Medicare households spend extra on well being care than different households

Medicare supplies medical insurance protection to 66 million adults, together with 59 million adults age 65 and older and greater than 7 million adults beneath age 65 with disabilities. Though the overwhelming majority (91%) of Medicare beneficiaries usually view their Medicare protection positively, healthcare-related points are usually not unusual. Medicare beneficiaries contribute to the price of their well being care protection by way of month-to-month premium funds, deductibles, and different cost-sharing necessities. As well as, individuals on Medicare could face extra premiums for Medicare Half D prescription drug protection and supplemental insurance coverage. Additional, there is no such thing as a restrict on out-of-pocket bills for beneficiaries in conventional Medicare, and beneficiaries typically incur out-of-pocket prices for companies not coated by conventional Medicare, akin to dental, listening to, and imaginative and prescient companies. Medicare Benefit plans have a cap on out-of-pocket prices and sometimes provide decrease value sharing with out a premium, however enrollees should still incur important prices.

In 2022, the Shopper Value Index (CPI) for all city customers, a intently watched measure of worth inflation, rose to the very best annual price since 1981, translating into larger prices for housing, meals, transportation and different family bills, together with the price of healthcare. The inflation price has since fallen, however costs for a lot of family bills are nonetheless considerably larger than earlier than. On this evaluation, we assess the monetary burden of well being care spending amongst households the place all members are coated by Medicare (known as Medicare households) in comparison with households the place no members are coated by Medicare (known as non-Medicare households). primarily based on knowledge from the 2022 Shopper Expenditure Survey. We additionally assess tendencies in family spending and the monetary burden of well being care spending over the ten-year interval from 2013 to 2022. (See Strategies for particulars on the evaluation.)

Healthcare burden was twice as excessive amongst Medicare households as amongst non-Medicare households in 2022

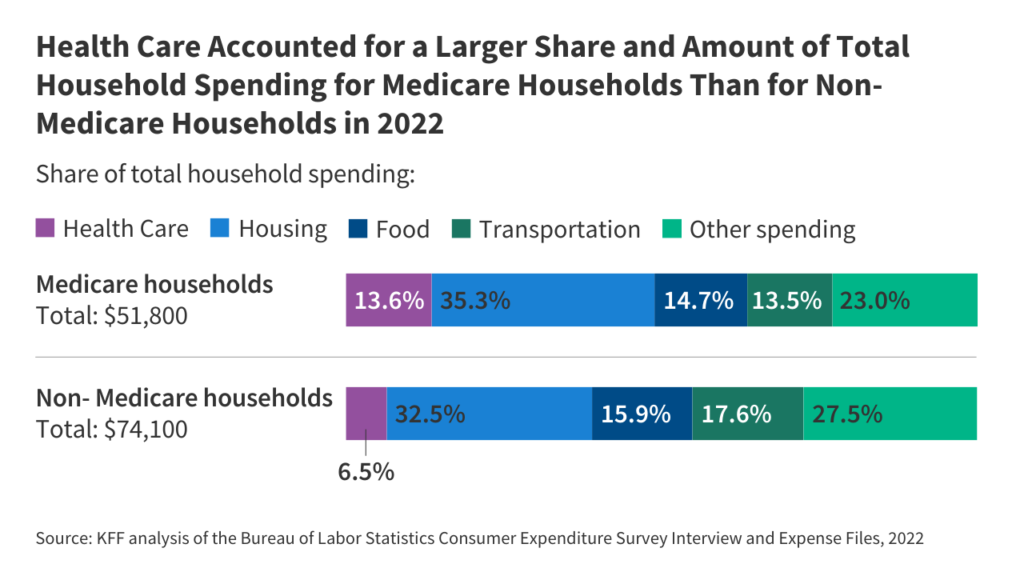

Common healthcare-related spending accounted for 13.6% of complete spending by Medicare households in 2022, in comparison with 6.5% for non-Medicare households.

Medicare households spent extra on well being care than non-Medicare households in 2022, each as an annual greenback quantity and as a share of complete family spending. Medicare households spent a mean of $7,000 on well being care, accounting for 13.6% of their complete family expenditures ($51,800), whereas non-Medicare households spent $4,900 on healthcare, accounting for six.5% of their complete family expenditures ($74,100) (Determine 1). Healthcare prices embrace medical insurance premiums, medical companies (e.g., hospital and doctor companies), prescribed drugs, and medical provides (e.g., crutches, glasses, listening to aids).

The better burden of well being care spending amongst Medicare households than amongst non-Medicare households is a perform of each decrease common complete family spending for Medicare households than non-Medicare households and better well being care utilization, leading to larger well being care spending by Medicare households .

Throughout all family spending classes, housing accounted for the biggest share of complete spending for each Medicare and non-Medicare households (35.3% for Medicare households and 32.5% for non-Medicare households). In different main classes of family bills – transportation, meals and different bills akin to training and clothes – Medicare households spent a smaller share of their family expenditures (and fewer in greenback phrases) on these things than non-Medicare households. This can be a perform of each smaller common household sizes in Medicare households than non-Medicare households (1.4 versus 2.6 individuals), in addition to decrease median family earnings ($31,700 versus $76,600).

In 2022, practically 3 in 10 Medicare households spent 20% or extra of their complete family spending on healthcare-related bills, in comparison with 7% of non-Medicare households

In keeping with larger common well being care spending amongst Medicare households in comparison with non-Medicare households, a better share of Medicare households than non-Medicare households spent 20% or extra of their complete family spending on well being care-related bills than didn’t -Medicare Households – Practically 3 in 10 (29%) Medicare households versus 7% of non-Medicare households. Practically three in 4 Medicare households (74%) spent 10% or extra of their complete family spending on well being care prices, in comparison with 1 / 4 (25%) of non-Medicare households (Determine 2).

