Annual household premiums for employer protection will rise 7% to a mean of $25,572 by 2024, benchmark analysis exhibits, after additionally rising 7% final 12 months

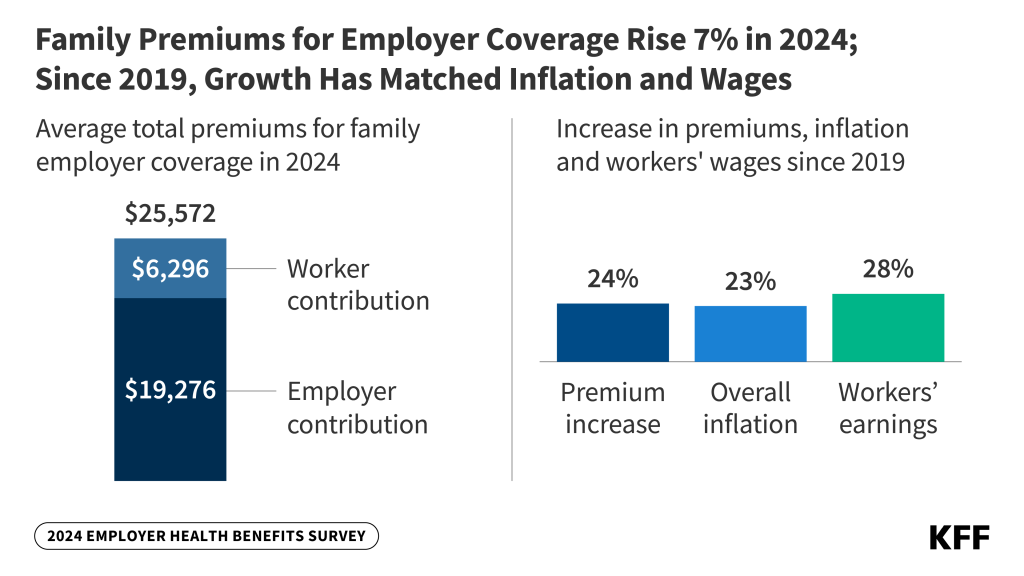

Household premiums for employer-sponsored medical insurance elevated 7% this 12 months to a mean of $25,572 per 12 months, in line with KFF's 2024 Employer Well being Survey. On common, workers contribute $6,296 yearly towards the price of household protection.

That is the second 12 months in a row that premiums have elevated by 7%. Over the previous 5 years – a interval of excessive inflation (23%) and wage development (28%) – the cumulative premium improve has been comparable (24%).

Whereas employers have seen complete premiums for household protection steadily rise, the quantity workers pay on common for his or her annual premiums has modified little over the previous 5 years — a rise of lower than $300 since 2019, or a complete of 5% over 5 years. This can be as a result of a good labor market.

Amongst staff who face an annual deductible for single protection, the typical this 12 months is $1,787, up from final 12 months's $1,735 and a modest 8% improve since 2019, when the typical was $1,655.

On common, deductible workers at small corporations (fewer than 200 workers) face a lot bigger deductibles than workers at bigger corporations ($2,575 versus $1,538). Of all lined workers, almost a 3rd (32%) of lined workers at smaller corporations face a mean deductible of at the very least $3,000.

“Employers spend the equal of shopping for an financial system automobile for every worker yearly to pay for household protection,” stated KFF President and CEO Drew Altman. “Within the tight labor market of latest years, they’ve been unable to shift prices to staff already battling well being care payments.”

About 154 million non-elderly Individuals depend on employer-sponsored messaging, and the twenty sixth annual survey of greater than 2,100 employers massive and small gives an in depth take a look at the traits impacting them. Along with the complete report and abstract of findings launched right this moment, Well being issues publishes an article with chosen findings on-line. The article additionally seems within the November difficulty.

The survey exhibits that a number of the nation's largest employers (at the very least 5,000 workers) are taking steps to guard lower-wage staff from the complete influence of rising well being care prices. Of those massive corporations, 29% say they’ve a program to cut back premiums for decrease wages, and 19% say they provide a decrease profit plan with extra reasonably priced protection.

Employer protection of GLP-1 weight reduction medicine is restricted and restricted

Amid a surge of curiosity in costly GLP-1 medicine like Wegovy to deal with weight reduction, this 12 months's survey additionally gauges how broadly this protection is on the market in employer plans.

