'Indicators of life': With falling rates of interest, house care M&A seems brighter

This text is a part of your HHCN+ membership

It's the curiosity, fool.

Voices from the house well being, house healthcare and hospice industries – myself included – have repeatedly identified inner components impacting M&A over the previous two and a half years. In the end, the overarching, major headwind has at all times been the extraordinarily excessive rates of interest imposed by the Federal Reserve to fight inflation.

These inner components affected the particular mergers and acquisitions that occurred, and they’re going to have a significant impact on the mergers and acquisitions that happen sooner or later.

But it surely was a idiot's errand to seek out inner the explanation why M&A exercise has slowed since early 2022.

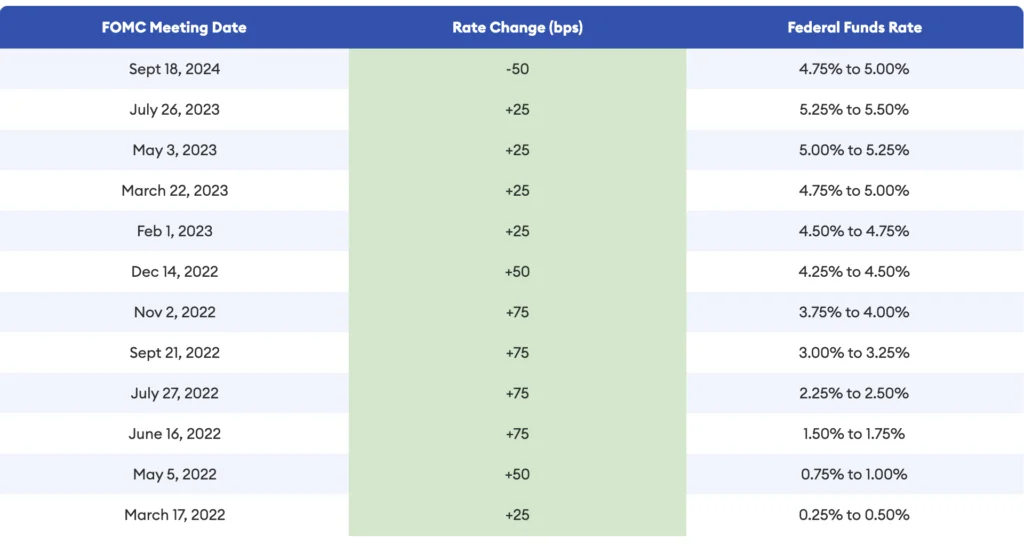

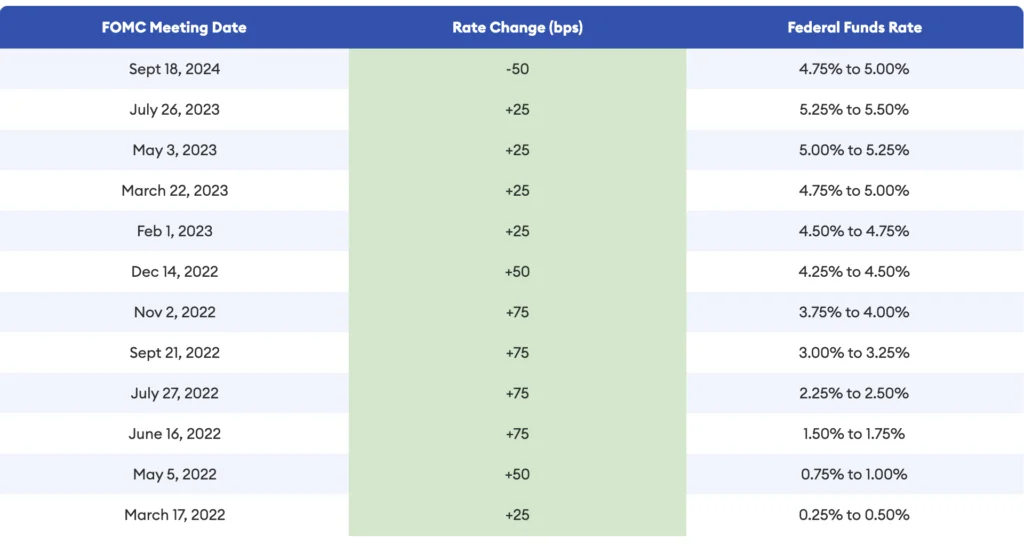

In March 2022, the Fed started to lift its traditionally low rates of interest. Extra particularly, on March 17, 2022, the federal fee went from close to zero to 0.50%. The will increase continued constantly till July 26, 2023, when the federal fee hit 5.50%.

The Fed introduced a half-percentage-point fee lower on Wednesday, anticipated to be the primary of a collection of cuts because the Fed focuses on points aside from inflation.

In the meantime, the pattern line for house care M&A was immediately reverse rates of interest. Whereas rates of interest rose, house care M&A declined, apart from just a few small spikes in 1 / 4 or two.

“I believe the rate of interest atmosphere has actually been extra vital than individuals might have acknowledged,” Les Levinson, accomplice and co-chair of the Transactional Well being Legislation Group at Robinson + Cole, informed me in a webinar this week. “If you had been doing offers in 2021 and 2022 — in what was functionally equal to a zero rate of interest atmosphere — you wanted quite a bit much less fairness to do a deal. And the chance in that transaction was primarily backed by debt protection. That went away when charges shot up.”

On this week’s unique HHCN+ Replace, I dive deeper into the speed lower and what it means for the house care M&A market within the quick time period.

Rate of interest lower offers beginning sign

All indications are that Wednesday's fee lower would be the first of many because the Fed shifts its focus more and more towards unemployment and away from inflation.

If we have a look at the previous few years, this is able to imply that we are going to see many extra transactions in house care within the close to future.

