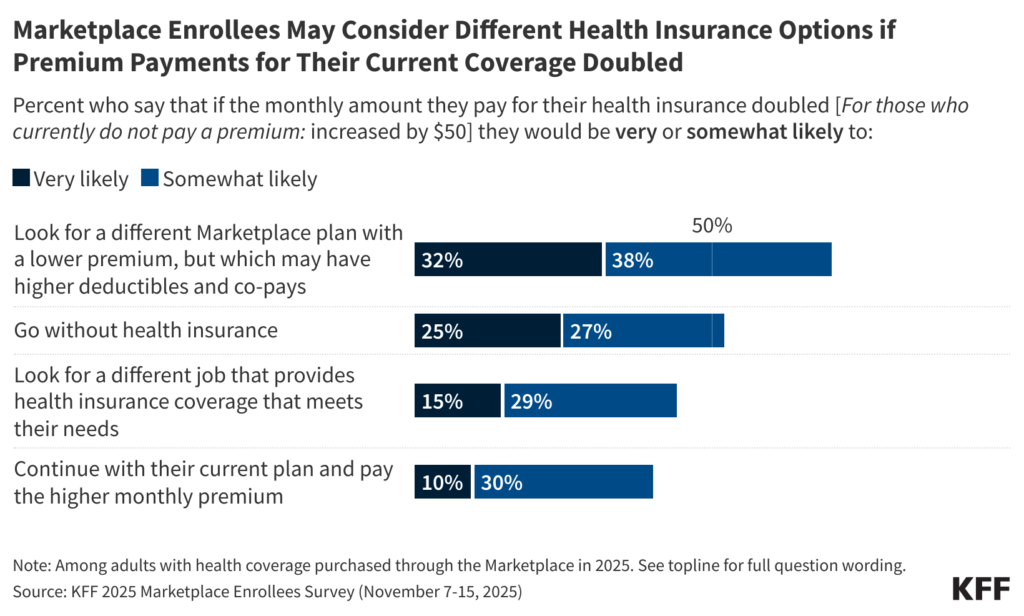

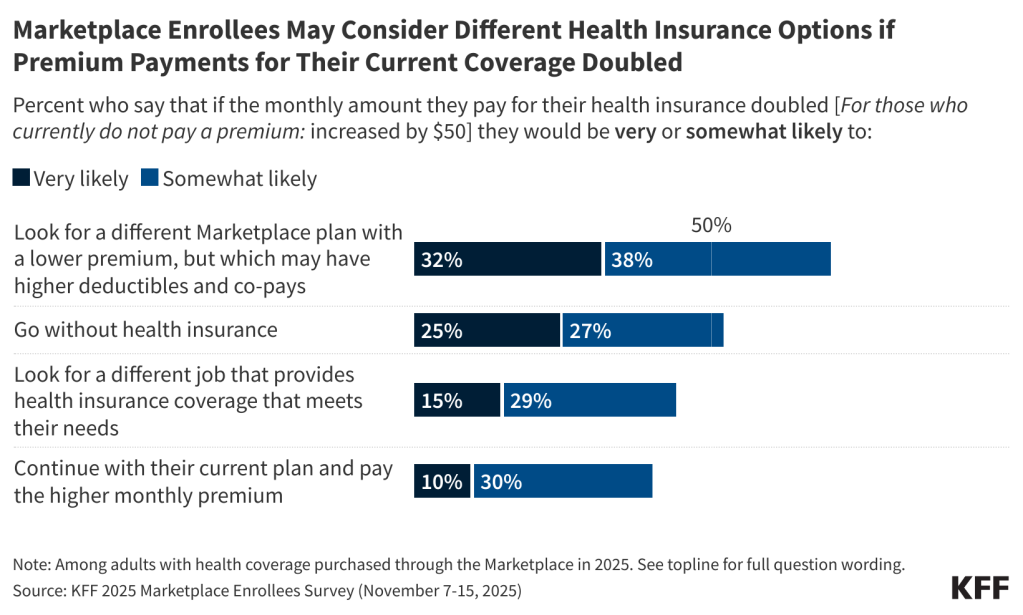

Survey: 1 in 3 ACA Market contributors say they’d “very possible” purchase a less expensive plan if their premium funds doubled; 1 in 4 say they’d “very possible” go with out insurance coverage

If the quantity they pay in premiums have been to double, about one in three enrollees in Inexpensive Care Act Market well being plans say they’d “very possible” search for a Market plan with a decrease premium (with larger deductibles and copays) and one in 4 would “very possible” go with out insurance coverage subsequent 12 months, in accordance with a brand new survey of Market enrollees shortly after open enrollment started within the first weeks of November.

The survey consists of the views and experiences of Market contributors as they weigh their protection choices for 2026, with out the improved ACA credit or different coverage adjustments that the Senate might debate this month. About 22 million of the 24 million Market enrollees have taken benefit of the expiring tax breaks, and with out them their premium funds are anticipated to rise a mean of 114%, from $888 to $1,904 per 12 months.

Almost six-in-ten enrollees (58%) say they may not afford a rise of simply $300 per 12 months within the quantity they pay for insurance coverage with out considerably disrupting their family’s funds. One other one in 5 (20%) say they can not afford to extend the quantity they pay for medical insurance by $1,000 per 12 months with out disrupting their funds.

If their whole well being care prices, together with premiums, deductibles and different price sharing, have been to extend by $1,000 subsequent 12 months, most Market contributors (67%) say they’d possible reduce on each day family wants, about half (54%) say they’d possible attempt to discover one other job or work further hours, and four-in-ten (41%) say they’d possible skip or postpone different payments. A 3rd (34%) say they’d take out a mortgage or enhance their bank card debt.

“The ballot reveals the vary of issues Market contributors will face if the improved tax credit usually are not expanded in some type, and people issues might be a textbook instance of the wrestle People face with well being care prices within the interim if Republicans and Democrats can’t resolve their variations,” stated KFF President and CEO Drew Altman.

Market enrollees have been requested how possible they’d be to simply accept every of 4 totally different attainable responses if the month-to-month premiums they pay have been to double (or enhance by $50 monthly for these not presently paying premiums).

Open enrollment for Market protection started on November 1 and runs by means of January 15 in most states, though shoppers should enroll in a plan by December 15 if they need their protection to start on January 1. The overwhelming majority of enrollees (89%) count on to decide by the tip of this 12 months, with many saying they’ve already made their determination on subsequent 12 months’s protection.