An summary of the traits shaping mergers and acquisitions in house care in 2026

This text is a part of your HHCN+ membership

Across the flip of the yr, offers closed within the earlier yr usually lastly shut, resulting in a rise in transaction quantity. The house care business has actually seen proof of this, as a variety of notable offers have been accomplished since early 2026.

Selection Well being at Dwelling has acquired a trio of house care corporations, Interim Healthcare has acquired the second largest franchise and Important Publish Companions has acquired HomeWell Care Companies. Different offers related to the sector additionally reached the end line, with SilverAssist buying Caring.com, for instance.

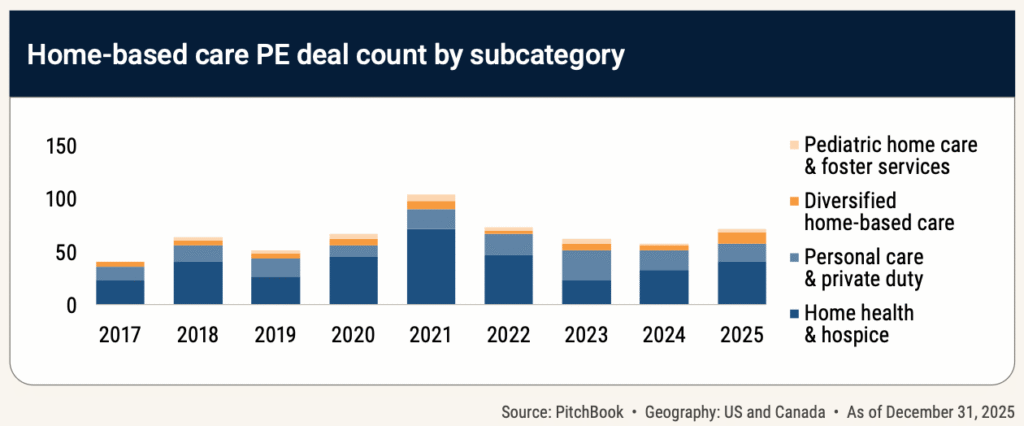

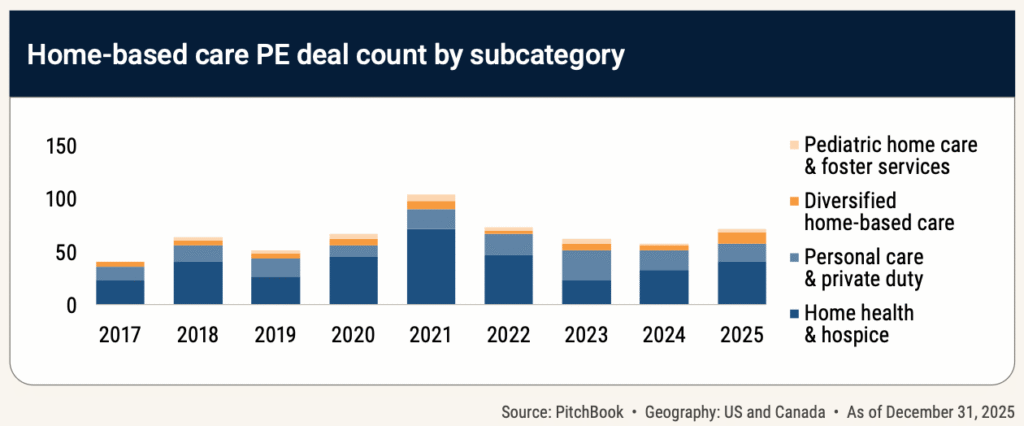

Total, I am hesitant to say {that a} month with just a few notable offers is a definitive signal of elevated exercise. However new information from Pitchbook reveals that house care noticed a 22.4% enhance in deal circulate in 2025, so there is definitely purpose to imagine the sturdy begin to the yr is not an outlier.

Along with deal quantity data, Pitchbook’s new report and an interview I did with Brian Wright, chief healthcare analyst at PitchBook, contained a number of items of data that excited me.

Firstly, there are indications that baby care at house is turning into more and more enticing to buyers and consumers. This subsector presents a number of particular challenges, so it will not be a straightforward growth of service choices for suppliers, nevertheless it may very well be a promising problem for suppliers prepared to make the investments obligatory for fulfillment on this market.

