HGP releases Well being IT Non-public Fairness funding tendencies for 2024

What it’s essential to know:

– Healthcare Progress Companions (HGP) and Eliciting Insights surveyed personal fairness funding professionals targeted on the healthcare and healthcare IT sectors.

– The 2024 Well being IT Non-public Fairness Survey The purpose was to seize the market's “new regular” given the present level within the rate of interest cycle, financial fluctuations and the upcoming US presidential election. Respondents included enterprise capital, progress fairness and buyout traders, offering a complete market overview.

Key themes and insights

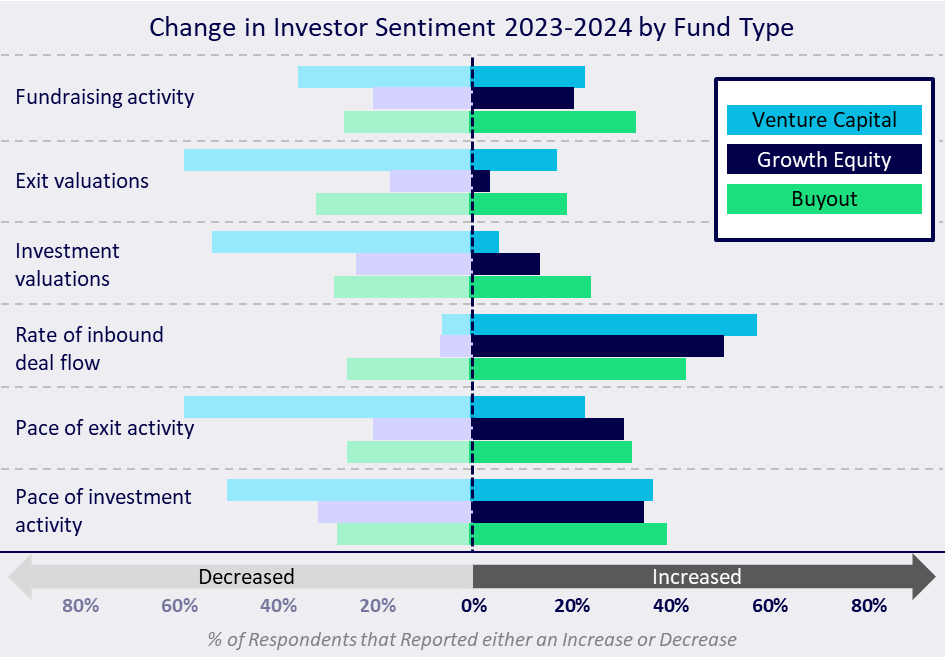

- Rankings and exercise: Regardless of a common decline in valuations for brand new investments and exits in 2024, funding and exit exercise has elevated. Buyout and progress fairness funds are exhibiting resilience, whereas enterprise capital funds have seen a extra pronounced decline.

- Profitability vs. Progress: The shift to profitability is seen by buyout and progress inventory traders as a return to self-discipline. Nevertheless, enterprise capital traders specific concern that the market will overemphasize profitability over progress.

- Investing in healthcare IT: There may be polarization in healthcare IT investing, with enterprise capitalists being much less bullish, whereas progress fairness and buyout traders are experiencing elevated exercise. Buyout traders are significantly bullish on Well being IT, noting greater valuations in comparison with the broader market.

- AI and know-how: AI is a key focus for all fund varieties and is especially seen as a instrument to enhance operations, somewhat than driving new investments.

- Market situations: Most traders usually are not involved concerning the slowdown within the IPO market and rising rates of interest, signaling power in personal markets and different exit methods.

- Election sentiment: The bulk imagine {that a} Trump presidency would profit personal fairness and healthcare investments greater than a Harris presidency.

Extra observations

- The analysis revealed some shocking tendencies, together with the resilience of progress shares, which look like recovering extra according to buyout funds than enterprise capital.

- Structured offers have gotten extra frequent, particularly amongst progress inventory traders, indicating a buyer-favorable market.

- Regardless of rising rates of interest, most traders have little concern concerning the debt ranges of their portfolio corporations, seemingly as a result of conservative debt practices.

- Buyers have combined however largely impartial views on the impression of distant work, citing some advantages akin to elevated productiveness and entry to expertise, but additionally challenges in sustaining firm tradition.

Whereas there may be some uncertainty, particularly throughout the enterprise capital house, the general sentiment factors to a level of resilience and adaptation to the 'new regular'. The analysis underlines the dynamic nature of the market and highlights areas of stability, progress and cautious optimism because the trade offers with financial modifications and the mixing of applied sciences akin to AI.