The brand new OMB Social Welfare Perform – Healthcare Economist

Lately, the Workplace of Administration and Funds launched new procedures for assessing authorities regulation (Round A-4) and financial coverage (Round A-94). What is exclusive about these pointers is that they weigh the advantages and prices of recent rules and insurance policies based mostly on the earnings of the people affected. The intention is to assist scale back inequality. Prices and advantages that accrue to individuals with a low earnings are weighed extra closely; people who accrue to high-income people are weighted much less.

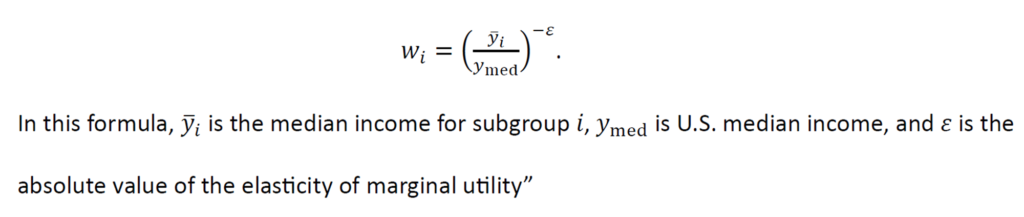

An article by Viscusi et al. (2024) explains what this coverage is and a few of its challenges. First, Viscusi explains that the coverage explicitly provides weight to insurance policies by earnings group, utilizing the next components:

So how does this components have an effect on the burden we give to the advantages and prices for various teams? If we assume that the typical earnings within the US is $75,000, then the worth of prices and advantages for somebody incomes $25,000 is weighted 4.7x extra closely than that of the typical particular person; somebody incomes $400,000 has a weight that’s 90% decrease than that of a mean particular person.

At first look, this will likely look like an inexpensive coverage; Lowering inequality is a laudable coverage aim. Nevertheless, these weights also can result in inefficient insurance policies. For instance, take into account the case the place every particular person in society owns a home whose worth is the same as his earnings. On this case, the earnings weights imply that the houses of wealthier individuals are being shriveled. However we additionally get a wierd consequence. As Visculsi writes:

Considerably paradoxically, market dwelling values improve at larger earnings ranges, however weighted dwelling values lower.

You possibly can see this within the desk above, the place a $25,000 home is valued at $116,000, however a $1,000,000 home has a weighted worth of simply $26,613. This may end up in the unusual state of affairs the place a catastrophe safety coverage can solely be applied whether it is utilized to guard much less helpful houses relatively than extra helpful houses. Whereas this will likely appear acceptable at first look – wealthy individuals would possibly be capable to purchase their very own insurance coverage – it does result in an inefficient coverage.

Contemplate the case the place policymakers thought-about a seawall to cut back flooding. Let's say the seawall prices $1,000 per home to construct and the danger of flooding is 1%. If this had been in a poor space – the place all homes price $25,000 – it could not be price constructing the wall in line with a typical OMB calculation, as a result of the anticipated losses are solely $250 (i.e. $25,000 x 1% = €250). Nevertheless, with the brand new weighting scheme, $25,000 houses are price $116,000, so OMB would say they need to construct it ($116,000 x 1% = $1,116 > $1,000). Nevertheless, if redistribution had been the aim, it could be simpler to provide poor owners $1,000 relatively than set up a seawall that’s price solely $250 per dwelling.

General, the Viscusi article reaches six conclusions:

- Quantitative distribution weights created. The OMB method creates specific and operational distribution weights.

- Massive influence. Viscusi believes that “the weights may have profound implications for benefit-cost analyses”

- Inefficient. Viscusi believes that “the applying of the OMB weights is probably very inefficient.” A part of the reason being that earnings is extremely right-skewed; a part of the reason being that there could also be extra environment friendly mechanisms for lowering earnings inequality.

- Grouping is essential. How OMB teams' insurance policies will matter. If there’s a metropolis that has half poor and half wealthy neighborhoods, the cost-benefit ratios might be elevated for poor neighborhoods and decreased for wealthy neighborhoods. If one other metropolis additionally has half poor and half wealthy people, however people dwell subsequent to one another, the people on this blended metropolis wouldn’t profit as a lot from the OMB method as a result of OMB wouldn’t be capable to separate insurance policies based mostly on earnings since all neighborhoods have blended earnings.

- Mortality dangers. OMB excludes well being advantages and dangers from the disparity weighting process. Nevertheless, if these had been utilized to cut back well being dangers, the lives of low-income individuals would explicitly be given way more worth than high-income individuals.

- Interplay with different insurance policies. Viscusi notes that there’s “no dialogue about how the weights will work together with different progressive parts of public coverage”

I encourage you to learn the total article right here.