Pepper Bio's 'Google Maps for Drug Discovery' finds path to potential new liver most cancers drug

Pepper Bio's drug discovery efforts have produced its first clinical-stage drug candidate, however not via the invention of a brand new molecule in its labs. As an alternative, the startup's proprietary know-how found that one other firm's shelved breast and lung most cancers drug additionally reveals promise for treating liver most cancers.

Boston-based Pepper is buying the rights to G1 Therapeutics drug lerociclib in a deal introduced Wednesday. The deal covers all indications besides the radioprotective functions which can be the main focus of North Carolina-based G1's Analysis Triangle Park.

Lerociclib is a small molecule designed to dam the cancer-causing proteins CDK and CD6. G1 has already launched a CDK4/6 inhibitor, Cosela. Blocking these proteins has the impact of defending and defending the bone marrow from dangerous results that restrict using chemotherapy. In 2021, the FDA accepted Cosela, which is run intravenously earlier than chemotherapy within the remedy of extensive-stage small cell lung most cancers.

Lerociclib is an oral CDK4/6 inhibitor designed by G1 to offer potential dosing and security benefits over at the moment accepted CDK4/6 inhibitors, corresponding to Pfizer's Ibrance and Novartis' Kisqali. Amongst G1, lerociclib generated optimistic part 1/2 medical information in ER-positive and HER2-negative breast most cancers. However the firm determined to not pursue additional improvement of the molecule and as an alternative appeared for a companion to take it over.

In 2020, China-based Genor Biopharma acquired rights to lerociclib in Australia and sure Asian nations. The settlement covers the event of the drug for all indications in these areas. In line with G1's regulatory data, Genor paid G1 $6 million up entrance. Shortly thereafter, G1 reached a separate settlement with EQRx, which paid the corporate $20 million upfront for lerociclib's rights in a lot of the remainder of the world. However after EQRx was acquired by Revolution Medicines in an all-stock deal final yr, EQRx G1 indicated it will terminate the licensing settlement.

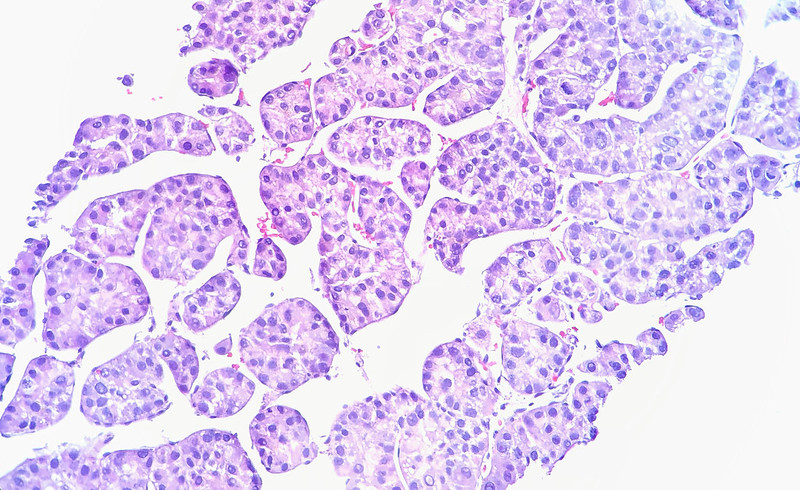

Pepper Bio has described its platform know-how as “a Google Map for drug discovery.” The platform processes a wide range of '-omics' information: genomics, proteomics, phosphoproteomics and transcriptomics. This “trans-omics” information creates an entire and complete image of illness biology, which in flip guides the corporate's efforts to search out medication to deal with them. Pepper Bio mentioned its know-how recognized CDK4/6 as probably essential targets for the remedy of hepatocellular carcinoma, the commonest type of liver most cancers. The corporate mentioned it then examined lerociclib in animals, which produced outcomes displaying superior efficacy to straightforward liver most cancers remedies throughout and after dosing.

Pepper Bio's cope with G1 provides the startup all rights to lerociclib, excluding areas already licensed to Genor. G1 and Pepper Bio mentioned the upfront funds are within the tens of millions, which is lower than what EQRx had paid. Pepper Bio's settlement makes it liable for as much as $135 million in milestone funds relying on the drug's progress in as much as three indications. If Pepper Bio can convey the drug to market, it will owe G1 royalties on gross sales.

The Pepper Bio pipeline already has a liver most cancers drug candidate. PEP001 is in preclinical improvement for hepatocellular carcinoma pushed by the Myc oncogene. Two further applications are in improvement for diffuse giant B-cell lymphoma. A fourth program is in preclinical improvement for stable tumors.

“Lerociclib reveals promise as a cornerstone of our oncology portfolio, and we’re excited to leverage its potential to convey lifesaving remedies to these in want,” Jon Hu, co-founder and CEO of Pepper Bio, mentioned in a ready assertion.

Pepper Bio launched in 2021. Final November, the corporate introduced $6.5 million in seed funding led by NFX.

Picture by Flickr consumer Ed Uthman by way of a Artistic Commons license