Charges are driving premiums for small firms

Small firms can anticipate that the current charges levied by President Trump will improve the worth of a number of imported items from totally different nations. However much less is predicted how this commerce coverage can wrinkle by way of the well being advantages of workers. President Trump not too long ago indicated that the administration will go on the charges on pharmaceutical imports – beginning with a 'small charge', climb to 150% inside round 12 to 18 months, and finally rises to a minimum of 250% – as a part of an try to scale back drug manufacturing to the US

Charges can not directly affect the premiums for medical health insurance insurance policies by growing the prices of imported medical items, specifically prescription medicines. With worth plans, insurers should incur assumptions on future medical prices, usually months upfront. Within the absence of clear coverage pointers, some insurers comply with a cautious method by together with potential price will increase of their proposed charges for the approaching planning 12 months. As a substitute of ready for closing selections, some carriers have taken into consideration these dangers to forestall worth. This may be the case specifically if the affected medicines are model identify or particular medicines with restricted alternate options, a lot of that are imported. By constructing assumptions on potential price will increase, charges can affect the premiums, even earlier than a measurable worth change has occurred, specifically in markets the place insurers can already work on tighter margins.

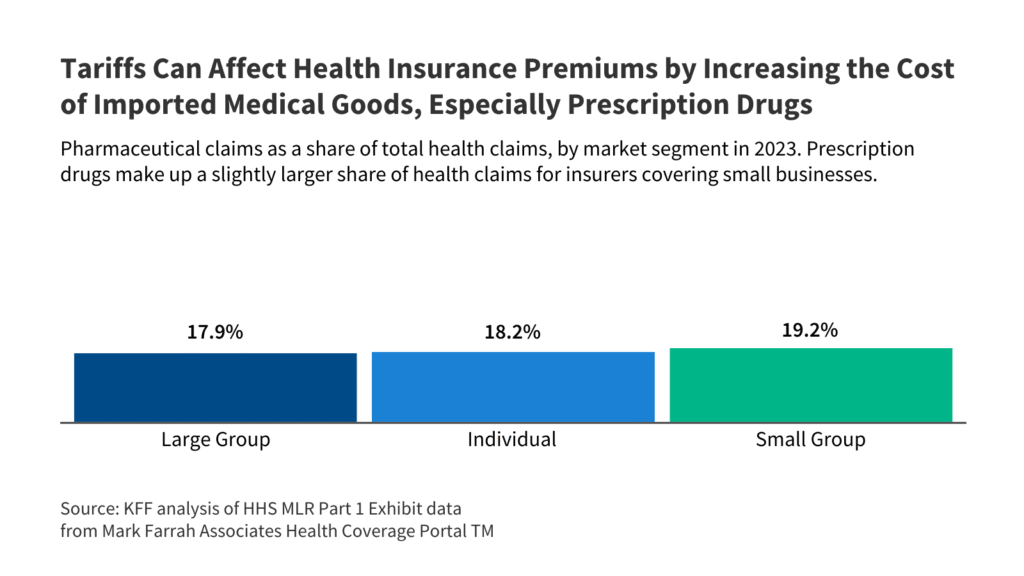

The share of whole well being claims that may be attributed to medicines varies per market section, however typically issues between one sixth and one fifth of the whole claims after correction for pharmaceutical reductions.

Pharmaceutical merchandise embody a barely bigger share of the whole claims in well being care available in the market for small teams in comparison with the person and huge group markets. Out there for small teams, medicines are good for barely lower than one fifth of all claims (19.2%), whereas the share is barely decrease within the particular person (18.2%) and huge group (17.9%) markets.

Medical health insurance firms should submit their proposed premium modifications for the approaching 12 months to state regulators within the spring and summer time. As a part of this course of, some insurers within the Inexpensive Care Act (ACA) compliant are known as assured marketplace for small groups-network as within the particular person market-complicit charges, specifically these of pharmaceutical imports, as a purpose for greater than anticipated premium. Within the particular person market, numerous insurers have included upward changes of roughly 3% in response to the anticipated will increase in drug prices which are linked to charges, whereas others acknowledge the chance, however haven’t included it of their worth assumptions. Of the 88 market charges for small group markets that have been assessed intimately, 1 / 4 (22 insurers) explicitly talked about charges. Different insurers could have taken into consideration in tariff results with out mentioning instantly.

In numerous states, the information of the small group observe that anticipating new import charges is predicted to extend the prices of sure model identify and specialist medicines, particularly these with out generic alternate options.

“IHBC is searching for a normal curiosity change of 18.9% in 2026, primarily because of elevated prices as a result of inflation and charges.” – Unbiased Well being Advantages Company (New York)

“To consider uncertainty with regard to charges and/or the reassurance of manufacturing and their affect on the whole medical prices, specifically pharmaceutical merchandise, a complete declare results of two.9% are constructed into the tariff purposes initially submitted. This has elevated our premium by roughly 2.7%.” – United Healthcare Insurance coverage Firm (Oregon)

Amongst insurers of small teams which have justified the potential affect of charges of their charge purposes, the estimated premium impact varies from 1.7% to three.0%. Different insurers consult with the opportunity of charges, however don’t take them into consideration of their worth assumptions.

“The neighborhood has not taken into consideration the affect of charges in the course of the tariff improvement, because the charges have been created on the idea of present laws right now and there may be an excessive amount of uncertainty about which (if none) charges shall be closing.” – Neighborhood Well being Plan of Rhode Island (Rhode Island)

As a result of insurers within the ACA-Conforming marketplace for small teams need to lock the premiums properly earlier than the protection 12 months, usually six to 9 months upfront, they usually towards coverage uncertainty. In distinction to inflation or shifts in using providers the place insurers can draw on historic expertise, there may be little precedent for the way radical import charges can affect the worth of prescription medicines.

As well as, ACA-compliant insurers of small teams should additionally adhere to the necessities for medical loss ratio (MLR), which restrict the share of premiums that may go to administrative prices and revenue. If premiums exceed the precise bills, carriers should concern reductions. But when they underperform premiums and charges, the drug prices can improve, insurers may be confronted with monetary deficits.

This dynamic may translate into greater workers' bills for small firms, as a result of these charges come into power and affect the costs for medicines. For employers who work on slender margins, even small premium will increase can proceed to supply selections on employer contributions, price alternate or in any respect protection. Whereas ACA's MLR guidelines shield employers from some prices by demanding insurers that they return surplus premiums if the expenditure fails, these guidelines aren’t insulating from the entrance bother with greater premiums. With out clear precedent to oversee assumptions, rate-related uncertainty is now a consider how some small group insurers method the dedication of the pace including a brand new variable to the affordability of some protection on a job.