Well being prices use a big a part of the revenue for thousands and thousands of individuals with medication

Medicare and Social Safety play a central position within the lives of tens of thousands and thousands of older adults and folks with disabilities within the US, within the type of medical health insurance from Medicare and Pensioen or Incapacity from social safety. However even with medication protection, beneficiaries might be confronted with substantial out-of-pocket well being care prices, which may eradicate the monetary help of social safety. Medicare Half B and D premiums and solely price trade accounts for nearly a fourth of the typical month-to-month social safety advantages, not considering different well being care prices, resembling dental companies, residence care or care in a nursing residence or premiums for added protection. Though a lot of the medication beneficiaries produce other sources of revenue along with social safety, greater than a 3rd of the recipients of social safety of 65 years and older at social safety are half or extra their revenue. As well as, many Medicare beneficiaries stay from comparatively low incomes: one in 4 beneficiaries of Medicare had revenue below $ 21,000 per individual in 2023, whereas half had revenue beneath $ 36,000 per individual.

Medicare beneficiaries with low incomes and restricted monetary assets can get assist to pay for out-of-pocket prices and companies that aren’t lined by Medicare if they’re eligible for and obtain full Medicaid advantages that pertains to long-term care, imaginative and prescient and dental care. They will additionally get assist if they’re registered for the Medicare financial savings applications that pay for the premiums of Medicare and typically demand for sharing prices. The lately decided tax and expenditure account, nevertheless, consists of provisions which can be anticipated to lead to much less low-income medicare beneficiaries which have entry to those advantages, and lowering family assets for individuals within the soil of the distribution of revenue, together with households with Medicare beneficiaries. And even at present, not all beneficiaries with low incomes which can be eligible for these advantages, they obtain, whereas others have revenue or belongings simply above the qualification thresholds.

To doc affordability challenges which can be set by out-of-pocket well being care prices for folks with Medicare, these quick analyzes analyze outdoors of enterprise healthcare prices as a share within the revenue of social safety and the entire revenue, together with different sources of revenue along with social safety. On account of variations within the underlying information sources, the evaluation of the typical expenditure is offered as a share of the typical revenue of social safety based mostly on a per individual, and a broader vary of measures-average, median, 75one and 90one Percentile-for-out-of-pocket spending as a share of the entire revenue. (To see Strategies For extra info and information sources).

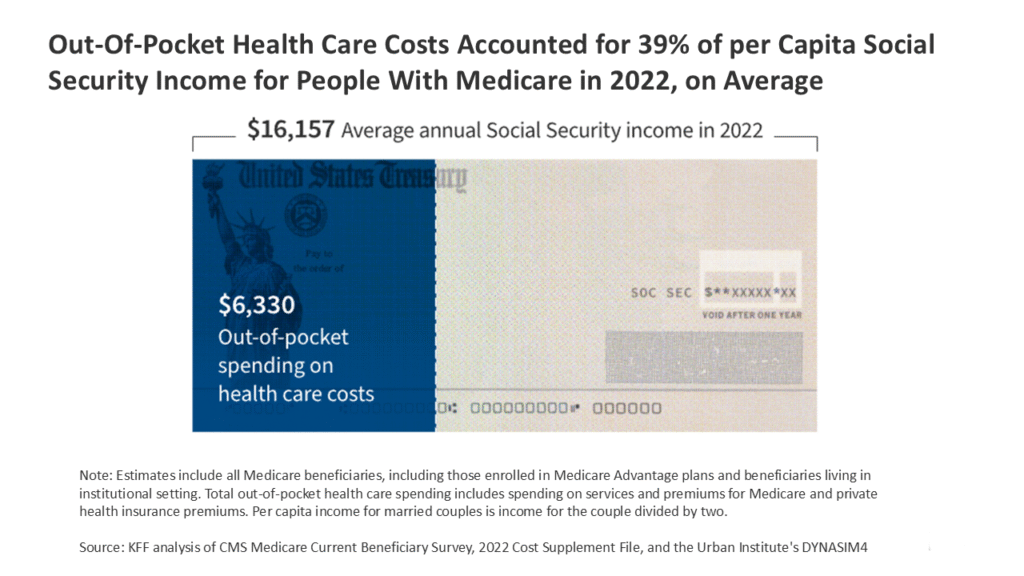

Out-of-pocket well being care expenditure by medicare beneficiaries have been on common 39% of social safety revenue per individual per individual, common

In 2022, Medicare beneficiaries spent a complete of $ 6,330 out of the pocket on the prices of well being care, together with premiums for medication and prices for Medicare-covered companies and companies that Medicare doesn’t cowl, resembling dental, imaginative and prescient and listening to companies and help companies and help, whereas the typical per head of social safety was $ 16.157 was $ (Determine 1, Appendix Desk 1).

Determine 1

Medicare beneficiaries spent a median of 11% of their whole revenue per head of the inhabitants on the prices of care, however 1 in 4 beneficiaries spent at the least 21% and 1 in 10 beneficiaries spent 39% or extra

Bearing in mind different sources of revenue Along with social safety, well being care expenditure amounted to a median of 11% of the entire revenue per head of the inhabitants for Medicare beneficiaries in 2022 (common (common (Determine 2). Out-of-pocket healthcare prices are a smaller share in whole revenue than revenue from social safety as a result of most beneficiaries produce other sources of revenue, resembling pensions, 401Ks or revenue from financial savings. In 2022, the revenue of social safety was a median of 29% of the entire revenue per medication beneficiary good. Expenditure issued consumed a bigger proportion of revenue for some Medicare beneficiaries, with one in 4 (15 million beneficiaries) who spends 21% or extra and one in 10 (6 million) expenditure of 39% or extra.