Healthcare spending by Medicare households elevated 53% between 2013 and 2022, however healthcare as a share of complete family spending has modified little over time

In 2022, Medicare households spent a mean of $7,000 on well being care – $2,400 or 53% greater than the quantity spent on well being care in 2013 ($4,600) (determine 3). As a result of complete household spending by Medicare households grew at practically the identical price as well being care spending progress in recent times, well being care as a share of complete household spending was just about the identical in 2022 (13.6%) because it was in 2013 (13.5 %). .

Equally, non-Medicare households additionally spent extra on well being care in 2022 ($4,900) than in 2013 ($2,800), a rise of 71% ($2,100). Well being care as a share of complete family spending for non-Medicare households was barely larger in 2022 (6.5%) than in 2013 (5.4%).

Specializing in family spending tendencies from 2019 to 2022, the twin results of the COVID-19 pandemic and worth inflation emerge.

Between 2019 and 2020, Medicare family spending on meals and transportation fell, probably as a result of stay-at-home insurance policies carried out firstly of the COVID-19 pandemic, and total family spending fell barely (Determine 4). In distinction, complete family expenditure elevated considerably between 2021 and 2022, reflecting will increase in all classes of family expenditure, as worth inflation reached its highest degree since 1981 in 2022. This utilized to each Medicare households and non-Medicare households.

Dialogue

Well being care spending was twice as nice for Medicare households as for non-Medicare households in 2022, as measured by common well being care spending as a share of complete family spending, and a better share of Medicare households spent at a minimum of 20% of their family receives healthcare. well being care budgets than non-Medicare households. Importantly, this evaluation underestimates well being care spending for households that incur prices for long-term care amenities as a result of the Shopper Survey doesn’t think about individuals dwelling in establishments. This exclusion is extra prone to have an effect on estimates of the expenditure burden for Medicare households than for non-Medicare households, as spending on long-term care amenities represents a good portion of common out-of-pocket well being care prices for individuals with Medicare.

With well being care use rising with age and most Medicare beneficiaries dwelling on comparatively low incomes and modest monetary belongings to attract on in retirement, it’s not sudden that well being care is a bigger expense for Medicare households. This value burden has essential implications for coverage debates, together with the extent of value sharing and premiums in Medicare. Insurance policies aimed toward enhancing monetary safety for Medicare beneficiaries have been proposed in recent times. The Inflation Discount Act of 2022 comprises a number of provisions that scale back prescription drug prices for individuals with Medicare, together with a cap on Medicare beneficiaries' out-of-pocket spending beneath the Medicare Half D profit; an insulin cost-sharing restrict of as much as $35 per 30 days in Medicare Half B and Half D; and expanded eligibility for full Half D subsidies for low-income earners. Policymakers have additionally thought-about different proposals that may enhance healthcare affordability for Medicare beneficiaries, akin to elevating the earnings thresholds for the Medicare Financial savings Packages to permit extra individuals to qualify for this monetary help, and including its personal restrict. on value sharing for advantages coated by conventional Medicare. Nonetheless, implementing such adjustments would require extra federal spending.

This work was supported partly by AARP. KFF retains full editorial management over all its coverage evaluation, polling and journalism actions.

Nancy Ochieng and Juliette Cubanski are at KFF. Anthony Damico is an unbiased advisor.

| This evaluation makes use of 2013-2022 knowledge from the Bureau of Labor Statistics Shopper Expenditure Survey (CE). The CE supplies knowledge on spending, earnings, and demographic traits of customers in the USA.

The CE is a survey of households (“client items”), excluding individuals residing in establishments akin to long-term care amenities. A client unit consists of any of the next: (1) all members of a selected family who’re associated by blood, marriage, adoption, or different authorized preparations; (2) an individual who lives alone or shares a family with others or lives as a roommate in a personal house or boarding home or in everlasting dwelling quarters in a lodge or motel, however who’s financially unbiased; or (3) two or extra individuals dwelling collectively who use their earnings to make joint spending choices. Monetary independence is set by spending habits throughout the three main classes of bills: housing, meals and different dwelling bills. Whole expenditure consists of the next parts of family expenditure: meals; housing; transportation; healthcare; leisure; private care services; studying; training; tobacco merchandise and smoking provides; money contributions: life, endowment, annuity and different private insurance coverage; contributions to old-age pensions and social safety. Please observe that the overall expenditure for every client unit doesn’t embrace tax expenditures akin to earnings tax. Whole well being care spending consists of spending on 4 subcomponents of well being care: medical insurance premiums, medical companies, prescribed drugs, and medical provides. The estimates offered on this evaluation are averages for client demographic teams, not per capita estimates, and thus are usually not akin to estimates primarily based on different research that report per capita estimates, akin to out-of-pocket well being care expenditures which have been reported within the Medicare Survey of Present Beneficiaries. People' expenditures would deviate from the typical even when the traits of the group are much like these of the person. One other supply of variations between the averages reported right here and elsewhere is that the spending knowledge are primarily based on self-reports from surveys and are due to this fact topic to non-sampling error, together with the shortcoming or unwillingness of respondents to supply correct knowledge. Except in any other case said, all variations mentioned within the textual content are important on the 95% confidence degree. |