Protein-Design startup Archon provides $20 million to indicate how 'cages' can change antibody medication

Over the previous many years, antibodies have confirmed to be an necessary therapeutic modality for a variety of illnesses. However antibodies as they happen in nature didn’t evolve for use as drugs, says James Lazarovits, co-founder and CEO of Archon Biosciences. These proteins turned medicines as a result of scientists used them to do issues.

One of many limitations of at the moment out there antibodies is the therapeutic window, that’s, the dose vary inside which a drug achieves its therapeutic impact with out additionally inflicting dose-limiting toxicity. Lazarovits describes this window because the trade-off between how a lot of the drug goes the place you need it to go, and the way a lot goes the place you don't need it to go (creating poisonous results). Archon's know-how modifications the dimensions and form of an antibody, adjusting how a remedy will get the place it must go within the physique, what it does when it will get there, and whether or not or not it stays there. The Seattle-based startup emerged from stealth this previous week with $20 million in funding for R&D of what might grow to be a brand new class of antibody medication.

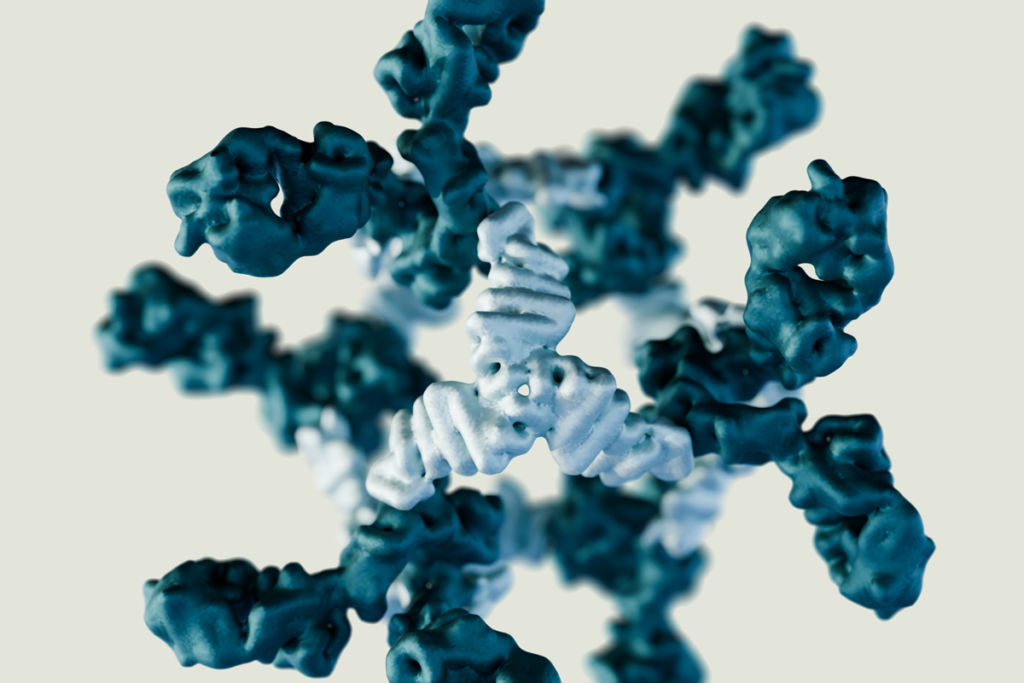

The analysis and improvement discipline of antibody medication contains efforts in multivalence, that’s, the power to bind to a number of websites on the identical goal, and multispecificity, which binds to 2 or extra totally different antigens. These antibodies could also be good for sure functions, however not so good for others, Lazarovits stated. Relatively than growing an antibody by altering the order of the amino acids that make up a protein or by including totally different arms or a number of binding domains, Archon designs antibodies in a means that controls their constructions. Archon calls its medication antibody cages, or AbCs. These antibodies are made in a means that matches the established format for antibody manufacturing, by merely including an additional work step on the finish of the manufacturing course of. However this further step provides the antibody traits it didn't have within the first place.

An AbC affords tunability that doesn't happen naturally in antibodies, Lazarovits stated. The construction of the AbC cannot solely allow or disable a goal, but in addition to what extent. Antibodies typically require secondary alerts to activate. Whereas that is possible and controllable in a closed system, it turns into tougher inside a affected person and between affected person populations. Lazarovits stated the construction of the AbC can autonomously activate pathways with out something having to occur elsewhere.

“The construction we create modifications the way in which we really activate the biology of a cell floor,” he stated. “It's not about whether or not the antibody binds to the goal, it's about the way it binds to the goal.”

The Archon know-how comes from the College of Washington's Institute for Protein Design, which is led by David Baker, the biochemistry professor who gained the 2024 Nobel Prize in Chemistry for his work in computational protein design. Computational protein corporations which have emerged from the institute embody vaccine developer Icosavax, which was acquired by AstraZeneca final yr for $800 million, and A-Alpha Bio, whose know-how for analyzing protein-protein interactions has introduced in companions like Bristol Myers Squibb. .

Archon co-founder George Ueda labored with Baker for greater than a decade. Lazarovits stated their analysis initially centered on growing proteins that had by no means existed in nature. They then wished to design proteins with distinctive constructions. From there, they wished to see if these constructions might do something.

Lazarovits got here into the image about 5 and a half years in the past with a background in antibody administration. Baker gave each Ueda and Lazarovits college positions. Their analysis resulted in $7 million in grants to additional develop the AbC platform. The scientists had been capable of generate preclinical information to indicate what issues these new antibodies might deal with. This analysis was revealed within the journal Science in 2021. Lazarovits stated the analysis additionally helped scientists perceive what sort of capital can be wanted to make use of this new antibody science to develop new medication. Archon was based in early 2023.

Archon doesn’t but announce which therapeutic indications it’s investigating. However Lazarovits stated the packages the startup has chosen deal with well-characterized targets which have been elusive to the pharmaceutical business. Based mostly on preclinical analysis, Archon understands the contingencies for activating and deactivating the chosen targets. What that would imply for an Archon drug is comparable exercise in comparison with an already out there drug, however fewer negative effects, elevated efficiency or a mix of each, Lazarovits stated. He added that the corporate is pursuing acute indications, not persistent therapies.

By specializing in identified, sought-after targets which have remained elusive, the “checkbox” of knowledge Archon requires is extremely standardized, Lazarovits stated. The corporate is aware of the info it wants to gather and what it wants to indicate to display how the antibodies differ. If all this from the beginning, producing the info may be achieved rapidly.

The startup's technique resonated with traders. Archon's seed funding was led by Madrona Ventures, a Seattle-based enterprise capital agency that has invested in a number of synthetic intelligence-based biotech corporations, resembling Ozette and Nautilus Biotechnology. Different contributors within the Archon financing embody DUMAC Inc., Sahsen Ventures, WRF Capital, Pack Ventures, Alexandria Enterprise Investments and Cornucopian Capital. Lazarovits stated the funding provides Archon a few two-year runway.

Archon won’t solely generate information to display the science of AbCs, but in addition use its new capital to construct a enterprise case. Finally, the startup desires to kind partnerships with bigger corporations, Lazarovits stated. When that occurs, he desires to have sufficient information to know which property to deploy and which to maintain to construct worth for the younger firm. Discussions are already underway with pharmaceutical corporations and extra traders, Lazarovits stated.

“As a result of that is such an acceptable know-how for partnerships, we're getting our geese in a row,” he stated. “In the event you attempt to do every thing, you'll do every thing fairly badly.”

Picture: Archon Biosciences