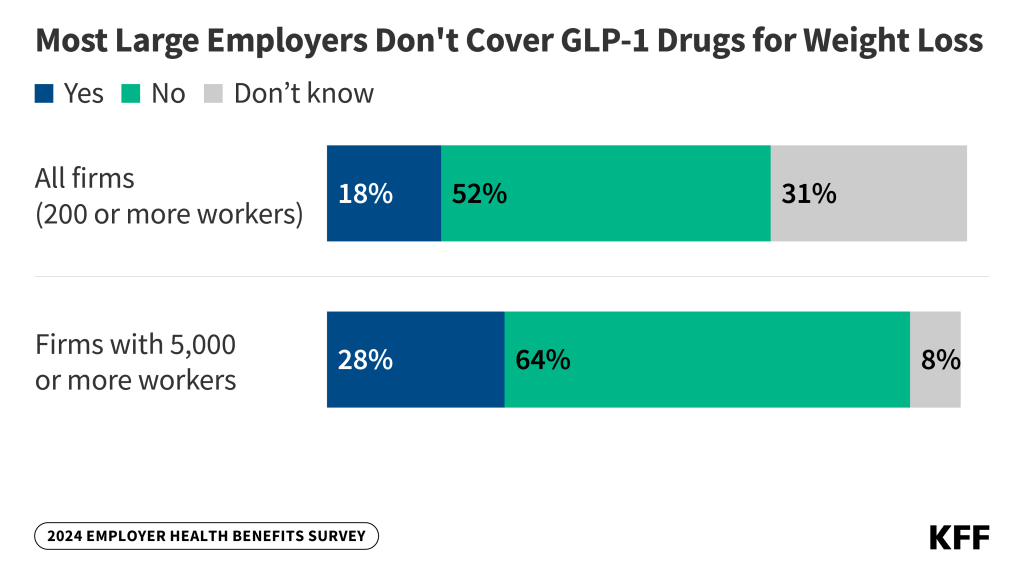

Fewer than 1 in 5 massive employers with at the very least 200 workers who provide well being advantages (18%) say they cowl GLP-1 weight reduction drugs, whereas half (52%) say they don’t cowl them, and the others ( 31%) are usually not positive. Of the most important corporations with at the very least 5,000 workers, greater than 1 / 4 (28%) say they promote GLP-1 medicine, and nearly two-thirds (64%) say they don’t.

Of the key corporations that supply the medicine, about half (53%) have phrases or necessities related to their protection. These circumstances can pose limitations to accessing the drugs, comparable to first assembly with a dietitian, psychologist or different skilled (24%); requiring participation in a way of life or weight-loss program both earlier than (8%) or throughout (10%) use of the drugs; or one other kind of situation or requirement (26%).

Protection of those weight-loss drugs has important price implications for employers, as a earlier KFF evaluation estimated that almost 50 million adults in employer plans meet the medical standards to be used of such drugs, which might price 1000’s of {dollars} per particular person yearly.

Of the key corporations providing GLP-1 weight reduction medicine, a 3rd (33%) say it is going to have a “important influence” on prescription drug spending. Amongst main corporations, almost half (44%) say that protecting GLP-1 drugs shall be “essential” or “necessary” to their workers' satisfaction with their well being plan.

Amongst main corporations that don’t at the moment provide GLP-1 weight reduction medicine, few (3%) say they’re “very probably” to take action within the coming 12 months. 1 / 4 (23%) say that is considerably more likely to occur.

“Employers face the problem of integrating these doubtlessly necessary therapies into their already costly profit plans,” stated Gary Claxton, KFF vp and research creator.

Different findings embody:

- IVF and different household constructing advantages. Amongst massive employers with at the very least 200 workers, a few quarter (27%) say they cowl in vitro fertilization (IVF), and an identical proportion (26%) say they cowl synthetic insemination. Extra individuals say they cowl fertility drugs (37%), whereas fewer say they cowl egg or sperm freezing (12%). A couple of third of corporations aren't positive if their plans cowl each aspect.

- Reductions from pharmacy profit managers (PPE). PBMs administer prescription drug advantages on behalf of payers, together with employers, and sometimes negotiate rebates with drug producers in trade for favorable placement of their medicine on formularies. Among the many largest corporations with at the very least 5,000 workers, 34% say they obtain “most” of the reductions agreed to of their PPE or well being care plan; 34% say they obtain “some,” and eight% say they obtain “little or no.” The remainder are uncertain how a lot of the reductions they may obtain.

- Abortion. Amongst massive employers with at the very least 200 workers, 8% say their plans don’t cowl legally carried out abortions beneath any circumstances, and one other 18% say they cowl such abortions beneath restricted circumstances, comparable to rape, incest or life or well being. of the pregnant enrollee. Most (45%) different massive employers say they had been uncertain whether or not or how their plans lined abortion. These figures have modified little in comparison with 2023.

- Psychological well being and substance abuse. A couple of quarter of employers say their plan's community for psychological well being and substance abuse providers is “considerably” or “very” slim, in comparison with 10% who say the identical about their networks general. About half (48%) of enormous corporations with at the very least 200 workers say they’ve elevated the psychological well being sources out there to their workers by way of an worker help program or third-party suppliers comparable to Headspace or Lyra Well being.

- Affiliate protection and non-enrollment incentives. Amongst massive corporations with at the very least 200 workers that supply well being advantages to spouses of workers, 1 / 4 (24%) require greater premiums or restrict protection when spouses are supplied medical insurance from one other supply. Moreover, 12% of enormous corporations that supply well being advantages provide further compensation or advantages to workers who enroll in a partner's plan, and 13% provide further compensation or advantages to workers if they don’t take part within the firm's well being advantages.