Artiva's IPO Raises $167 Million to Deploy NK Cell Remedy for Autoimmune Illnesses

Cell remedy first reached sufferers as a remedy for most cancers. Artiva Biotherapeutics is a part of a rising group of firms trying to carry cell remedy to autoimmune ailments, and its IPO raised $167 million for scientific trial plans.

Artiva priced the IPO at $12 per share, which was decrease than the $14 to $16 per share value vary the biotech had tentatively set final week. Nevertheless, the corporate elevated the deal measurement by growing the variety of shares within the providing. The 8.7 million shares it initially deliberate to supply would have raised $130.5 million on the proposed midpoint value. The corporate may elevate extra by promoting 13.92 million shares.

Shares of San Diego-based Artiva debuted Friday on the Nasdaq underneath the ticker image “ARTV.” However these shares had been flat, closing their first day of buying and selling at their IPO value.

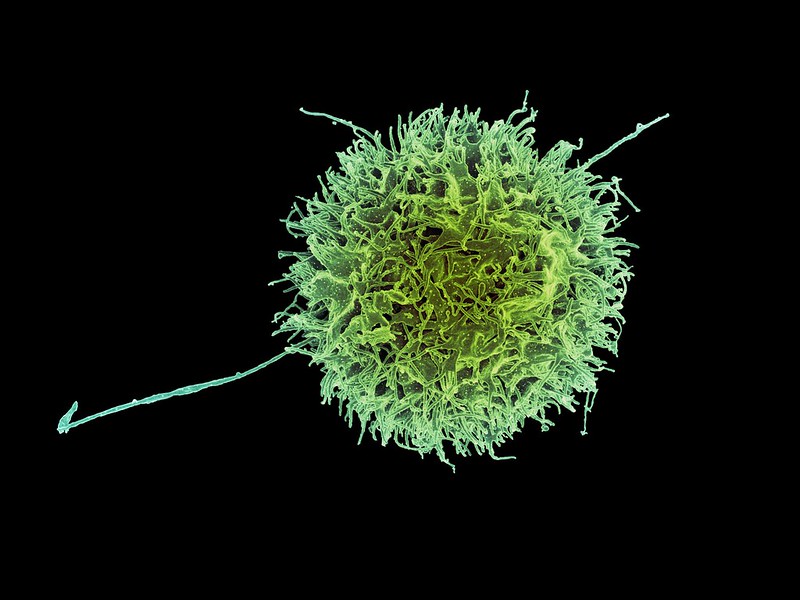

The primary most cancers cell therapies had been autologous, made out of a affected person’s personal T cells in a prolonged, costly, multistep course of. Artiva works with a distinct kind of immune cell, known as a pure killer cell, or NK cell. Artiva’s therapies are allogeneic, made out of donor cells in a course of the corporate says is cost-effective and scalable. Quite than sourcing NK cells from wholesome donors, as some NK cell remedy builders do, Artiva’s cells come from umbilical wire blood. After manufacturing, these cell therapies are saved frozen, able to be shipped to a affected person’s remedy web site when wanted.

Lead Program Artiva AlloNK is in Part 1/1b testing in sufferers with systemic lupus erythematosus, the most typical type of lupus. Some lupus sufferers additionally develop lupus nephritis. Artiva’s open-label examine is enrolling lupus sufferers who’ve this kidney situation, in addition to those that don’t. Research members will obtain the investigational drug together with Rituxan or Gazya, each of that are FDA-approved antibody medication that deplete B cells, a sort of immune cell related to many autoimmune ailments, together with lupus.

AlloNK can also be being examined for the remedy of a spread of extra immunological situations in an investigator-initiated scientific trial. This analysis is being performed as a basket examine, a scientific trial that evaluates how a remedy works towards a number of ailments that share a typical function. Illnesses being studied within the basket examine embrace rheumatoid arthritis, pemphigus vulgaris, and two subtypes of anti-neutrophil cytoplasmic autoantibody-associated vasculitis.

In its IPO submitting, Artiva says it believes AlloNK is the primary allogeneic NK-cell remedy candidate to obtain the FDA’s inexperienced gentle for a scientific trial, in addition to the primary to obtain the company’s fast-track designation for an autoimmune illness. The corporate additionally claims to be the primary to advance a cell remedy into an autoimmune illness basket trial.

“We consider that as we proceed to execute on our strategic plan, these important first mover benefits will solidify our management in a number of autoimmune ailments with excessive unmet want,” the corporate stated within the submitting.

Artiva plans to use $55 million of the IPO proceeds to the Part 1/1b trial of AlloNK in lupus, based on the prospectus. The IPO cash can even fund the basket examine. Artiva stated within the submitting that it expects preliminary knowledge from each research within the first half of 2025.

Different firms are additional alongside within the scientific improvement of cell therapies for autoimmune ailments, albeit with therapies made out of completely different immune cells. Earlier this 12 months, Kyverna Therapeutics’ IPO raised $319 million for early- and mid-stage scientific testing of its CAR T therapies in systemic sclerosis, a number of sclerosis and myasthenia gravis, amongst different autoimmune ailments. Different firms are creating cell therapies for autoimmune ailments based mostly on a sort of immune cell known as a regulatory T cell, or Treg.

Artiva was based in 2019, spun out of GC Lab Cell Company (now GC Cell), a South Korea-based cell remedy developer. Artiva holds rights, exterior of Asia, to GC Cell’s NK cell manufacturing expertise and packages, together with its lead program AlloNK. In 2020, Artiva launched with $78 million in Collection A funding. Earlier than the IPO, Artiva stated it had raised $222.4 million since inception. GC Cell’s father or mother firm, GC Corp., is Artiva’s largest shareholder with a 13.5% stake following the IPO, based on the submitting. 5AM Ventures, venBio and RA Capital Administration every personal 8.1% of the corporate following the IPO. The corporate reported a money place of $62.1 million on the finish of the primary quarter of this 12 months.

The IPO is Artiva’s second try at going public. The corporate first filed a registration assertion in 2021, when the biotech IPO market was nonetheless sizzling. On the time, the NK cell remedy firm was centered on most cancers. A most cancers analysis collaboration with Merck closed in 2021, paying the biotech $30 million up entrance. The pharma big terminated the deal final fall.

When Artiva withdrew its IPO software in late 2022, the IPO market had cooled significantly. However by then, the corporate had entered into one other most cancers partnership with Affimed in Hodgkin lymphoma. This collaboration is testing AlloNK together with Affimed’s acimtamig, an NK cell engager. Affimed is funding this scientific trial, which is at present in Part 2 testing.

Picture by Flickr person NIAID through a Inventive Commons license