Medicare Spending on Ozempic and Different GLP-1s Skyrockets

This publish was up to date on March 27, 2024 to incorporate an evidence of the medicines included within the evaluation and extra details about rebates.

GLP-1 medication reminiscent of Ozempic, Wegovy and Mounjaro had been initially developed to deal with kind 2 diabetes, however their effectiveness as anti-obesity medication has generated great pleasure and excessive demand amongst individuals who have struggled to shed pounds in different methods. traps. These medication are additionally being examined to deal with different circumstances, and the FDA simply accredited a brand new use of Wegovy to cut back the danger of opposed cardiovascular occasions. However the annual value of those medication within the U.S. — greater than $11,000 at current listing costs, though web costs could also be decrease with reductions negotiated by pharmacy profit managers — has raised issues in regards to the fiscal influence of GLP's broad protection -1 medication on Medicare. , different well being insurers and sufferers.

Medicare is prohibited below present regulation from masking medicines used for weight reduction, however Medicare Half D plans can cowl GLP-1s for his or her different medically accepted indications, together with the remedy of diabetes, and now to cut back cardiovascular danger, based mostly on a current memo from the Facilities for Medicare & Medicaid Providers (CMS). Though the potential value of authorizing Medicare protection of weight problems medicines is a barrier to passing laws to raise the ban, being coated by Medicare for licensed use has already made these medicines among the many finest promoting Half D medication. , Medicare's outpatient drug profit program.

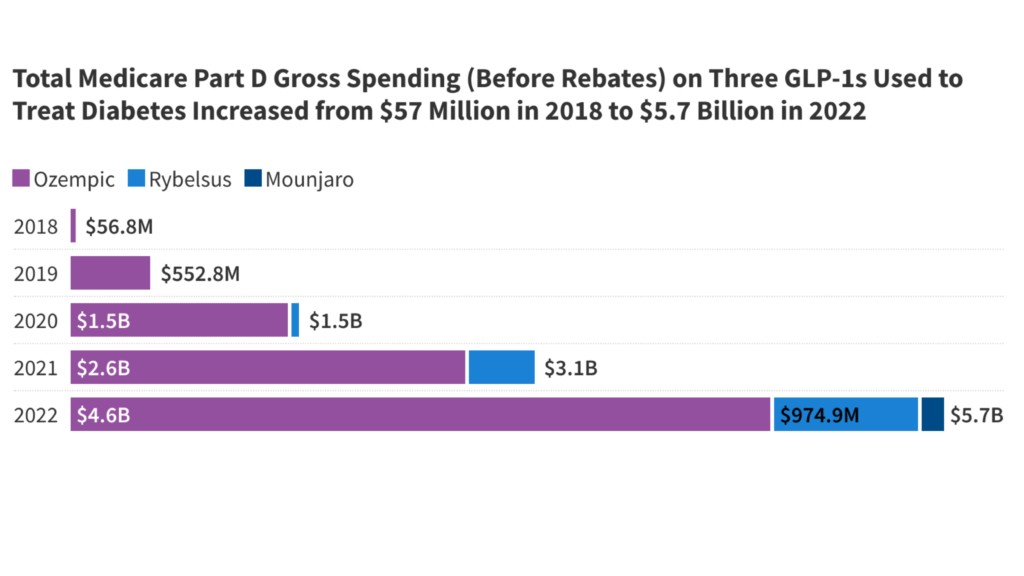

KFF's evaluation of not too long ago launched Medicare Half D spending information from CMS exhibits that complete gross Medicare spending for the three latest variations of those diabetes medication that had been additionally not too long ago accredited for weight reduction — Ozempic, Rybelsus and Mounjaro — has been trending upward lately shot. growing from $57 million in 2018 to $5.7 billion in 2022 (Exhibit 1). (Gross expenditures don’t take into consideration rebates that end in decrease web expenditures.) Ozempic (semaglutide injection) was accredited in December 2017; Rybelsus (semaglutide tablets) was accredited in September 2019; and Mounjaro (tirzepatide) was accredited in Might 2022. As a weight reduction drug, semaglutide was accredited in 2021 as Wegovy and in 2023 tirzepatide was accredited as Zepbound. (This evaluation doesn’t embrace all GLP-1s coated by Medicare, solely these merchandise with newer FDA approvals which can be additionally accredited as weight reduction medicines.)

Spending on Ozempic alone has elevated considerably between 2021 and 2022. Ozempic rose from 10e rank among the many 10 best-selling Half D medication in 2021, with gross expenditures of $2.6 billion, to sixe will happen in 2022, with an expenditure of $4.6 billion (Determine 2). Total, gross spending below Medicare Half D was $240 billion in 2022; Ozempic accounted for two% of this quantity. That is earlier than bearing in mind rebates, which in accordance with Medicare actuaries would complete 31.5% in 2022, however may very well be as excessive as 69% for Ozempic in accordance with one estimate.

Given the comparatively excessive stage of gross Medicare Half D spending as of 2022 for the 2 semaglutide merchandise collectively, Ozempic and Rybelsus, it’s attainable that Medicare may choose this product for drug worth negotiations as early as 2025, which is barely could be greater than seven years later. preliminary FDA approval in late 2017. (For small molecule medication reminiscent of semaglutide, a minimum of seven years should have handed from the FDA approval date to be eligible for choice, and for medication with a number of FDA approvals, CMS will evaluate the earliest approval date to make this determination.) If that occurs, a negotiated Medicare worth could be obtainable beginning in 2027. This might cut back total Medicare spending on semaglutide merchandise, together with Ozempic, Rybelsus and Wegovy.

The truth that protection of GLP-1s below Medicare Half D for licensed use is already impacting complete spending for the Half D program may very well be an indication of even greater spending as Half D plans can now cowl Wegovy for its coronary heart well being advantages. , as different makes use of for GLP-1s have been accredited, and as policymakers take into account laws that will authorize Medicare to cowl weight problems medicines. Competitors amongst GLP-1 medication may have a moderating impact on launch costs and result in greater reductions negotiated between producers and pharmacy profit managers. These medication provide substantial potential well being advantages, however the mixture of excessive demand, new makes use of, and excessive costs for these therapies will doubtless place monumental strain on Medicare spending, Half D plan prices, and premiums for Half D protection.