Determine 2

The burden of well being care is larger for some Medicare beneficiaries, together with these with decrease incomes and people of 85 years and older

On common, the prices for look after the look after a significantly bigger share within the whole revenue per head of the inhabitants in Medicare beneficiaries with decrease revenue than larger incomes (34% amongst beneficiaries with revenue of $ 10,000 or much less versus 7% amongst beneficiaries with greater than $ 50,000) (Determine 3) (Determine 3). Though Medicare beneficiaries with decrease incomes have decrease out-of-pocket healthcare prices than beneficiaries with a better revenue, their very own prices are on common good for a bigger share of their decrease revenue. Assist from Medicaid and the Medicare Financial savings Program will help to restrict enterprise bills for medicare beneficiaries with the bottom incomes, however not all beneficiaries with a low revenue are eligible for or obtain assist from these applications. With none type of monetary assist, beneficiaries with a decrease revenue can reasonably chorus from the required care, as a result of they’re much less probably than beneficiaries with a better revenue to have the ability to pay companies with excessive prices for sharing prices or companies that aren’t lined by Medicare, resembling dental companies or lengthy -term companies and help.

Medicare beneficiaries aged 85 and older launched a bigger a part of their revenue to out-of-pocket healthcare prices than youthful beneficiaries (22% versus 9% amongst beneficiaries aged 65-74) on common. Medicare beneficiaries aged 85 and older have a a lot larger common well being care prices than these aged 65-74, largely as a consequence of larger expenditure for long-term care, that are good for greater than half of the entire expenditure for out-of-pocket on all companies for all age and older companies. Beneficiaries within the oldest age cohort even have a decrease whole revenue per head of the inhabitants than youthful outdated beneficiaries, on common in all probability partially as a consequence of a decrease revenue from revenue after retirement. (For extra details about further demographic teams, see Appendix Desk 1 And Desk 2).

Strategies

Knowledge on out-of-pocket healthcare expenditure comes from the Facilities for Medicare & Medicaid Providers (CMS) Medicare present beneficiary survey, 2022 Price Complement File (the latest obtainable information of information). The pattern includes 59.9 million folks with Medicare in 2022 (weighed), together with beneficiaries in conventional Medicare and Medicare Benefit and people who stay in neighborhood and services, solely beneficiaries who have been solely registered partially A or half B for essentially the most of their Medicare registration in 2022 and beneficiaries who had medicines as a secondundar.

The file complement file hyperlinks Medicare claims to research info reported immediately by beneficiaries. The file collects out-of-pocket details about intramural and outpatient hospital care, physician and different medical care supplier, residence well being companies, sustainable medical tools, long-term and expert nursing facility companies, hospice companies, dental companies, listening to companies and medicines on prescription.

In survey reported from enterprise funds are these funds from the beneficiary or their households, together with direct money funds and social safety or extra safety revenue (SSI) checks which can be paid on to nursing houses. Out-of-Pocket expenditure for premiums are derived from administrative information on Medicare Half A, Half B, Half C (Medicare Benefit) and half D premies which can be paid by every pattern, along with investigations reported by premium bills for different sorts of medical health insurance insurance policies (together with medigap, employer-sponge, employer-sponge, employer-sponge-sponge, employer-sponge-sponge, employer-sponig-sponge-sponge-sponge,-employer-sponig-sponseling).

From 2019, the MCBs launched an imputation methodology that makes use of Medicare Benefit -meeting information to enhance the estimate of medical occasions and prices for Medicare Benefit and to take note of the non -reported use of Medicare Benefit. As a result of information is attributed to Medicare Benefit-in-law, estimates of the entire common from enterprise expenditures on this evaluation could also be conservative.

Earnings information relies on the self -reported revenue of each beneficiaries within the MCBS and estimates of the dynamic simulation of the revenue mannequin of the City Institute (Dynasim4). Dynasim4 is a dynamic microsion mannequin that tasks the inhabitants and analyzes the long-term distribution dolitions of pension and ageing points. Dynasim4 takes into consideration revenue from all sources, together with social safety, wages, pensions and belongings revenue together with recordings of IRAS. The simulation is tailor-made to the middleman prices of the 2024 Social Safety Trustees Financial and Demographic projections. Dynasim4 generates the typical and percentiles of social safety per head of the inhabitants and the entire revenue for particular demographic teams. It calculates the typical social safety per head of the inhabitants and the entire revenue for married {couples} by dividing the revenue for the couple by two. KFF adapts the self -reported revenue of the beneficiaries within the MCBs with estimates of Dynasim to adapt for sub -reporting revenue from sure sources.

For common expenditure for the outside as a share of common social safety per head of the inhabitants and the typical whole revenue per head of the inhabitants, this evaluation makes use of common per head of the inhabitants issued from the MCBs and common social safety per head of the inhabitants and whole revenue from Dynasim. Percentile values of out-of-pocket expenditure as a share of whole revenue (median, 75oneand 90one) are calculated from MCBS information about out-of-pocket editions and revenue values corrected by Dynasim within the MCBS.

This work was partially supported by Aarp Public Coverage Institute. KFF maintains full editorial management over all its coverage evaluation, polling and journalism actions.

Nancy Ochieng, Juliette Cubanski and Tricia Neuman are at KFF. Anthony Damico is an unbiased advisor.