Pfizer raises $1.9 billion by divesting stake in HIV Medication firm majority owned by GSK

Pfizer will cease creating and advertising and marketing HIV medicine by withdrawing its minority stake in ViiV Healthcare, an organization the pharmaceutical large based seventeen years in the past in partnership with GSK.

Beneath a brand new deal, Pfizer’s possession in ViiV will probably be changed by Shionogi, one other minority shareholder of the HIV firm. Beneath deal phrases introduced Tuesday, ViiV will cancel Pfizer’s 11.7% stake within the firm and Pfizer will obtain $1.875 billion. In the meantime, ViiV will subject new shares to Shionogi for $2.125 billion, growing the Japanese firm’s stake in ViiV from 10% to 21.7%.

GSK, which has been ViiV’s majority shareholder for the reason that firm’s inception, retains a 78.3% stake. The London-based pharmaceutical firm may also obtain a particular dividend of $250 million, payable in British kilos. The transaction nonetheless requires regulatory approval in sure markets however is anticipated to shut within the present quarter.

ViiV launched in 2009 with a portfolio of ten HIV medicine from GSK and Pfizer, together with plans to develop new medicine derived from each corporations’ analysis. On the time, GSK owned 85% of ViiV and Pfizer 15%. In 2012, ViiV acquired the worldwide rights to HIV medicine developed in collaboration with Shionogi. In return, Shionogi turned a ten% shareholder of ViiV and was given a seat on the corporate’s board of administrators.

The ViiV portfolio at present accommodates 15 accepted medicines whose gross sales are recorded by GSK. In 2024, GSK reported that HIV medicines generated £7.1 billion (about $9.5 billion) in gross sales, up 10.9% from the earlier yr. The very best ViiV product is Dovato, a once-daily capsule accepted for the therapy of HIV in sufferers 12 years and older. GSK reported £2.2 billion (about $2.9 billion) in income for Dovato in 2024.

Pfizer’s monetary studies acknowledged dividends from ViiV as revenue. Within the context of promoting HIV medicine, these funds are nominal. For 2024, Pfizer reported a $272 million dividend from ViiV; final yr the dividend was $265 million.

ViiV’s foremost rival in HIV medicine is Gilead Sciences. The most recent product in Gilead’s HIV portfolio is Yeztugo, a biannual injection that was accepted by the FDA final summer time for HIV-1 pre-exposure prophylaxis (PrEP). ViiV’s FDA-approved PrEP drug Apretude is run as an injection each different month, however the firm has been testing an ultra-long-acting model of the drug that would permit dosing intervals of 4 to 6 months. That work, together with a ViiV pipeline of 4 preclinical HIV medicine, will now proceed with simply two companions.

“This settlement simplifies ViiV’s shareholder construction and we sit up for persevering with our extremely profitable partnership with Shionogi to advance ViiV’s pipeline and portfolio of long-acting injectable HIV therapy and prevention medicines,” David Redfern, chairman of ViiV Healthcare, stated in a ready assertion.

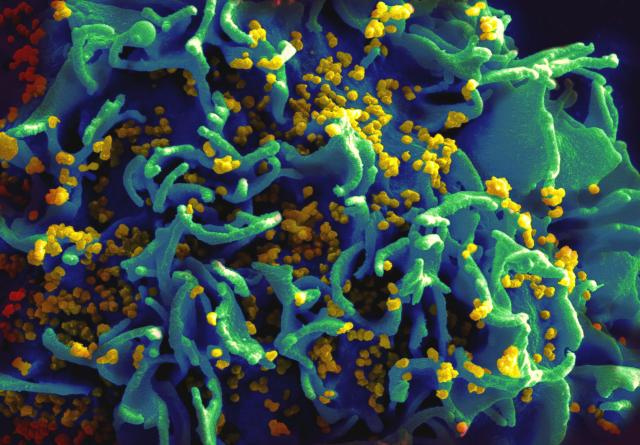

Picture by Flickr consumer NIAID by way of a Artistic Commons license