After that first enhance in March 2022, one thing modified within the beforehand sturdy M&A panorama.

In Q3 and This fall of 2020 alone, there have been 95 complete transactions in house well being, house care and hospice, in line with M&A agency Mertz Taggart. In the identical interval in 2021, there have been 106 transactions.

In 2022, after the primary fee lower, a complete of fifty transactions happened within the third and fourth quarters, a lower of greater than 50% in comparison with the earlier yr.

Other than just a few quarters of modest spikes, M&A income has remained traditionally low so far.

The variety of personal equity-sponsored offers was additionally traditionally low.

With the rate of interest pattern line now on the opposite facet of the mountain, we count on house care exercise – and PE-backed exercise – to extend.

“We’re on the finish of an almost five-year cycle that began with COVID and the Fed stimulating the financial system,” Cory Mertz, Managing Companion at Mertz Taggart, informed me through the webinar. “Rates of interest went to about zero. Sellers had been burned out. They needed to get out early earlier than the election, and a brand new administration raised the capital positive factors tax fee. It was actually an ideal storm of exercise and it was, fairly frankly, a bubble. The Fed raised fund charges at a fairly wholesome tempo beginning in 2022 and that slowed every thing down for a few years. However now we’re beginning to see some indicators of life.”

The Fed was anticipated to chop charges on Wednesday, with most ready to see whether or not it might be by 1 / 4 or half a p.c. The choice to take the latter route will open issues up even additional than beforehand anticipated.

The share will in all probability fall additional over the following one to 2 years, in direction of 3%.

In accordance with Mertz, demand for high-quality house care property has not declined through the quiet interval. As a substitute, market situations have stored transaction ranges low. These market situations additionally embrace the truth that, with near-zero rates of interest and a rush to house care through the pandemic, multiples have risen considerably.

Since then, consumers have been ready for expectations to return to regular.

“These similar consumers are nonetheless hungry for high quality offers,” Mertz stated. “They don’t need to, and gained’t, pay a premium for offers that don’t warrant a premium. [price]. Now, the premiums right now in comparison with the premiums in 2021 or 2022 are down just a little bit, however not by a lot. For a top quality company, not less than. That's my expertise.”

