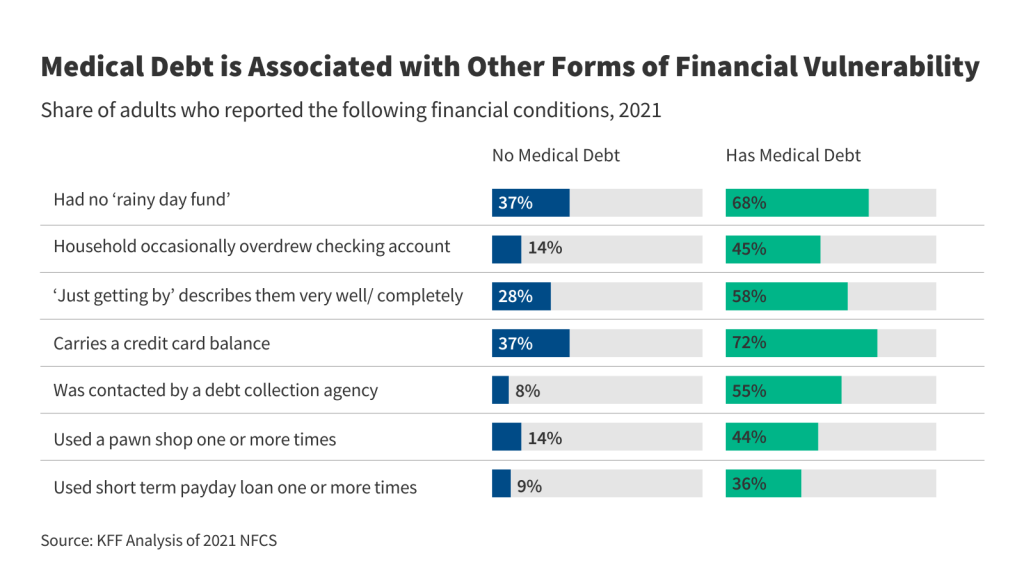

Individuals with medical debt are more likely to expertise different types of monetary stress

Individuals with medical debt are more likely than folks with out such debt to indicate different indicators of economic fragility, akin to missing a “wet day” fund, overdrafting a checking account or counting on costly loans, in response to a brand new KFF evaluation of a nationwide survey information.

Medical debt stays a serious downside within the US, even amongst folks with medical health insurance. In 2021, 23% of U.S. adults had a number of unpaid and delinquent payments from a medical supplier.

KFF's 2022 Healthcare Debt Survey discovered comparable outcomes: 24% of adults say that they had overdue or unable to pay medical or dental payments, and a complete of 41% had some type of healthcare debt, together with on credit score. playing cards or owed to family.

Medical debt and different types of monetary instability have an effect on folks and households throughout the revenue spectrum and might trigger people to forgo wanted care. Within the award-winning collection “Prognosis: Debt,” KFF Well being Information examined the epidemic of medical debt that has develop into a defining function of the U.S. well being care system.

The Client Monetary Safety Bureau is predicted to launch necessities that may take away medical debt from credit score stories and crack down on sure debt assortment practices. Some states and localities have additionally purchased or are attempting to purchase up their residents' medical debt, partially with remaining COVID aid funds.

KFF's new evaluation relies on information from the 2021 Nationwide Monetary Capabilities Survey. The survey makes use of info from greater than 27,000 adults in each state and D.C.