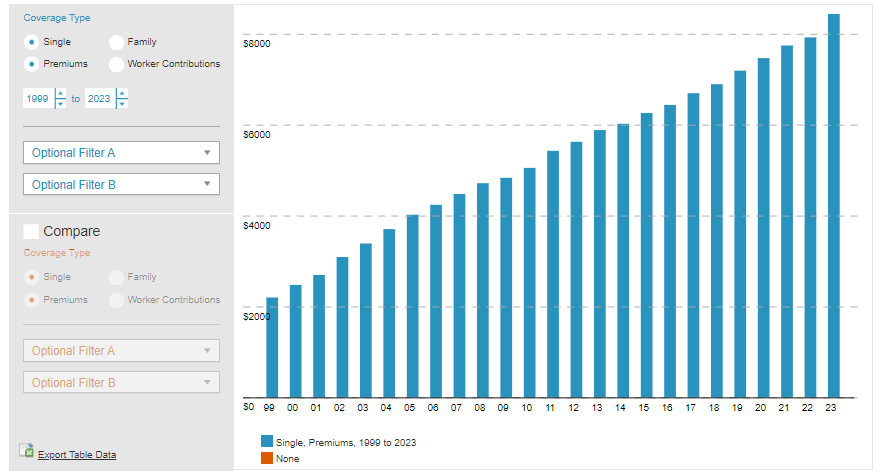

Premiums and worker contributions amongst workers coated by employer-sponsored protection, 1999-2024

Since 1999, the Employer Well being Advantages Survey has documented traits in employer-sponsored medical health insurance. Every year, non-public and non-federal public employers with three or extra workers full the survey. The survey asks firms, amongst different issues, the premium (or full price per individual) of their well being protection, in addition to worker contributions (the quantity of premium workers pay). The graphical software beneath seems to be at adjustments in premiums and worker contributions over time for coated workers at several types of firms.

Findings from the 2024 survey and extra data can be found right here. For extra data on the survey methodology, see the Survey Design and Strategies part. For added questions concerning the Employer Well being Advantages Survey or this software, please go to the Contact Us web page and choose “SUBJECT: Well being Advantages.”

Commonplace errors (SE): As with all surveys, there may be uncertainty in each estimate within the Employer Well being Advantages Survey. Estimates for smaller, extra particular teams are likely to have extra uncertainty. Commonplace errors (SEs) are a measure of how a lot uncertainty there may be in an estimate. Commonplace errors are utilized in statistical checks to find out whether or not the distinction between two estimates is important. Typically even massive variations between two teams should not actually meaningfully totally different. Commonplace errors can be found for every information level within the 'Export desk information' obtain hyperlink above.

Not sufficient information (NSD): In instances the place there are too few firms in a subpopulation to supply an affordable estimate and/or defend respondent confidentiality, the abbreviation NSD is used.

Weights: To make sure that estimates are nationally consultant, firms are randomly chosen and weights are utilized to every firm's information. The estimates of premiums and worker contributions are weighted primarily based on the variety of workers receiving well being advantages. These weights are adjusted to the variety of workers within the trade and firm measurement classes. See the Survey Design and Strategies part for extra data.

Variable definitions: Household protection covers a household of 4. Corporations that provide self-funded or partially self-funded plans bear some or the entire monetary threat related to straight masking their workers' medical claims. These firms sometimes contract with a third-party administrator or insurer to supply administrative companies for plans. In some instances, this employer can also buy stop-loss protection from a third-party insurer to guard the employer from paying very massive claims. For extra details about self-funding, see Chapter 10. Corporations that provide a number of plan sorts are outlined as self-funded or totally insured primarily based on the traits of their largest plan sort; nevertheless, premiums are calculated as a weighted common of as much as two forms of plans. Due to this fact, the premiums of each self-funded and totally insured plans could also be included within the common premium and worker contribution for some firms.

Trade classifications are primarily based on an organization's main Commonplace Industrial Classification (SIC) code, as decided by Dun and Bradstreet. A enterprise's area is set by the placement of its main location, in line with US Census Bureau definitions. Enterprise possession classifications are reported by the survey participant.

Corporations with many workers with decrease or greater wages: Since 2013, the thresholds for higher- and lower-wage employees have been primarily based on the twenty fifth and seventy fifth percentiles of nationwide employee earnings, as reported by the Bureau of Labor Statistics (BLS) Occupational Employment Statistics (OES) (2020). The restrict values have been adjusted for inflation and rounded to the closest thousand. From 2007 to 2012, wage reductions are calculated utilizing the now-eliminated Nationwide Compensation Survey. Corporations with greater wages are these the place a minimum of 35% of workers earn greater than the seventy fifth percentile. Decrease-paying firms are these the place a minimum of 35% of workers earn lower than the twenty fifth percentile. To scale back the survey burden on respondents, in some years the survey instrument included questions solely about higher-wage employees.

|

35% of workers earn… or much less |

35% of workers earn… or extra |

|

|

1999 |

$20,000 |

$75,000 |

|

2000 |

$20,000 |

$75,000 |

|

2001 |

$20,000 |

Not accessible |

|

2002 |

$20,000 |

Not accessible |

|

2003 |

$20,000 |

Not accessible |

|

2004 |

$20,000 |

Not accessible |

|

2005 |

$20,000 |

Not accessible |

|

2006 |

$20,000 |

Not accessible |

|

2007 |

$21,000 |

$50,000 |

|

2008 |

$22,000 |

$52,000 |

|

2009 |

$23,000 |

Not accessible |

|

2010 |

$23,000 |

Not accessible |

|

2011 |

$23,000 |

Not accessible |

|

2012 |

$24,000 |

$55,000 |

|

2013 |

$23,000 |

$56,000 |

|

2014 |

$23,000 |

$57,000 |

|

2015 |

$23,000 |

$58,000 |

|

2016 |

$23,000 |

$59,000 |

|

2017 |

$24,000 |

$60,000 |

|

2018 |

$25,000 |

$62,000 |

|

2019 |

$25,000 |

$63,000 |

|

2020 |

$26,000 |

$64,000 |

|

2021 |

$28,000 |

$66,000 |

|

2022 |

$30,000 |

$70,000 |

|

2023 |

$31,000 |

$72,000 |

|

2024 |

$35,000 |

$77,000 |