However as the varied expectations are balanced, it’s doubtless that demand will lastly decide up and offers might be closed.

However lively, high-quality house care businesses have grow to be more and more scarce in recent times.

“A high quality house well being care service, I believe, is the premium in post-acute care,” David Jackson, CEO of Selection Well being at Dwelling, informed me through the webinar. “Hospices have a very nice basis. Dwelling care [agencies] “They’ve actually secure valuations, far more secure than the others. They don’t go up and down as a lot as a premium house care asset that does properly from a compliance, high quality and monetary perspective. These have gotten rarer day-after-day, and that’s as a result of it’s a really powerful sector.”

Selection Well being at Dwelling is predicated in Tyler, Texas and provides a variety of house providers, together with house well being care, house healthcare and hospice care. Backed by Coltala Holdings and Trive Capital, the agency has accomplished greater than 20 transactions up to now 4 years. Along with Texas, it has a presence in Nevada, Utah, Colorado, Arizona, Oklahoma and Kansas.

In house care, consumers are likely to favor closing offers within the second half of the yr, significantly This fall. That’s as a result of there’s usually extra certainty about cost after the Facilities for Medicare & Medicaid Providers (CMS) releases ultimate house care laws in October or November.

Quite a bit has modified

Though the offers have been placed on maintain, quite a bit has modified beneath.

As consumers and sellers return to the desk, they are going to be discussing house care sectors that look nothing like they did three to 4 years in the past.

In house well being, CMS has proposed three cost cuts and finalized two. Greater than 50 p.c of Medicare beneficiaries are actually additionally coated by Medicare Benefit (MA) plans. MA plans usually cowl a lot much less for house well being providers than conventional Medicare.

Dwelling well being care suppliers—even the standard ones—are struggling to adapt to a world with a much less sure cost panorama. They’re coping with CMS cuts to conventional Medicare, whereas additionally competing for greater charges from MA plans. Some have even lower ties with MA plans to show a degree, and likewise to reallocate their sources to raised payers.

In house well being, the finalized Medicaid Entry Rule included the 80-20 provision, which might require 80 p.c of reimbursement for house and community-based providers (HCBS) to go to staff. That provision gained’t be applied for almost six years, however it’ll doubtless nonetheless affect M&A.

On the one hand, for instance, many suppliers consider that scale is critical to take care of working efficiency underneath such a provision. Addus Homecare Corp. (Nasdaq: ADUS) has acknowledged this regularly and has additionally been a really lively acquirer of late.

Nevertheless, exterior events may even see the supply as a purpose to keep away from HCBS – in the intervening time.

Addus has additionally benefited from the M&A downturn itself. Whereas rates of interest have been excessive, Addus has considerably expanded its house care and residential healthcare footprints.

“Realistically, we haven't seen plenty of competitors over the past 12 to 18 months,” Dirk Allison, CEO of Addus, stated not too long ago. “There's been the occasional smaller strategic participant that's purchased just a few offers on an area foundation. From a PE standpoint, it's been actually sluggish when it comes to competitors these days. Now, if charges come down in September, as everybody expects, there's clearly going to be a degree the place PE comes again and that's high-quality. It's a market the place we've at all times operated with competitors from these individuals up till the final yr or so.”

VitalCaring President Luke James additionally informed me earlier this yr that there are advantages to rising throughout an M&A and cost decline. His firm additionally not too long ago agreed to amass divested property from Amedisys (Nasdaq: AMED), however that deal is contingent on the Optum-Amedisys deal closing first.

Both approach, if the Fed continues on the trail it began on this week, occasions are altering.

When M&A picks up once more, consumers must contemplate different components. However the consumers – the beforehand dormant strategic and personal fairness gamers – will come again.

The house care and residential healthcare sectors have been seen as ripe for consolidation over the previous decade. However consolidation has not come as shortly as many thought.

Now that the mud has settled, nonetheless, M&A has the chance to alter the face of house care – as soon as once more.