Provisional tariff requests from insurers anticipate the most important will increase of ACA Market Plan -Premies since 2018

Be aware: For up to date information on proposed ACA market premiums of greater than 300 insurers in all 50 states and DC, learn our up to date evaluation.

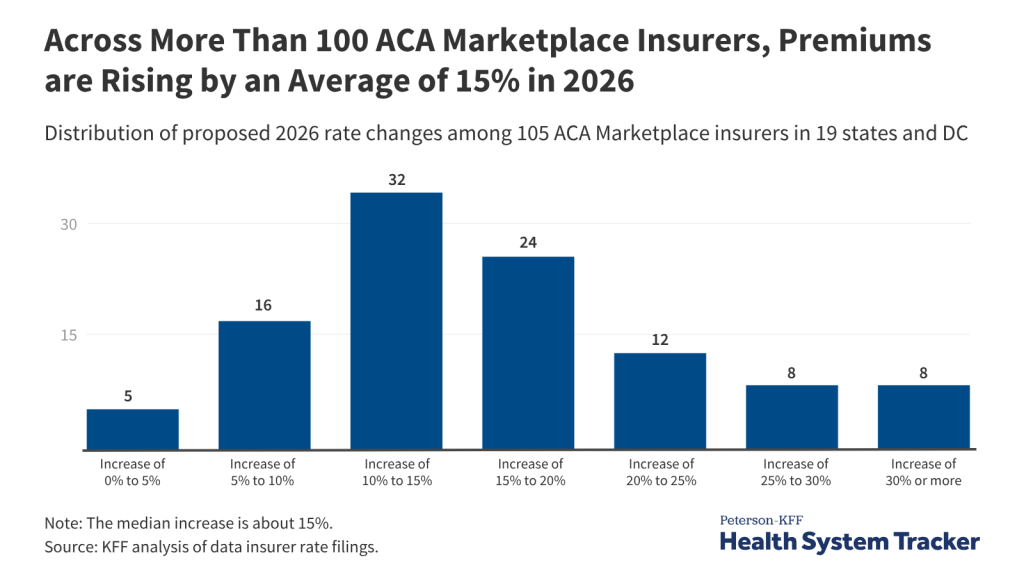

ACA Market Insurers suggest a median premium improve of 15% for 2026, based on a brand new evaluation of provisional tariff functions. Primarily based on the early indications, particular person market insurers will introduce the most important rise in premiums since 2018, the final time that coverage uncertainty has contributed to sharp premium progress.

Concerning the 105 ACA market insurers in 19 states and DC who’ve submitted tariff functions up to now, most premium will increase require 10% to twenty% for 2026, and greater than 1 / 4 proposes premium will increase of 20% or extra.

Along with the anticipated progress in well being care prices, insurers have made numerous coverage modifications that they anticipate to extend the charges subsequent yr, together with the next:

- The expiry of the improved Premium tax credit on the finish of this yr, which made the protection extra inexpensive and have contributed to record-high registration within the ACA marketplaces, is anticipated to be anticipated to fall on common by greater than 75% of greater than 75% on common and far more healthy registered.

- The influence of charges on some medicines, medical gear and provides. Some insurers estimate that they may improve the premiums by a mean of three% greater than they might in any other case have.

Different elements may affect premium modifications, together with the laws on funds coordination and the rule of the marketplace for market and affordability, each of which have been decided and accomplished after many of those insurers have submitted their provisional tariff requests. The ultimate modifications in 2026 are anticipated to be printed in late summer season. Sponsored registered individuals are usually protected at annual fee will increase, as a result of their tax credit maintain premium funds with a part of their earnings.

With improved tax credit that can expire later this yr if the congress doesn’t take motion to increase them, sponsored registered individuals pay extra as a result of they’ve much less monetary assist. Center earnings individuals with an earnings above 4 instances the poverty hazard would not be eligible for assist and will bear your entire premium.

The complete evaluation and different well being prices can be found on the Peterson-KFF Well being System Tracker, a web-based info hub that focuses on monitoring and assessing the efficiency of the American well being system.