feel snug once more residence care merchandise,” Mertz stated.

Notably, VitalCaring Group has acquired Traditions Well being’s residence well being enterprise, including 5 states to the supplier’s footprint.

Dealmaking in hospice sectors, in the meantime, reached its highest quantity since 2021, with a complete of sixteen transactions closed through the quarter. Issues about Medicare clawbacks have led to warning about offers on this space, main Mertz to advocate a pre-market audit for hospice operators contemplating a transaction within the subsequent two to a few years.

Within the residence care trade basically, lowered rates of interest stored consumers interested by making offers.

“There have been some new curveballs in 2025 with macroeconomic uncertainty, a brand new administration wanting to shake issues up, regulatory considerations surrounding the CMS residence well being care rule and elevated scrutiny of hospice compliance, however M&A exercise remained comparatively sturdy because the Fed continued to chop charges and consumers noticed a chance to deploy the dry powder they had been holding on to,” Mertz stated.