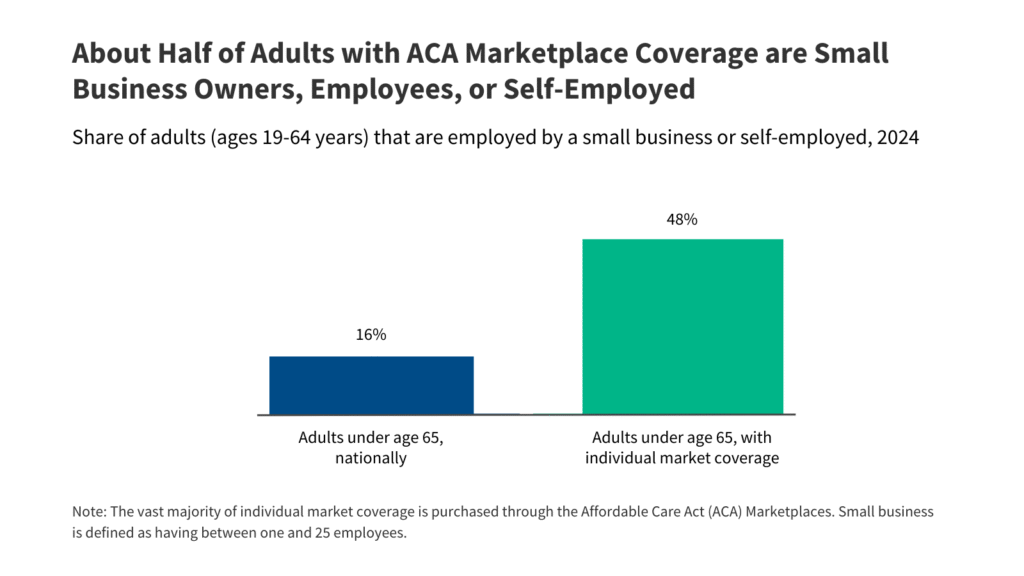

About half of the adults with ACA Market protection are homeowners of small firms, workers or self-employed individuals

The improved premium tax credit, based beneath the American Rescue Plan Act (ARPA) and later expanded through the Inflation Discount Act (IRA), have decreased premiums for hundreds of thousands of market registrations. In addition they contributed considerably to the registration available on the market, greater than doubled to 24.3 million folks in 2025.

At present, greater than 9 out of 10 registered (92%) obtain an quantity of premium tax credit score. If these improved tax credit ended on the finish of 2025, the premiums exterior the bag would rise on common by greater than 75% for the overwhelming majority of individuals and households who purchase protection through the Inexpensive Care Act (ACA) market. As well as, insurers suggest a rise in gross premiums (earlier than premium tax credit are utilized) of 18%, partly as a result of impression on the chance software of the expiry of improved premium tax credit. This enhance within the double digits would affect the federal government prices for tax credit, in addition to market advantages who don’t obtain a premium assist.

A lot of the dialogue concerning the ACA marketplaces focuses on people and households who purchase themselves. Nevertheless, many registrations are linked to small firms or are self -employed. An earlier KFF evaluation confirmed that 38% of grownup particular person market registrations beneath the age of 65 are greater than 400% of the federal poverty line (FPL) self-employed, in comparison with 7% of adults (age 19-64) with incomes for 4 occasions poverty nationwide. If the improved premium tax credit expire, personal people and households with family incomes of greater than 400% FPL would now not be eligible for premium tax credit, which suggests they’ve the total prices of their medical health insurance premium.

With the assistance of knowledge from the present annual social and financial dietary supplements of the Inhabitants Survey (CPS), we estimate that 48% of adults youthful than 65 years registered within the protection of the person market (direct buy) are utilized by a small firm with fewer than 25 workers, impartial entrepreneurs or homeowners of small firms. In different phrases, about half of the registrations for adults within the particular person medical health insurance market – of which the overwhelming majority is bought through the ACA marketplaces – is affiliated with a small firm. For the context, 16% of all adults youthful than 65 years previous are employed by a small firm or his self -employed individual.

For a lot of workers of small firms and the self -employed, the person market acts as their most essential supply of in depth medical health insurance exterior the standard protection of employers. In distinction to bigger firms, small firms provide much less likelihood of providing well being advantages to their workers, in order that workers and entrepreneurs stay depending on the affordability and stability of the person market.

The improved premium tax credit have decreased the premium prices for registered out there. If these subsidies expire as deliberate on the finish of 2025, particular person market registrations-including many people who find themselves linked to small companies are being contronted with increased premiums from the bag.

Strategies

The above knowledge relies on KFF evaluation of the annual social and financial complement of 2024 CPS. The evaluation contains adults beneath the age of 65 who purchase their medical health insurance immediately and are at the moment not college students. Folks have been thought-about self -employed or employed by a small firm in the event that they have been reported as self -employed or labored at an organization with between one and 24 workers. You possibly can add this sentence on the finish of the strategies. The scale of the employer is measured for the first job within the earlier yr and will be totally different on the time of the survey.