Second, dealmaking traits will probably be characterised by know-how adoption. Whereas on the healthcare aspect, AI is just not at the moment the driving power behind dealmaking, Wright says know-how innovation will play an more and more essential function in dealmaking, dividing the business into winners and losers.

On this members-only HHCN+ Replace, I present my predictions for 2026 dealmaking and supply evaluation and key insights, together with:

– Why suppliers should select between care continuum and specialised care

– The danger of being a late know-how adopter

– Why dealmaking with house care will enhance in 2026

Pediatric house care on the to stand up

Youngsters’s house care and foster care skilled a exceptional enhance in deal quantity by 50% in 2025. In my opinion, this enhance in investor curiosity means that in-home baby care will turn into more and more widespread – whilst suppliers should overcome important hurdles to take care of this inhabitants and seize this chance.

“Relying in the marketplace, I believe you could have a fantastic alternative to make a distinction in the neighborhood,” Mark Bush, CEO of Care Choices for Children, stated earlier at Dwelling Well being Care Information’ FUTURE convention. “However it’s so exhausting, emotionally, psychosocially [load]. It is exhausting to be a sidecar of one thing else. I believe you in all probability want a devoted group centered on personal duties as they’re out there 24/7. It is extremely completely different from another extra intermittent house care providers.”

Suppliers trying to capitalize on rising purchaser curiosity and affected person demand – in addition to the flexibility to offer essential care to younger individuals – should fastidiously take into account the necessity for a devoted group and a slim focus. However the investments can repay for individuals who do.

I ought to make clear that Pitchbook didn’t separate pediatric house care from foster care on this information level, nor may it achieve this instantly upon request. So my prediction of this development comes with a caveat, however both approach, these information recommend that house care for youngsters is of rising significance.

The one house care subsegment with a better year-over-year enhance in deal quantity was diversified house care, which noticed a 120% enhance. Buyers are due to this fact most serious about suppliers that method house care from a one-stop-shop perspective – which brings me again to Selection’s current acquisitions.

Selection CEO David Jackson advised HHCN that its progress technique is to turn into a complete house care supplier, and the trio of acquisitions show this. Selection’s current acquisitions span the continuum of house care, palliative care, hospice care and private house care. The 120% enhance we noticed in 2025 reveals that Jackson is just not alone in utilizing this technique.

In fact, the friction between the 2 house care subsegments with the very best deal quantity progress is that one requires generalized house care providers and the opposite wants hyper-specific pediatric care.

Extra offers will showcase the know-how winners

There are just a few components that point out deal quantity will enhance in 2026. Non-public fairness shares are growing older, and the valuation hole created by the sky-high valuations created through the peak of the COVID-19 pandemic will disappear, Wright stated.

“If you concentrate on just a few extra charge cuts within the second half of this yr, after we get a brand new Fed chairman, the price of cash turns into cheaper,” Wright stated. “And as individuals implement these new ambient scribe applied sciences and workflow brokers for healthcare providers, they’re basically altering the return profiles for these corporations and bettering the profitability of the businesses. So I believe decrease prices of capital and improved margin profiles over the long run for these corporations ought to slim these gaps, and we must always shut extra offers in 2026.”

I’m notably within the applied sciences that enhance profitability. A slew of recent know-how helps corporations enhance effectivity, high quality of care and outcomes. Sometimes, I hear about suppliers adopting back-office enhancement applied sciences that assist with recruiting or payroll, however the pleasure appears to be centered round environmental authoring capabilities and different AI applied sciences.

Many individuals I discuss to, whereas enthusiastic about these applied sciences, are joyful to be mid-pack customers. Cautious optimism appears to prevail in the mean time. However for individuals who act too conservatively, there could also be penalties.

“Finally, it’s a basic operational execution drawback, and those that carry out nicely will profit from the know-how,” Wright stated. “For me, the winners and the [well] working corporations, the hole between them and everybody else will widen, and that can create a possibility to roll up some inferiorly managed corporations.”

These mid-pack adopters, if they do not time their know-how adoption plan proper, will miss out on the winner on this state of affairs. And I hate to recommend a binary between winners and losers, when what actually issues is the standard of affected person care and outcomes. However the threat is that suppliers who stand too nonetheless within the fast-moving river of house care know-how will probably be unsettled, whereas those that transfer with the circulate will turn into what Wright predicted: the “winners” of house care.